Argo AI

Founded Year

2016Stage

Dead | DeadTotal Raised

$500MAbout Argo AI

Argo AI ceased operations in October 2022. Argo AI is an artificial intelligence company that is developing machine-learning software for autonomous vehicles. It offers services such as autonomous rideshare, autonomous delivery, and pilot opportunities and products such as argo autonomy platform, argo lidar, and argo hub. The company was founded in 2016 and is based in Pittsburgh, Pennsylvania.

Argo AI's Product Videos

Compete with Argo AI?

Ensure that your company and products are accurately represented on our platform.

Argo AI's Products & Differentiators

Argo Autonomy Platform

SAE Level 4 self-driving system that includes the software, hardware, HD maps, and backend support needed to power full-service self-driving operations at scale. Today, our autonomous technology is integrated into both Ford and Volkswagen vehicles with custom-built hardware and redundant safety systems.

Research containing Argo AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Argo AI in 11 CB Insights research briefs, most recently on May 2, 2023.

Expert Collections containing Argo AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Argo AI is included in 3 Expert Collections, including Auto Tech.

Auto Tech

2,043 items

Startups building a next-generation mobility ecosystem, using technology to improve connectivity, safety, convenience, and efficiency in vehicles.Includes technologies such as ADAS and autonomous driving, connected vehicles, fleet telematics, V2V/V2X, and vehicle cybersecurity.

Smart Cities

2,087 items

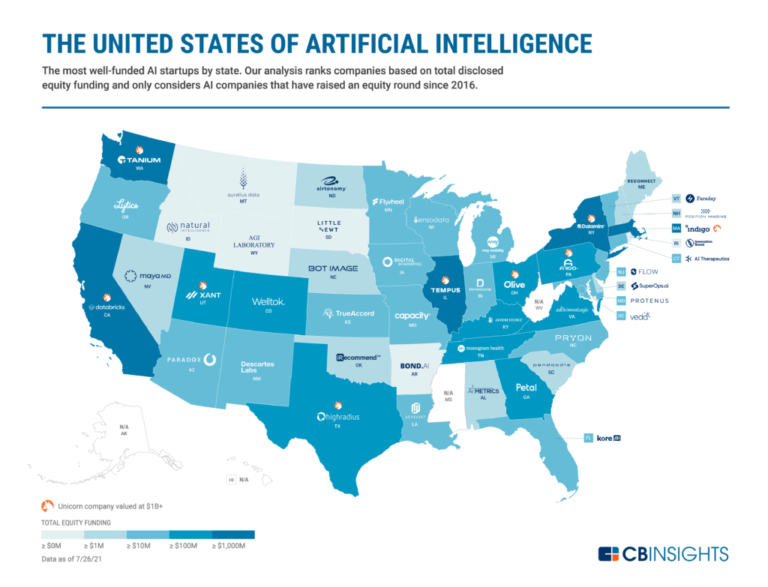

Artificial Intelligence

10,624 items

This collection includes startups selling AI SaaS, using AI algorithms to develop their core products, and those developing hardware to support AI workloads.

Argo AI Patents

Argo AI has filed 251 patents.

The 3 most popular patent topics include:

- Autonomous cars

- Machine learning

- Image processing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/29/2020 | 4/18/2023 | Image processing, Continuous distributions, Computer vision, Geographic information systems, 3D imaging | Grant |

Application Date | 6/29/2020 |

|---|---|

Grant Date | 4/18/2023 |

Title | |

Related Topics | Image processing, Continuous distributions, Computer vision, Geographic information systems, 3D imaging |

