Fireblocks

Founded Year

2018Stage

Series E | AliveTotal Raised

$1.039BValuation

$0000Last Raised

$550M | 1 yr agoAbout Fireblocks

Fireblocks operates as a platform to create blockchain-based products and manage digital asset operations. It streamlines operations by bringing all exchanges, counterparties, hot wallets, and custodians into one platform. It was founded in 2018 and is based in New York, New York.

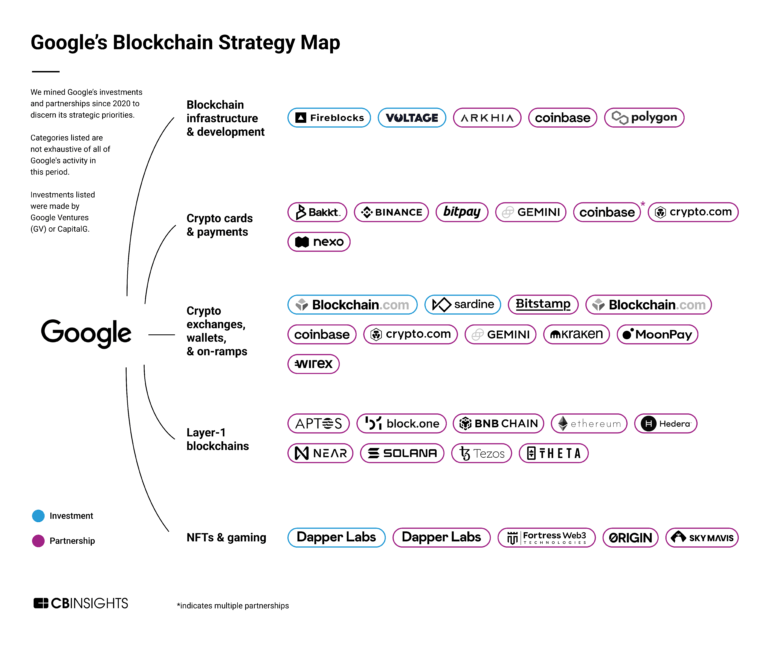

ESPs containing Fireblocks

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Compete with Fireblocks?

Ensure that your company and products are accurately represented on our platform.

Fireblocks's Products & Differentiators

MPC-CMP wallet infrastructure

Fireblocks leverages multi-party computation cryptography (MPC) to secure digital assets from external and internal threats and human errors by eliminating the private key as a single source of compromise. Fireblocks MP-CMP distributes private key material across multiple SGX-protected secure enclaves across customer devices and Microsoft Azure and IBM clouds.

Research containing Fireblocks

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Fireblocks in 12 CB Insights research briefs, most recently on Feb 23, 2023.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Fireblocks

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Fireblocks is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,208 items

Blockchain

9,177 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Various industries include financial services, trade finance, supply chain, enterprise tech, consumer and retail, and healthcare.

Fintech

7,974 items

US-based companies

Blockchain 50

100 items

Fintech 250

499 items

250 of the top fintech companies transforming financial services

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Fireblocks Patents

Fireblocks has filed 2 patents.

The 3 most popular patent topics include:

- Alternative currencies

- Bitcoin

- Blockchains

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/10/2021 | Cryptocurrencies, Alternative currencies, Bitcoin, Financial markets, Blockchains | Application |

Application Date | 2/10/2021 |

|---|---|

Grant Date | |

Title | |

Related Topics | Cryptocurrencies, Alternative currencies, Bitcoin, Financial markets, Blockchains |

