Investments

113Portfolio Exits

49Funds

31Partners & Customers

3Service Providers

1About Baird Capital Partners

Baird Capital Partners, the U.S.-based buyout fund of Baird Capital, makes buyout investments in high potential companies in the Business Services, Healthcare and Manufactured Products. The fund invests in well-positioned U.S. companies with successful, highly motivated management teams offering differentiated products and services in growing markets.

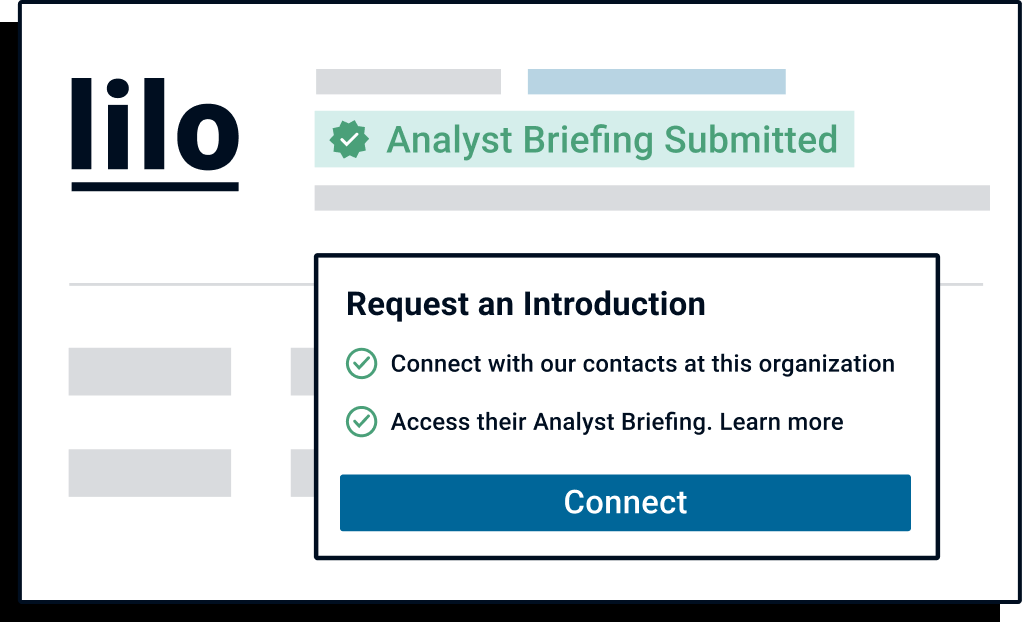

Want to inform investors similar to Baird Capital Partners about your company?

Submit your Analyst Briefing to get in front of investors, customers, and partners on CB Insights’ platform.

Research containing Baird Capital Partners

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Baird Capital Partners in 1 CB Insights research brief, most recently on Apr 6, 2021.

Latest Baird Capital Partners News

Feb 1, 2022

(NASDAQ: ALYA) 02/01/2022 | 03:44pm EST Message : CLIENT Founded in 1992, Vitalyst, LLC ("Vitalyst" or "the Company") is an award-winning Microsoft Gold Partner that provides best-in-class employee experience and transformative change enablement services via an on-demand, subscription-based training platform. The Company serves as a strategic partner to a diverse base of Fortune 1000 blue-chip customers across a wide variety of industries. Vitalyst's more than 165 professionals currently support over 350 business applications for over 400 clients that operate in more than 20 countries. Its services are offered in over 10 languages and drive usage and awareness of Microsoft applications, allowing organizations to achieve the maximum return on their investment by enhancing user proficiency and productivity. G2 served as sell-side advisor to Vitalyst, portfolio company of Baird Capital, on its sale to Alithya (NASDAQ: ALYA) SITUATION Vitalyst and prior owner Baird Capital Partners ("Baird") were seeking to further the Company's position as a leading technology services provider building on the strength of its extensive experience in virtual learning and its long-standing partnership with Microsoft. They sought a partner that shared the vision of Vitalyst's growth strategy and its focus on customer and employee satisfaction. ENGAGEMENT G2 Capital Advisors , LLC ("G2") was engaged by Vitalyst as its exclusive financial advisor. G2 led a highly targeted, strategic, and efficient sell-side transaction process focused on identifying the right partner for the Company. OUTCOME In January 2022, the transaction was successfully executed through a sale to Alithya Group, Inc. (NASDAQ: ALYA, "Alithya"), a leader in strategy and digital transformation. "Vitalyst is a highly differentiated service provider that, with Alithya's partnership, is primed to continue on an exciting growth trajectory. We are eager to see what opportunities their new partnership will unlock. This transaction is a fantastic example of G2's strategy of partnering with market-leading organizations within industry verticals that we know incredibly well." said Kerri Ford, G2 Managing Director and Head of Technology & Business Services . Brett Tucker, Partner at Baird shared, "The Vitalyst management team has done an exceptional job leading the business and we were honored to partner with a best-in-class team at G2. Kerri and the team at G2 ran an outstanding process, and we couldn't be more pleased with the result." About G2 Capital Advisors G2 Capital Advisors provides M&A, capital markets and restructuring advisory services to the middle market. We offer integrated, multi-product and sector-focused services by pairing highly experienced C-level executives with specialist investment bankers. We aspire to be the trusted advisor of choice to our clients including corporations and institutional investors. For more information, visit www.g2cap.com . CONTACTS ON THIS DEAL:

Baird Capital Partners Investments

113 Investments

Baird Capital Partners has made 113 investments. Their latest investment was in Forj as part of their Series A on January 1, 2023.