Status | Grant |

Latest Argo AI News

May 5, 2023

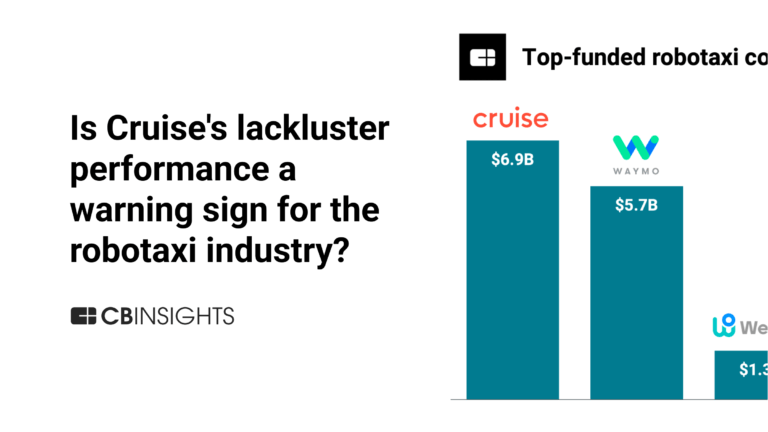

TechnoHoop After years of multibillion-dollar investments, “just around the corner” promises of robotaxis, and predictions that today’s children might never need to learn to drive, 2022 ended with a hard wake-up call for the autonomous car industry. High-profile crashes made headlines instead of big technological leaps. Major companies raised the white flag and retreated from the effort. And the demise of respected tech leader Argo AI left investors and industry officials alike wondering if they can’t do it, who can? But even with a newfound understanding that driverless cars are years or even decades away, automakers and tech companies alike are still aiming for that goal. And big investments in driverless technology are being made, proving that autonomous vehicles remain a priority even in a weak capital environment and an uncertain economy. Automakers and tech companies alike are still aiming for that driverless goal A recent report from F-Prime Capital showed how steep this decline was. In 2022 alone, AV investments went down nearly 60 percent year over year as startups struggled through layoffs or outright closures. At the Shanghai Auto Show last month, a spokesperson for the rising Chinese EV giant BYD offered a rare dose of extreme skepticism about AVs that flew in the face of most competitors, telling CNBC that self-driving fully separated from humans is “basically impossible.” And here in America, consumer trust and interest in self-driving cars seem to have hit an all-time low. And in a perfect encapsulation of mid-2010s autonomy hype, Intel in 2017 predicted a $7 trillion industry — more than double what the global auto industry does now—around autonomy by 2050. But now it looks like that lofty goal, or something close to it, didn’t actually go away. It’s just cooled off a bit. Case in point: Toyota and tech giant Nvidia are two investors putting $43 million into Foretellix, an Israeli company developing autonomy and advanced driver-assistance systems (ADAS). Foretellix’s Series C fundraising was announced this week, and company officials say it has already raised $93 million so far. That, and the fact that the funding comes partly from Nvidia — a graphics chip and software giant now making huge moves in the automotive space — and Woven Captial, Toyota’s $800 million global investment fund for mobility projects — says a lot about where autonomy is going. AV investments went down nearly 60 percent year over year Granted, and as TechCrunch pointed out, it’s not quite on the level of the nine-figure acquisition and funding race we saw just a few years ago. Those moves saw things like Ford and Volkswagen’s investments into Argo, General Motors’ acquisition of Cruise Automation, and Uber’s ill-fated foray into self-driving taxis. But Toyota’s new CEO has placed “city-integrated autonomous mobility” among his top priorities for the future. And apart from the only theoretically lucrative robotaxi business, new enhancements to ADAS functions are coming to passenger cars each year, helping drivers to navigate traffic and protecting them from dangerous situations in novel ways. Foretellix specializes in verifying and validating the safety and reliability of autonomous systems. In this case, the company’s forté is using supercomputing to virtually test for millions of combinations of scenarios a car might encounter, including extreme edge cases. Foretellix CEO Ziv Binyamini said the trucking units at Daimler and Volvo are already customers as well. “Autonomous vehicles are extremely complex, but the slightest mistake can cause a lot of damage,” Binyamini said. “So, how do you test the system, in all possible situations, all possible scenarios, and there are millions and millions of them?” Both the speed of deployment and ensuring safety will be necessary to get to where most automakers want to go, which is so-called Level 4 autonomy: a high level of automation where a vehicle may or may not need a steering wheel and driver controls at all. This is said to be key to most major automakers’ goals of significantly reducing traffic as well as crashes, injuries, and fatalities, to say nothing of future subscription revenue and potential robotaxi businesses. “Autonomous vehicles are extremely complex, but the slightest mistake can cause a lot of damage” In the interim, advanced autonomy makes headlines more for high-profile crashes and mistakes than breakthroughs that enhance the urban quality of living. GM’s Cruise robotaxi operation has drawn the ire of San Francisco residents after traffic jams and at least one crash into a bus, and its traffic mishaps in Austin haven’t done much to sell residents on the idea, either. And Tesla’s Autopilot and so-called Full Self-Driving systems, assuredly the most boundary-pushing automated technologies available on passenger cars, continue to get hit with lawsuits and investigations. Nonetheless, Elon Musk is still hinging Tesla’s future on self-driving. The Wall Street Journal’s Tim Higgins recently reported that one reason for Tesla’s rapid-fire price cuts this year is to get as many buyers into cars as possible right now, then gamble the company’s future on self-driving subscription revenue later on. Don’t think he’s alone in such an idea, even if Tesla’s willing to move faster on it than others. Even after Ford withdrew its investment in Argo AI, it still established a new division called Latitude AI to do much of the same work in-house — and staffed by hundreds of former Argo employees. And Ford’s already debuted a “hands-free, eyes on” version of its BlueCruise ADAS setup that doesn’t require drivers to keep their hands on a steering wheel so long as in-car cameras detect that they’re paying attention to the road. GM also didn’t take 2022 as a lesson to slow down. Besides the Cruise Bolts zooming around Austin with nobody inside, it’s ramping up the deployment of its purpose-built Origin robotaxi shuttles there, too, and hopes to open them up to customer rides in a few months. On the consumer side, the next big thing will be the Ultra Cruise ADAS system, which also offers hands-off driving so long as the human pilot is paying attention. That system is due to launch, albeit in limited quantities, in the Cadillac Celestiq luxury EV late this year or in early 2024. Even if Level 4 autonomy is the goal, Binyamini still describes it as a “moonshot.” But he said that while he does predict the eventual deployment of robotaxis in urban environments, more conservative developments are also underway for improving driver assistance systems in passenger vehicles on the road now. Those include Level 2 Plus and Level 3 ADAS systems, which are available on just about every new car sold today, as well as last-mile solutions for delivery vehicles and automating certain parts of long-haul trucking. Still just a “moonshot”? He added that high automation is already prevalent in industries like mining, where companies don’t have to worry about road regulations or traffic and just need a faster and safer way to get difficult work done. “I think there is a readjustment of the overall autonomy to focus on more realistic, achievable goals,” Binyamini said. Still, he added, “The overall industry is investing in autonomy. There is no slowdown.” But more than ever now, the onus will be on these AV companies to actually deliver on their eventual robotaxi dreams and prove they can operate more safely than humans do. Otherwise — and much to the chagrin of investors everywhere — you have to wonder how many more downturns fully self-driving cars can take before they get tossed into the same dustbin as flying cars. Source link

