Cross River Bank

Founded Year

2008Stage

Series D | AliveTotal Raised

$1.053BValuation

$0000Last Raised

$620M | 1 yr agoAbout Cross River Bank

Cross River Bank operates as a financial services organization. It merges the established expertise and traditional services of a bank with the forward-thinking offerings of a technology company and combines a comprehensive suite of products into a banking-as-a-platform solution, encompassing lending, payments, and risk management. It was founded in 2008 and is based in Fort Lee, New Jersey.

ESPs containing Cross River Bank

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Companies in this market include cloud-native and cloud-based SaaS platforms that integrate with or replace banks’ existing core systems. These solutions can enable cost-savings across the retail banking value chain, reduce silos in front and back-end operations, help launch new products, and drive better consumer experiences.

Cross River Bank named as Leader among 15 other companies, including Finastra, Mambu, and TrueLayer.

Compete with Cross River Bank?

Ensure that your company and products are accurately represented on our platform.

Cross River Bank's Products & Differentiators

Core financial services infrastructure

provide infrastructure via APIs

Research containing Cross River Bank

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cross River Bank in 3 CB Insights research briefs, most recently on Oct 4, 2022.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Mar 9, 2021

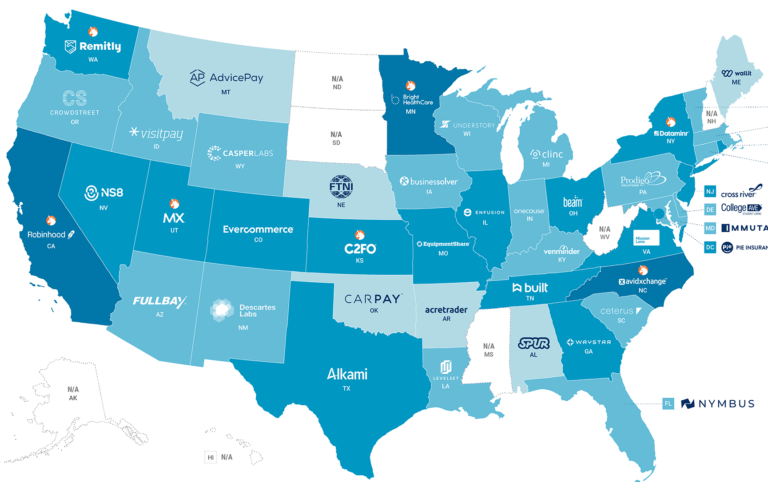

The United States Of Fintech StartupsExpert Collections containing Cross River Bank

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cross River Bank is included in 10 Expert Collections, including Banking.

Banking

1,356 items

Unicorns- Billion Dollar Startups

1,208 items

Blockchain

6,117 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Various industries include financial services, trade finance, supply chain, enterprise tech, consumer and retail, and healthcare.

Fintech 250

1,247 items

Digital Lending

1,883 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,230 items

Cross River Bank Patents

Cross River Bank has filed 1 patent.

The 3 most popular patent topics include:

- Bitcoin

- Cryptocurrencies

- Digital currencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/29/2020 | Payment systems, Interbank networks, Cryptocurrencies, Digital currencies, Bitcoin | Application |

Application Date | 12/29/2020 |

|---|---|

Grant Date | |

Title | |

Related Topics | Payment systems, Interbank networks, Cryptocurrencies, Digital currencies, Bitcoin |

