wefox

Founded Year

2015Stage

Series D - II | AliveTotal Raised

$1.379BValuation

$0000Last Raised

$55M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+60 points in the past 30 days

About wefox

wefox provides digital insurer services. It focuses on personal insurance products. The company enables customers, insurance brokers, and insurance providers to transact and manage insurance products digitally. It was formally known as Finance Fox. The company was founded in 2015 and is based in Berlin, Germany.

Missing: wefox's Product Demo & Case Studies

Promote your product offering to tech buyers.

Reach 1000s of buyers who use CB Insights to identify vendors, demo products, and make purchasing decisions.

ESPs containing wefox

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital insurance marketplace market refers to the online platforms that connect consumers with various insurance providers. These platforms offer a range of solutions, including comparison tools, policy management services, and claims processing assistance. The market has seen significant growth in recent years due to increasing consumer demand for convenience and transparency in the insuranc…

wefox named as Highflier among 10 other companies, including Cover Genius, Instanda, and Bolttech.

Missing: wefox's Product & Differentiators

Don’t let your products get skipped. Buyers use our vendor rankings to shortlist companies and drive requests for proposals (RFPs).

Research containing wefox

Get data-driven expert analysis from the CB Insights Intelligence Unit.

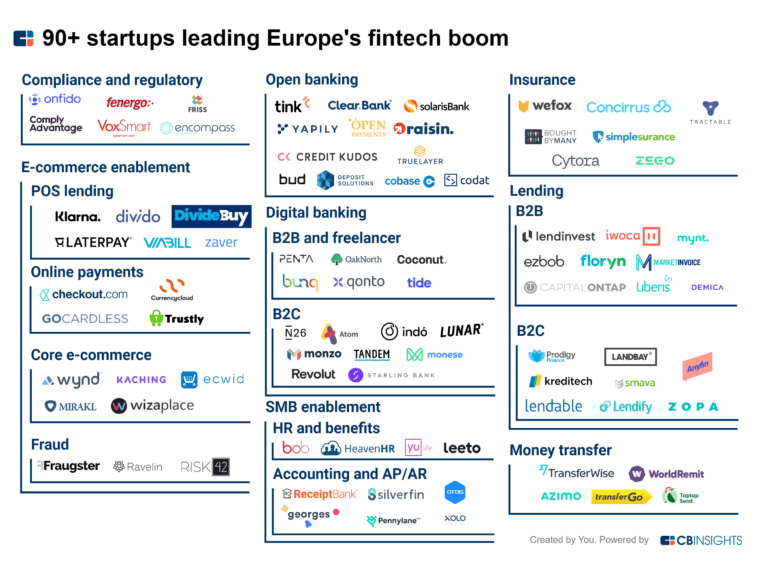

CB Insights Intelligence Analysts have mentioned wefox in 5 CB Insights research briefs, most recently on Jul 13, 2022.

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing wefox

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

wefox is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,208 items

Fintech 250

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,116 items

Companies and startups that use of technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

