Checkout.com

Founded Year

2012Stage

Valuation/Change | AliveTotal Raised

$1.83BValuation

$0000Revenue

$0000About Checkout.com

Checkout.com helps companies accept more payments around the world through one integration. It offers payment processing, payment methods, fraud detection, authentication, integrated platforms, and more. It was formerly known as Opus Payments. It was founded in 2012 and is based in London, United Kingdom.

ESPs containing Checkout.com

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

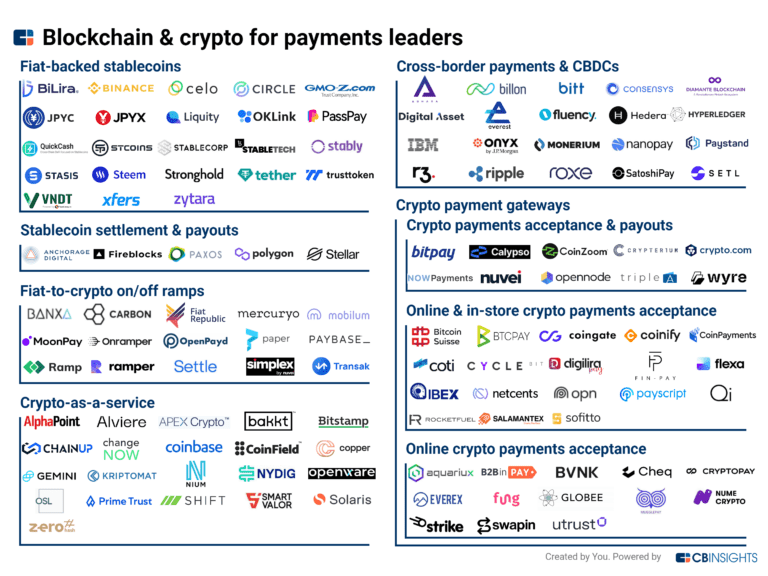

Payment APIs & infrastructure companies enable businesses to seamlessly manage payments. APIs provide direct connections to payments infrastructure to power faster, more secure, and lower-cost transaction processing.

Checkout.com named as Leader among 14 other companies, including Stripe, GoCardless, and Unqork.

Compete with Checkout.com?

Ensure that your company and products are accurately represented on our platform.

Checkout.com's Products & Differentiators

Consolidated payment technology platform

Checkout.com's consolidated payment technology platform offers merchants an all-in-one solution featuring a fully proprietary payment processing, acquiring, and payment gateway, resulting in offering optimal authorization rates and complete access to data.

Research containing Checkout.com

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Checkout.com in 14 CB Insights research briefs, most recently on Jan 27, 2023.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Sep 27, 2022

The Transcript from Yardstiq: Microsoft vs. everyone

Sep 21, 2022 report

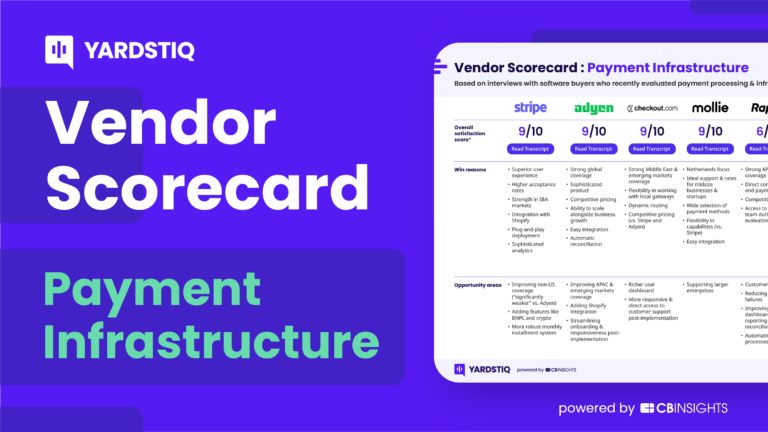

Top payment infrastructure companies — and why customers chose themExpert Collections containing Checkout.com

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Checkout.com is included in 8 Expert Collections, including E-Commerce.

E-Commerce

10,541 items

Unicorns- Billion Dollar Startups

1,208 items

Payments

2,682 items

Companies and startups in this collection enable consumers, businesses, and governments to pay each other - online and at the physical point-of-sale.

Conference Exhibitors

5,302 items

Fintech 250

749 items

250 of the top fintech companies transforming financial services

Retail Tech 100

100 items

The winners of the 2020 CB Insights Retail Tech 100, published December 2020.

