BharatPe

Founded Year

2018Stage

Debt - VI | AliveTotal Raised

$702.25MValuation

$0000Last Raised

$14M | 2 yrs agoAbout BharatPe

BharatPe provides financial services. It offers merchant discount rate (MDR) services and allows merchants to sign up and start receiving the funds in the bank account. It serves offline retailers and businesses. It was founded in 2018 and is based in Gurgaon, India.

Missing: BharatPe's Product Demo & Case Studies

Promote your product offering to tech buyers.

Reach 1000s of buyers who use CB Insights to identify vendors, demo products, and make purchasing decisions.

ESPs containing BharatPe

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Omnichannel payments companies provide a comprehensive payment processing solution for businesses, allowing them to accept payments through multiple channels including online, mobile, and in-store. These platforms offer data integration across payments, marketing, and sales channels so that customers can shop and transact the same way both online and offline, giving businesses a unified view into …

BharatPe named as Highflier among 15 other companies, including Stripe, SumUp, and Razorpay.

Missing: BharatPe's Product & Differentiators

Don’t let your products get skipped. Buyers use our vendor rankings to shortlist companies and drive requests for proposals (RFPs).

Research containing BharatPe

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned BharatPe in 3 CB Insights research briefs, most recently on Oct 5, 2021.

Oct 5, 2021 report

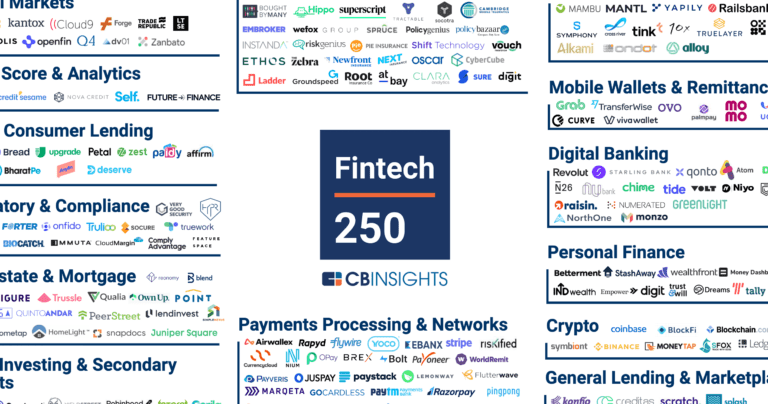

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing BharatPe

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

BharatPe is included in 6 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,543 items

Startups aiming to work with retailers to improve brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,208 items

SMB Fintech

1,647 items

Payments

2,682 items

Companies and startups in this collection enable consumers, businesses, and governments to pay each other - online and at the physical point-of-sale.