5,143 items

Insurtech 50

50 items

Latest wefox News

May 3, 2023

May 3, 2023 wefox, the Berlin-based insurtech, has launched a global affinity business, which increases its existing distribution channel and extends the ability of the company to deliver insurance solutions through partners. This core business vertical is part of the company’s overall tech platform strategy in which wefox connects insurance companies with partners to distribute insurance products. The team, led by Tomaso Mansutti and Pierfrancesco Ricca, will be targeting a global market worth around US$3 trillion in just embedded insurance alone. wefox explained that its affinity partners are businesses that do not have insurance as their core business and form a wefox partnership in order to distribute insurance as an extra source of revenue. In Germany, the new country head, Guenther Blaich, will lead the local affinity business. Last November saw two additions to the team: Thomas Rettenwander is leading the affinity business for Austria, while Daniele Del Bo was appointed group business development director for Affinity Automotive. Other hires are in the process. “In taking our affinity business global we are not only endorsing our affinity knowledge and experience, but also ensuring every one of our partners benefits from more than just products and service solutions,” commented Tomaso Mansutti, group head of International Partnerships at wefox. “We will continue to develop bespoke insurance products for our affinity customers, but for us, mutually successful affinity business is also about culture and authenticity. We collaborate and always place our customers at the heart of every decision we take together,” he said. “wefox delivers innovative solutions across channels that empower our partners with new revenue streams and increase customer loyalty. The technology wefox offers creates new opportunities, from insurance embedded in electricity for new mobility, to new underwriting capabilities using totally new variables. All this is offered to insurance carriers for our partners,” Mansutti added. “This is a perfect fit and a huge market opportunity for wefox. Through our existing capabilities, experience and industry knowledge across insurance, distribution and technology, we will deliver value for our customers and succeed in this space,” said Pierfrancesco Ricca, group head of Affinity Partnerships. “We are an insurance business enabler. Through our extended platform model we are in a unique position to offer the customers the technology and services that are needed to build and to run successful programmes,” Ricca continued. “wefox delivers end-to-end digital journeys, from promoting and selling products and services through our partners channels, to managing renewals, upselling and cross selling, claims and a detailed and regular reporting system on the progress of the entire program.” “Our model enables our partners to make affinity insurance a core part of their business and ensure that they retain complete control,” Ricca said. “This is achieved through our simple and transparent process. We have built solid systems and processes and can easily integrate with all the stakeholders to ensure robust compliance, customer satisfaction and the highest business performance, regardless of the complexity of the business in terms of product solutions, insurers – the best performing one for each product – channels and third parties or countries involved.” wefox said affinity partner businesses enhance their core businesses by selling embedded and/or stand-alone insurance solutions that allow them to generate additional revenues, increase customer loyalty and differentiate their offers. Some of them, with the right support, have the potential to become leading insurance players in their markets, wefox added. About wefox Founded in 2015 by Julian Teicke, Fabian Wesemann and Dario Fazlic, wefox is a full-stack insurtech that has doubled revenues every year to reach US$580 million in 2022. It serves more than 2 million customers across Austria, Germany, Italy, Poland, The Netherlands and Switzerland where wefox currently operates. In July 2022, wefox closed a US$400 million series D funding round at a post-money valuation of US$4.5 billion. In June 2021, wefox closed a record series C investment round for an insurtech of US$650 million with a post-money valuation of US$3 billion. Source: wefox

wefox Frequently Asked Questions (FAQ)

When was wefox founded?

wefox was founded in 2015.

Where is wefox's headquarters?

wefox's headquarters is located at Urbanstrasse 71, Berlin.

What is wefox's latest funding round?

wefox's latest funding round is Series D - II.

How much did wefox raise?

wefox raised a total of $1.379B.

Who are the investors of wefox?

Investors of wefox include OMERS Ventures, Horizons Ventures, LGT Capital Partners, Mubadala, Salesforce Ventures and 35 more.

Who are wefox's competitors?

Competitors of wefox include ELEMENT Insurance, Feather, Coya, Surer, GetSafe and 7 more.

Compare wefox to Competitors

Getsafe is an insurtech startup from Heidelberg using technology and AI to help people identify, organize and protect what they care most about in life. With a few clicks, customers can learn about, buy, and manage insurance on their smartphone.

Luko offers home insurance through an online platform. The company aims to circumvent the need to make a claim in the first place using sensors, data, and machine learning.

Allianz is an insurance and asset management company. It is based in Munich, Germany.

Lovys is an aggregated monthly subscription service for its users' insurance needs.

Qover is an insurance technology company. It provides solutions such as claims management, insurance solutions, data analysis and reports, and more. The company serves industries including automotive, travel, real estate, and more. It was founded in 2016 and is based in Brussels, Belgium.

Muffin provides financial and insurance advisory services. The company helps users manage finances and insurance policies and offers advisory services in retirements and investments, and crypto matters. It was founded in 2021 and is based in Berlin, Germany.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.