Brex

Founded Year

2017Stage

Series D - II | AliveTotal Raised

$1.49BValuation

$0000Last Raised

$300M | 2 yrs agoAbout Brex

Brex provides a business-to-business financial product. It offers a corporate credit card for technology companies, expense management, financial modeling, bill payment, business account, and more. It was formerly known as Veyond. It was founded in 2017 and is based in San Francisco, California.

Missing: Brex's Product Demo & Case Studies

Promote your product offering to tech buyers.

Reach 1000s of buyers who use CB Insights to identify vendors, demo products, and make purchasing decisions.

ESPs containing Brex

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The spend management software market provides solutions that help organizations manage their expenses and optimize their spending. These solutions typically include features such as spend analysis, budgeting, invoice management, and supplier management. By implementing these tools, companies can gain greater visibility into their spending patterns and identify areas where they can reduce costs or …

Brex named as Leader among 15 other companies, including Tide, FreshBooks, and Qonto.

Missing: Brex's Product & Differentiators

Don’t let your products get skipped. Buyers use our vendor rankings to shortlist companies and drive requests for proposals (RFPs).

Research containing Brex

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Brex in 34 CB Insights research briefs, most recently on Apr 3, 2023.

Nov 14, 2022

The Transcript from Yardstiq: Tug of oar

Oct 25, 2022

The Transcript from Yardstiq: Toppling Salesforce

Oct 4, 2022

The Transcript from Yardstiq: Ramp vs. Brex

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Brex

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Brex is included in 9 Expert Collections, including Banking.

Banking

1,071 items

Unicorns- Billion Dollar Startups

1,208 items

Digital Lending

1,883 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

2,682 items

Companies and startups in this collection enable consumers, businesses, and governments to pay each other - online and at the physical point-of-sale.

Fintech 250

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Brex Patents

Brex has filed 12 patents.

The 3 most popular patent topics include:

- Payment systems

- Data management

- Banking technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/25/2019 | 2/28/2023 | Enterprise application integration, Data management, Payment systems, Information technology management, Banking technology | Grant |

Application Date | 10/25/2019 |

|---|---|

Grant Date | 2/28/2023 |

Title | |

Related Topics | Enterprise application integration, Data management, Payment systems, Information technology management, Banking technology |