Status | Application |

Latest Cross River Bank News

May 7, 2023

The $50,000 donation to the New Jersey educational institution will ensure access to education and foster talent in the technology sector Cross River Bank , a technology infrastructure provider that offers embedded financial solutions, announced the creation of the Cross River Opportunity Scholarship with the New Jersey Institute of Technology (NJIT). The annual scholarship is gifted through the Company’s giving arm, Foundation@ Cross River, with a donation of $50,000 to The Foundation at NJIT. The funds will provide direct support to students and empower those interested in finance and technology-related fields. “When our giving effectuates change in the lives of students, like it will at NJIT, we are succeeding in our mission to provide impactful philanthropy” “When our giving effectuates change in the lives of students, like it will at NJIT, we are succeeding in our mission to provide impactful philanthropy,” said Miriam L. Wallach, Head of Social Responsibility at Cross River. “We’re thrilled to partner with New Jersey Institute of Technology to support their students in earning their degrees, and provide learning opportunities about the local technology community that can only be gained through mentor-mentee relationships.” Each academic year, two talented and hardworking students who are attending the Martin Tuchman School of Management (MTSM) full time as FinTech majors will be named Cross River Opportunity Scholars. The funds will be awarded to first-generation students from low-income backgrounds and/or members of historically underrepresented groups. The Cross River Opportunity Scholars for Spring 2023, Ali Smithson ‘25 and Dominick Gryzb ’26, were given a chance to meet representatives of their benefactor, Cross River, at a networking luncheon to honor the inauguration of the school’s President Teik C. Lim. At the lunch, Cross River’s Head of Social Responsibility, Miriam L. Wallach heard first-hand the incredible difference the Scholarship produces in the lives of these students by making education accessible. “I am deeply grateful to Cross River for its generous investment in our talented students and in the university,” said NJIT President Teik C. Lim . “Our institutions clearly share many of the same values, commitments, and aspirations, from expanding the pipeline of future, career-ready tech talent to promoting diversity and inclusion in the STEM and STEM-adjacent fields. The partnership we have initiated will bring together our distinctive assets and resources, and that combination will benefit not only Cross River and NJIT but also the larger community. This is the very definition of a mutually beneficial university-industry partnership.” In addition to providing tuition assistance, the scholarship will provide funding for Cross River Opportunity Scholars to participate in experiential learning activities, such as community service and development activities, training programs, workshops and conferences. The partnership between Cross River and NJIT provides value beyond the scholarship, benefitting all students from MTSM and the university community. Cross River leadership and employees will serve as guest lecturers, in addition to creating recruitment opportunities for internships, co-ops and jobs. As a leading financial technological company reshaping global finance and financial inclusion, Cross River is deeply invested in supporting initiatives that help communities drive positive change for a better future. The Company’s philanthropic arm, Foundation@ Cross River, supports initiatives, programs and projects that provide not-for-profit community organizations with funds and services needed to achieve their goals.

Cross River Bank Frequently Asked Questions (FAQ)

When was Cross River Bank founded?

Cross River Bank was founded in 2008.

Where is Cross River Bank's headquarters?

Cross River Bank's headquarters is located at 400 Kelby Street, Fort Lee.

What is Cross River Bank's latest funding round?

Cross River Bank's latest funding round is Series D.

How much did Cross River Bank raise?

Cross River Bank raised a total of $1.053B.

Who are the investors of Cross River Bank?

Investors of Cross River Bank include Andreessen Horowitz, Battery Ventures, T. Rowe Price, Whale Rock Capital Management, Eldridge and 9 more.

Who are Cross River Bank's competitors?

Competitors of Cross River Bank include Stilt, Yapily, Grasshopper Bank, OpenFin, NovoPayment, Zenus Bank, TrueLayer, Tink, Deposit Solutions, Meniga and 12 more.

What products does Cross River Bank offer?

Cross River Bank's products include Core financial services infrastructure and 4 more.

Who are Cross River Bank's customers?

Customers of Cross River Bank include Dwolla, Rocketloans and Affirm.

Compare Cross River Bank to Competitors

Synapse develops a platform that helps banks and developers work together. The technology involves developer-facing APIs that allow companies to connect with banks to offer services, and also bank-facing APIs that allow banks to automate and extend back-end operations.

Fabrick is a new open financial ecosystem that enables and fosters a fruitful exchange between players that discover, collaborate, and create innovative solutions for end customers, through an API platform. Fabrick presents the new way of doing banking: open, modular, and data driven. For banks and financial institutions, Fabrick represents a vast ecosystem of quality services to access in order to grow their business.

OpenFin provides financial services. It is a desktop operating layer that enables banks and trading platforms to deploy desktop applications both in-house and to the buy-side and sell-side customers. It was founded in 2010 and is based in New York, New York.

TrueLayer offers an open banking payments network. It helps startups and banks to drive products in financial services and supports account verification, know-your-customer (KYC) processes, and transactional data for account aggregation, credit scoring, and risk assessment. It was founded in 2016 and is based in London, United Kingdom.

Leveris has developed an end-to-end platform to allow financial institutions and fintech startups such as digital-only banks or challenger banks to run their services.

Meniga builds white-label personal finance management (PFM) and online banking solutions for retail banks. Meniga's digital banking platform helps banks use personal finance data to enrich their online and mobile customer experiences. Meniga has expanded its product offering to include data-driven card-linked offers, personalization, and other user-centric services designed to make online and mobile banking more engaging and useful. Banks can also use Meniga's technology to quickly introduce new services into their digital offerings.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.