Argo AI Frequently Asked Questions (FAQ)

When was Argo AI founded?

Argo AI was founded in 2016.

Where is Argo AI's headquarters?

Argo AI's headquarters is located at 2545 Railroad Street, Pittsburgh.

What is Argo AI's latest funding round?

Argo AI's latest funding round is Dead.

How much did Argo AI raise?

Argo AI raised a total of $500M.

Who are the investors of Argo AI?

Investors of Argo AI include Volkswagen Group and Ford Autonomous Vehicles.

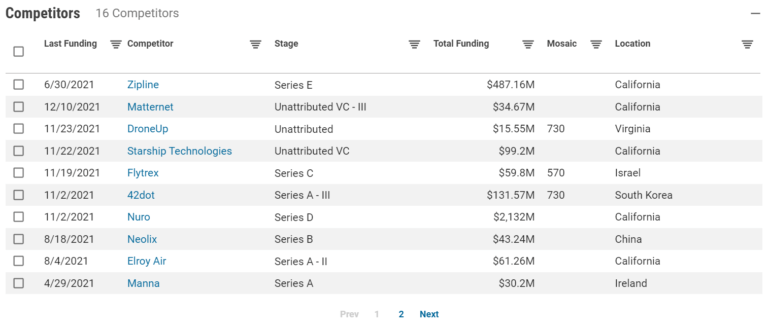

Who are Argo AI's competitors?

Competitors of Argo AI include Ghost Autonomy and 8 more.

What products does Argo AI offer?

Argo AI's products include Argo Autonomy Platform and 2 more.

Who are Argo AI's customers?

Customers of Argo AI include Lyft and Walmart.

Compare Argo AI to Competitors

Motional is an autonomous vehicle company making self-driving vehicles a safe, reliable, and accessible reality. Motional is a joint venture between Hyundai Motor Group, one of the world's largest vehicle manufacturers and Aptiv, a global technology leader in advanced safety, electrification, and vehicle connectivity.

Waymo is a self-driving technology company with a mission to make it safe and easy for people and things to move around. With the Waymo Driver, the company seeks to improve the world’s mobility while saving thousands of lives.

Cruise Automation makes automated driving technology. Cruise has built a highway autopilot system that installs on existing vehicles. It uses sensors and machine vision technology to keep users in their lane and a safe distance from the car in front of them. The company was founded in 2013 and is based in San Francisco, California. On March 20th, 2022, General Motors acquired a majority stake in Cruise Automation at a valuation between $19B to $30B.

Pony.ai is a technology firm aiming to build autonomous driving solutions. It provides software algorithms and infrastructure that enables vehicles to perceive their surroundings. It offers a variant solution like perception, planning, and mapping localization. It was founded in 2016 and is based in Fremont, California.

Apex.AI develops operating systems for various types of autonomous mobility platforms. Apex's software stack is designed to easily integrate into existing systems and serve as the enterprise version of the Robot Operating System, an open-source software middleware for robotics. It was founded in 2017 and is based in Palo Alto, California.

Applied Intuition offers autonomous vehicle (AV) development. It provides the software infrastructure to safely develop, test, and deploy autonomous vehicles at scale. It was founded in 2017 and is based in Mountain View, California.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.