Status | Grant |

Latest Brex News

May 5, 2023

I write about tech disruption to startup finance and banking. Got it! NurPhoto via Getty Images “Confidence in a financial institution is built over decades and destroyed in days. As each domino falls, the next weakest bank begins to wobble,” said Bill Ackman this afternoon. Well, PacWest is the next domino. Today its stock plummeted over 50% – down almost 90% year-to-date. The latest casualty from the loss in investor confidence in the regional banking system following the collapse of Silicon Valley Bank , alongside Signature Bank and First Republic Bank . Some argue that PacWest is even less deserving of investors and depositors jumping ship than its failed peers. Since March, PacWest’s core deposits have actually increased to $28 billion. And while SVB ranked dead last in uninsured deposits, with over 93% of customer deposits uninsured , PacWest was in 3x better shape with under 30% deposits uninsured in Q1. Nevertheless, when the bank mentioned it was exploring “a potential sale,” investor sentiment instantly evaporated. Perhaps, the Fed is to blame. After all, Jerome Powell hiked rates yesterday for the 10th time in just over a year, the fastest pace in decades, knowing the impact it might have on a small banks' balance sheet. What about the bank executives who decided to take duration risk in a rising rate environment? Or perhaps it's the Twitter influencers stirring the pot? Personally, I think there’s plenty of finger pointing to go around. But that’s not productive… One thing is for certain, with an implicit government guarantee, the Too Big To Fail banks are the real winners today. Meanwhile the startups and small businesses – those who value white glove service and customized financial products – are the losers. Founders and operators are in the crosshairs of fickle investors, unsatiable big banks and reluctant regulators. Especially J.P. Morgan Chase, who managed to back regulators into a corner, allowing Jamie Dimon to gobble up First Republic in a single bite. The $92 billion in deposits that JPM assumed from its First Republic purchase is a mere rounding error compared to the $2.4 trillion that they have under management. Yet, the deposits are a stark reminder that antitrust oversight is no match for a banking crisis. MORE FOR YOU Given the continued fear in the regional banking system, and the domino effect that is currently underway, one might wonder if J.P. Morgan Chase will continue devouring deposits of smaller peers as they fail. Thankfully for depositors, Chase isn’t only name in town anymore. Fintechs now also have a seat at the table. By some measures, BAM Fintechs (Brex, Arc and Mercury), took in nearly 30% of the outgoing deposits in the aftermath of the SVB collapse. Some people believe that scale is all that matters in tech banking these days. And at first, that seemed true. But there’s a reason that J.P. Morgan Chase and Wells Fargo didn’t win 100% of deposits outright: Too Big To Fail banks are structurally unfit to serve the hypergrowth tech companies that SVB spent decades winning over. Venture backed startups require more than just a strong brand name, big balance sheet, and FDIC coverage. They need access to capital products that are tailored to explosive growth software copmanies that burn more cash than they make—lines of credit, ARR financing, and venture debt made available long before they are cash flow positive. They need access to institutional-grade treasury solutions that allow founders and CFOs to optimize between liquidity and yield preferences. Most importantly, they deserve dedicated white glove support from Relationship Managers who understand their business coupled with an intuitive User Interface that empowers users to never speak to a banker if they so choose. That’s where the BAM (Brex, Arc, Mercury) Fintechs come in. Unlike regional banks that hold uninsured deposits on their balance sheets, Arc partners with the largest financial institutions in the world to provide a brand-name banking experience with over 20x the standard level of FDIC coverage. At the same time, like the regional banks, Arc provides access to capital, treasury management and dedicated support that is purpose built for the unique community it serves. While I’m not sure if more dominoes will fall in the regional banking system this year, one thing is clear to me — the future of banking for Silicon Valley will not be a bank at all.

Brex Frequently Asked Questions (FAQ)

When was Brex founded?

Brex was founded in 2017.

Where is Brex's headquarters?

Brex's headquarters is located at San Francisco.

What is Brex's latest funding round?

Brex's latest funding round is Series D - II.

How much did Brex raise?

Brex raised a total of $1.49B.

Who are the investors of Brex?

Investors of Brex include Greenoaks Capital Management, Technology Crossover Ventures, Y Combinator, DST Global, Ribbit Capital and 26 more.

Who are Brex's competitors?

Competitors of Brex include ZERO Health, Torpago, Navan, Novo, Reap, Center, Capital on Tap, Paytron, Mesh, Arc Technologies and 30 more.