Latest Checkout.com News

May 2, 2023

Tuesday 2 May 2023 15:26 CET | News UAE-based fintech Mamo has chosen Checkout.com as its payment provider of choice for its flagship product Mamo Business. This deal further supports Mamo’s mission to accelerate the growth of SMEs in the MENA region’s flourishing digital economy. Accelerating growth for SMEs in the MENA region The announcement unlocks Checkout.com’s proprietary payments platform for Mamo’s SME customers, which offers a complete range of popular payment methods across the MENA region. With Checkout.com’s leading technology stack, Mamo Business customers will also experience augmented payment performance, delivering the checkout experience consumers expect today. What’s more, supplemented by the direct integration with Checkout.com, Mamo will offer a swift onboarding process for its SME customers that can be done in just 24 hours. Moving forward, SMEs using Mamo Business will have access to multiple payment channels including disbursements, invoicing, payment links, e-wallets, API integrations, and exportable data reporting that helps them to maximise their revenue in every transaction. Additionally, SMEs can benefit from highly-reliable and secure transactions as Mamo is fully regulated and licensed by the Dubai Financial Services Authority (DFSA) to provide money services and is an officially registered Visa & Mastercard Payment Facilitator. Augmenting transfers Furthermore, as part of this agreement Mamo Business customers will soon benefit from the unique Checkout.com Account Funding Transactions (AFT) feature. This is especially beneficial as card-to-card transfers have potential for taking business ecommerce performance to the next level. Officials from Checkout.com said they are committed to providing high-quality payment processing services to their clients. The partnership with Mamo reinforces their commitment to this goal and to supporting the UAE government’s ambition to become a global digital economy player, all while increasing the contribution of SMEs in this area. Their collaboration with Mamo ultimately guarantees small business owners a secure and swift payment processing capability, which enables them to start their ventures quickly and more successfully. Moving towards a digital future Representatives from Mamo stated that digital commerce in the UAE and wider GCC is evolving at pace, and the demand for fintech companies that can offer easy-to-deploy solutions to merchants is on the rise. They believe this strategic collaboration with Checkout.com is key to growing the ecosystem in line with UAE’s digital agenda and Dubai’s D33 economic agenda. They are happy to partner with Checkout.com as the market leader to bring these latest solutions to our customers in the UAE and eventually across the GCC.

Checkout.com Frequently Asked Questions (FAQ)

When was Checkout.com founded?

Checkout.com was founded in 2012.

Where is Checkout.com's headquarters?

Checkout.com's headquarters is located at Wenlock Works, London.

What is Checkout.com's latest funding round?

Checkout.com's latest funding round is Valuation/Change.

How much did Checkout.com raise?

Checkout.com raised a total of $1.83B.

Who are the investors of Checkout.com?

Investors of Checkout.com include GIC, DST Global, Insight Partners, Blossom Capital, Endeavor and 12 more.

Who are Checkout.com's competitors?

Competitors of Checkout.com include Stripe, Circle, Sleek, Nomod, Rapyd and 9 more.

What products does Checkout.com offer?

Checkout.com's products include Consolidated payment technology platform.

Who are Checkout.com's customers?

Customers of Checkout.com include Curve, Careem, Dott and Wise.

Compare Checkout.com to Competitors

Stripe is a financial technology company that builds economic infrastructure for the internet. The company offers an online-based, payment processing platform that gives online merchants the ability to securely accept credit card payments through the use of custom-built forms. Stripe's software and APIs allow user's to accept payments, send payouts and manage businesses online. The company serves clients globally with a use case for SaaS, platforms, marketplaces, eCommerce, creator economy, crypto and embedded finance. It was founded in 2010 and is based in San Francisco, California.

Rapyd is a digital financial technology-as-a-service platform designed to order cash, exchange extra foreign currency and send cash to friends. The company's platform provides services like payments, checkout, funds collection, fund disbursements, and more. It was formerly known as CashDash. It was founded in 2016 and is based in Marylebone, United Kingdom.

Airwallex is a financial technology company. It allows customers to issue and pay international invoices and bills. It offers domestic and international business accounts, company cards, and expense management. The company was founded in 2015 and is based in Melbourne, Australia.

PayU Hub develops an application programming interface (API) connection to accepting and optimizing online payments in any global market. It offers access to hundreds of local and global online payment methods. The company was founded in 2002 and is based in Hoofddorp, Netherlands.

Talk Bank is a neo-bank that reduces costs for customer support costs by AI chat-bot in messengers, providing white-label banking solutions for banks, insurance companies, and marketplaces. Talk Bank platform includes advanced remote KYC, behavioral anti-fraud solutions, service for freelancers and self-employed, transparent transaction control.

Lemon Way is a pan-European payment institution dedicated to marketplaces, crowdfunding platforms, e-commerce websites, and other companies looking for payment processing, wallet management and third-party payment in a KYC/AML - regulated framework.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.