Fintech

3,893 items

Fintech 250

749 items

250 of the top fintech companies transforming financial services

Latest BharatPe News

May 3, 2023

IndianWeb2 Desk Trillion Loans to operate as an independent entity and explore partnerships with other fintech companies BharatPe Group, India’s leading name in fintech, today announced that it has completed its acquisition of a majority stake in Trillion Loans, a renowned NBFC (Non-Banking Financial Company) based out of Mumbai. The deal was completed in the month of April. This acquisition is in line with BharatPe Group’s vision to be at the forefront of addressing the credit gap for millions of businesses and consumers in the country. BharatPe shared that Ravindra Pandey, Nalin Negi and Sabyasachi Senapati have been appointed on the Board of Trillion Loans. Trillion Loans will operate as an independent entity with its own team under the supervision of the Board. It will explore partnerships with other fintech firms and other companies to enable credit across a diverse set of businesses and consumers. BharatPe has also infused a substantial amount of investment into Trillion Loans to enable the NBFC to grow its loan book. Trillion Loans is a fast-growing NBFC that offers a range of secured and unsecured loans to SMEs, including small business loans as well as working capital loans. Additionally, the company also offers a range of products for consumers, such as auto, gold, and education loans. Commenting on the acquisition, Shashvat Nakrani, Founder and COO, BharatPe said, “We had launched our merchant lending vertical in 2019 and it has grown exponentially over the course of the last 3+ years. Today, we facilitate loans of over Rs. 500 crores every month to our merchant partners. Providing access to credit to our merchant partners is key to our business model, and this acquisition will further propel our growth and accelerate our journey to profitability. Acquiring controlling stake in Trillion Loans is aligned to the BharatPe Group’s larger purpose and will enable us to facilitate access to capital to a wider set of underserved and unbanked businesses as well as customers. Trillion Loans will work independently and will be technology-driven NBFC. It will be open to partner with other fintechs and startups, so as to offer their customers a quick and streamlined experience. BharatPe values its existing partnerships with NBFCs and financial institutions and this acquisition will have no impact on these relationships.” Added Shashvat, “BharatPe will bring in the product and technology capabilities that will further empower Trillion Loans to launch new and path-breaking digital lending products that will cater to a diverse set of business owners and customers. I believe that there is a huge opportunity for Trillion Loans to further grow and address the close to US$ 380 billion MSME credit gap as well as meet the diverse consumer credit demand in the country that has the largest youth population in the world. I would like to welcome the Trillion Loans team to the BharatPe family.” Ravindra Pandey is a veteran in the financial services industry. A senior banker, he was superannuated recently after a stellar career spanning 37 years with the State Bank of India. Mr. Pandey has served on the Board of several large and highly reputed organizations. He was Director of the Board at Yes Bank, National Payments Corporation of India (NPCI), NPCI International, NPCI Bharat BillPay Ltd, SBI Payments and C-EDGE Technologies Ltd. In addition, he was a permanent invitee to the Board and other Board level committees of the State Bank of India. Nalin Negi is the CFO and interim CEO of BharatPe. Sabyasachi Senapati is currently a part of the leadership team at BharatPe and heads their banking vertical. About BharatPe Group BharatPe was founded in 2018 to make financial inclusion a reality for Indian merchants. In 2018, BharatPe launched India’s first UPI interoperable QR code, the first zero MDR payment acceptance service. In 2020, post-Covid, BharatPe also launched a card acceptance terminal – BharatSwipe. Currently serving 1 crore merchants across 400+ cities, the company is a leader in UPI offline transactions, processing 30 crores+ UPI transactions per month (annualized Transaction Processed Value of over US$ 24 Bn in payments). The company has already facilitated the disbursement of loans totaling close to ₹8000 crores. BharatPe’s POS business processes payments of over US$ 3.5 bn annually on its machines. BharatPe has raised over US$ 583 million in equity till date. The company’s list of marquee investors includes Tiger Global, Dragoneer Investment Group, Steadfast Capital, Coatue Management, Ribbit Capital, Insight Partners, Steadview Capital, Beenext, Amplo, and Sequoia Capital. In June 2021, the company announced the acquisition of PAYBACK India, the country’s largest multi-brand loyalty program company with 100 million+ members. In October 2021, the consortium of Centrum Financial Services Limited (Centrum) and BharatPe, was issued a Small Finance Bank (SFB) license by the Reserve Bank of India (RBI). BharatPe also entered the Buy Now Pay Later (BNPL) segment with the launch of postpe in October 2021. postpe has over 8 million downloads and an annualized TPV of close to Rs. 5000 crores. Recently, BharatPe Group received an in-principle nod from the Reserve Bank of India (RBI) to operate as an online payment aggregator. Advertisements

BharatPe Frequently Asked Questions (FAQ)

When was BharatPe founded?

BharatPe was founded in 2018.

Where is BharatPe's headquarters?

BharatPe's headquarters is located at Building No. 8 Tower C, 7th Floor, DLF Cybercity, Gurgaon.

What is BharatPe's latest funding round?

BharatPe's latest funding round is Debt - VI.

How much did BharatPe raise?

BharatPe raised a total of $702.25M.

Who are the investors of BharatPe?

Investors of BharatPe include MAS Financial Services, Northern Arc Capital, 360 ONE, Insight Partners, Ribbit Capital and 20 more.

Who are BharatPe's competitors?

Competitors of BharatPe include benow and 1 more.

Compare BharatPe to Competitors

Open develops a digital banking platform designed to offer efficient and secure banking services and automate business payments. The company's platform includes a digital business account that can be activated using a fully digital onboarding process and comes with integrated GST-complaint invoicing, bookkeeping, payments, API banking, and more. It was founded in 2017 and is based in Bengaluru, India.

Chqbook is a fintech startup that allows customers to explore, compare, book, and get personal finance products such as home loans, personal loans, and credit cards.

benow helps users save money on local shopping and pay directly from their bank account using the National Payment Corporations' UPI technology. On February 21st, 2022, benow was acquired by Mosambee. The terms of the transaction were not disclosed.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.