Compare Brex to Competitors

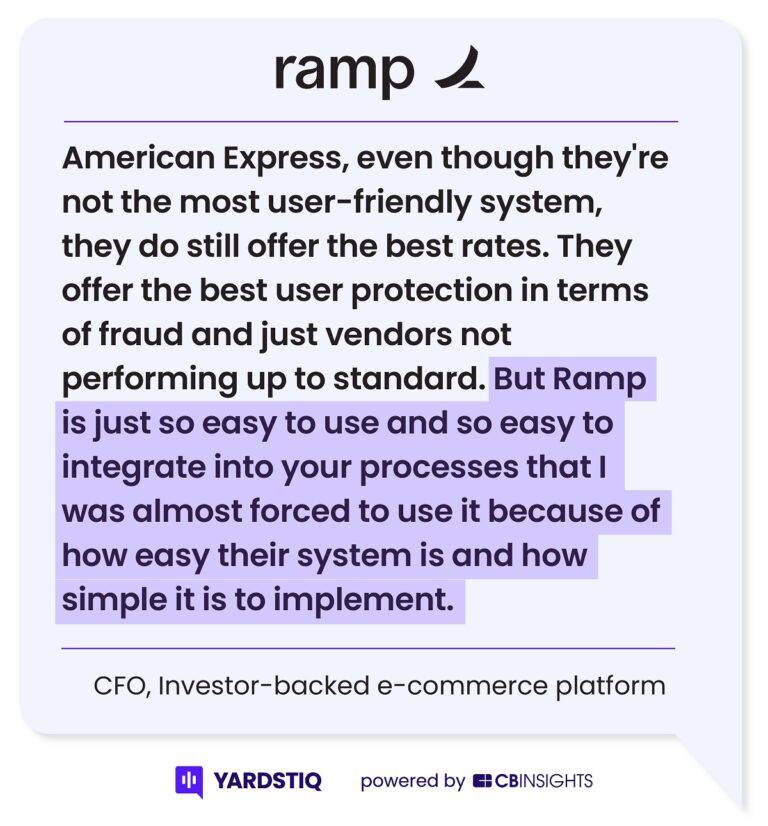

Ramp offers credit cards for small and medium-sized businesses (SMBs). The company aims to provide companies with higher card limits, saving opportunities, automated expense management, receipt matching, and accounting integration. It was founded in 2019 and is based in New York, New York.

Pleo offers smart payment cards for employees, enabling them to buy the things they need for work and keeping the companies in control of spending. The company pairs the cards with software/mobile apps to automatically match receipts and track all spending company-wide in real-time, with analytics and accounting software integrations to boot.

SAP Concur is a SaaS company that provides travel, expense, and invoice management solutions. It specializes in the development of SaaS-based products that include Concur Request, Concur Expense, Concur Travel, Concur Invoice, and more. The company caters to consumer products, healthcare, financial services, and manufacturing industries. The company was founded in 1993 and is based in Bellevue, Washington.

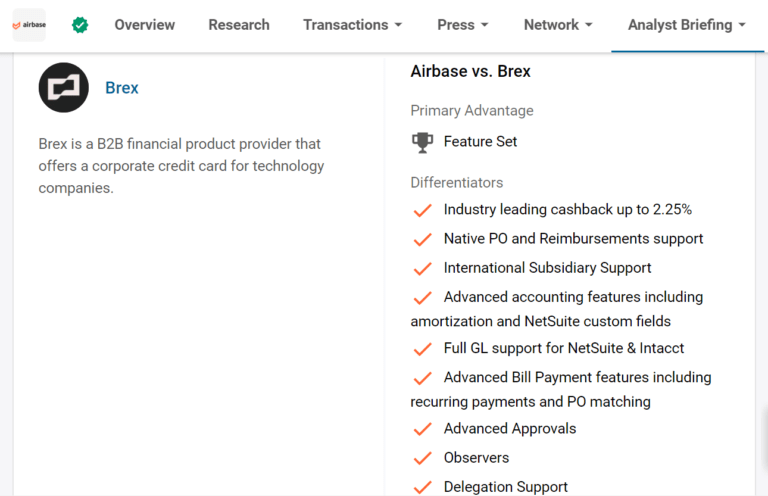

Airbase operates as a spend management platform available to small, midsize, and early enterprise companies. Its products include all-inclusive accounts payable automation, bill payments, software-enabled corporate cards, and reimbursements. The company was founded in 2017 and is based in San Francisco, California.

Jeeves offers an expense management platform built for global businesses. Its services include a corporate card in local currency with no fees or interest that allows firms to set up their financial function. It was founded in 2019 and is based in Orlando, Florida.

Payhawk issues company cards and helps companies to manage their expenses by combining credit cards, payments, expenses, and cash into one integrated experiencе. It issues virtual and physical cards and allows users to pay bills with free bank transfers. It also reimburses employees without cards and automates data entry and reconciliation. Its corporate cards feature built-in spend policies for greater control.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.