Baird Capital Partners Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

1/5/2023 | Series A | Forj | $18.05M | No | 7 | |

11/29/2022 | Series C | Zylo | $31.5M | Yes | 14 | |

11/29/2022 | Series B | HSP Group | $14M | No | 11 | |

10/20/2022 | Series B | |||||

9/7/2022 | Series C |

Date | 1/5/2023 | 11/29/2022 | 11/29/2022 | 10/20/2022 | 9/7/2022 |

|---|---|---|---|---|---|

Round | Series A | Series C | Series B | Series B | Series C |

Company | Forj | Zylo | HSP Group | ||

Amount | $18.05M | $31.5M | $14M | ||

New? | No | Yes | No | ||

Co-Investors | |||||

Sources | 7 | 14 | 11 |

Baird Capital Partners Portfolio Exits

49 Portfolio Exits

Baird Capital Partners has 49 portfolio exits. Their latest portfolio exit was bfinance on February 14, 2023.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

2/14/2023 | Management Buyout | Management Buyout (MBO) | 1 | ||

12/15/2022 | Acquired | 5 | |||

8/22/2022 | Acquired | 11 | |||

Date | 2/14/2023 | 12/15/2022 | 8/22/2022 | ||

|---|---|---|---|---|---|

Exit | Management Buyout | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | Management Buyout (MBO) | ||||

Sources | 1 | 5 | 11 |

Baird Capital Partners Acquisitions

41 Acquisitions

Baird Capital Partners acquired 41 companies. Their latest acquisition was eCube on August 20, 2020.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

8/20/2020 | Acq - Fin | 3 | ||||

7/24/2018 | Acq - Fin | 1 | ||||

6/6/2017 | Acq - Fin | 3 | ||||

6/2/2017 | ||||||

9/15/2016 | Other |

Date | 8/20/2020 | 7/24/2018 | 6/6/2017 | 6/2/2017 | 9/15/2016 |

|---|---|---|---|---|---|

Investment Stage | Other | ||||

Companies | |||||

Valuation | |||||

Total Funding | |||||

Note | Acq - Fin | Acq - Fin | Acq - Fin | ||

Sources | 3 | 1 | 3 |

Baird Capital Partners Fund History

31 Fund Histories

Baird Capital Partners has 31 funds, including Baird Capital Global Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/22/2021 | Baird Capital Global Fund II | $340M | 2 | ||

3/31/2020 | Baird Capital Partners Fund V | $215M | 2 | ||

12/27/2019 | BVP V Special Affiliates | Multi-Stage Venture Capital | Open | 1 | |

6/28/2017 | Baird Capital Partners Global Fund | ||||

11/18/2014 | Baird Capital Partners IV |

Closing Date | 7/22/2021 | 3/31/2020 | 12/27/2019 | 6/28/2017 | 11/18/2014 |

|---|---|---|---|---|---|

Fund | Baird Capital Global Fund II | Baird Capital Partners Fund V | BVP V Special Affiliates | Baird Capital Partners Global Fund | Baird Capital Partners IV |

Fund Type | Multi-Stage Venture Capital | ||||

Status | Open | ||||

Amount | $340M | $215M | |||

Sources | 2 | 2 | 1 |

Baird Capital Partners Partners & Customers

3 Partners and customers

Baird Capital Partners has 3 strategic partners and customers. Baird Capital Partners recently partnered with Moderna Therapeutics on August 8, 2021.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

8/19/2021 | Partner | United States | Baird Capital Portfolio Company Azzur Unveils Strategic Partnership with Moderna. Baird Capital portfolio company Azzur Group today announced the expansion of its ongoing business relationship with the life sciences company Moderna . | 1 | |

6/10/2019 | Partner | ||||

8/23/2018 | Partner |

Date | 8/19/2021 | 6/10/2019 | 8/23/2018 |

|---|---|---|---|

Type | Partner | Partner | Partner |

Business Partner | |||

Country | United States | ||

News Snippet | Baird Capital Portfolio Company Azzur Unveils Strategic Partnership with Moderna. Baird Capital portfolio company Azzur Group today announced the expansion of its ongoing business relationship with the life sciences company Moderna . | ||

Sources | 1 |

Baird Capital Partners Service Providers

1 Service Provider

Baird Capital Partners has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

Baird Capital Partners Team

15 Team Members

Baird Capital Partners has 15 team members, including former Chief Executive Officer, Michael Proudlock.

Name | Work History | Title | Status |

|---|---|---|---|

Michael Proudlock | Chief Executive Officer | Former | |

Name | Michael Proudlock | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Executive Officer | ||||

Status | Former |

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.