Status | Application |

Latest Fireblocks News

May 4, 2023

May 4 2023 Deal Box Announces Integration With Fireblocks to Increase Security and Reliability for Digital Asset Management Deal Box , a capital markets advisory and secure token offering packaging platform, today announced an integration with Fireblocks , an easy-to-use platform to create new blockchain-based products and manage day-to-day digital asset operations. This integration will allow Deal Box to utilize Fireblocks’ secure infrastructure to mint and burn tokens securely and efficiently by providing a suite of APIs and tools that facilitate the creation and management of digital assets. Fireblocks’ battle-tested direct custody technology will also enable Deal Box to provide a secure and reliable platform for its clients to invest in private securities and alternative assets. The digital asset market has snowballed in recent years and will likely reach $8 billion by 2027. However, with this growth comes a rise in cyber threats, hacking, and theft. Institutional investors and exchanges must be able to store and transfer these assets securely, which requires high security and sophistication. Deal Box is a digital securities investment platform that enables companies to raise capital from accredited investors through various investment vehicles, including digital securities offerings (DSOs). In 2022 alone, Deal Box tokenized over $250 million in illiquid alternative assets. These offerings allow companies to raise capital more efficiently, cost-effectively, and securely than traditional fundraising methods. Deal Box will utilize Fireblocks multi-party computation (MPC) based wallet technology to provide a secure environment for storing, transferring, and issuing digital assets, including cryptocurrencies, tokens, and other blockchain-based assets. As a platform that facilitates investment opportunities in private securities and alternative assets, security and custody are of utmost importance. Fireblocks’ technology will enable Deal Box to deliver a secure and institutional-grade custody solution that is tailored to its unique needs with innovative features including: Secure storage: Fireblocks uses a combination of advanced security features like MPC, hardware isolation, and tamper-proof hardware to ensure that digital assets are stored securely. This makes it very difficult for hackers to compromise the security of digital assets stored by Deal Box. Insurance: Fireblocks provides up to $30 million in insurance coverage for digital assets stored in their custody. This provides an additional layer of protection for Deal Box’s clients. Easy integration: Fireblocks provides a suite of APIs and tools that make it easy for Deal Box to integrate their custody solution into their existing platform. Compliance: Fireblocks is compliant with industry standards and regulations like SOC 2, PCI DSS, and ISO 27001. This ensures that Deal Box is able to maintain compliance with regulatory requirements. Deal Box will integrate with Fireblocks to offer customers maximum security and reliability, which are essential in the digital securities investment market. Fireblocks’ capabilities will enable Deal Box to seamlessly integrate digital asset services into its platform, making it easier for startups and emerging companies to raise capital through DSOs. This integration will provide Deal Box customers with a secure and efficient infrastructure for their digital asset management. It is also essential for the success of DSOs and the growth of the digital securities investment market. “Managing digital securities is at the core of our investment packaging services at Deal Box, which requires a highly secure platform in place for storing and transferring such sensitive assets,” said Deal Box CEO and Chairman Thomas Carter. “We are thrilled to integrate with Fireblocks to offer our clients the highest level of security, reliability, and efficiency when handling their digital assets, making it easier for them to raise capital through DSOs.” “One of the foremost use cases of blockchain technologies is being able to digitize financial assets for trading,” said Vice President and Head of Corporate Strategy Adam Levine at Fireblocks. “This trillion-dollar market requires industry-leading security infrastructure to ensure the safe storage and transfer of high-value assets. Using Fireblocks to underpin the security of new digital asset products and services will enable Deal Box to deliver that to their customers.” This news comes on the heels of Deal Box’s recent announcement of its investment arm, Deal Box Ventures, the company’s latest venture arm set to invest $125 million in web3 technologies. People In This Post Fintech Funding Funding News Fintech

Fireblocks Frequently Asked Questions (FAQ)

When was Fireblocks founded?

Fireblocks was founded in 2018.

Where is Fireblocks's headquarters?

Fireblocks's headquarters is located at New York.

What is Fireblocks's latest funding round?

Fireblocks's latest funding round is Series E.

How much did Fireblocks raise?

Fireblocks raised a total of $1.039B.

Who are the investors of Fireblocks?

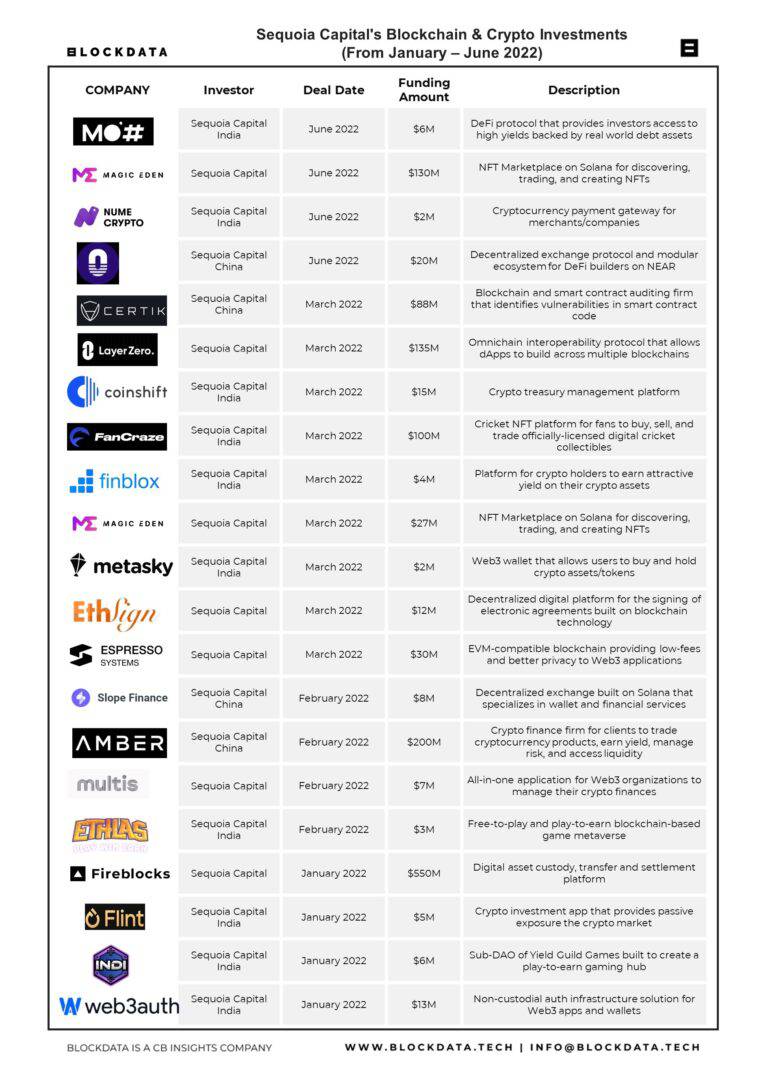

Investors of Fireblocks include Tenaya Capital, Paradigm, Coatue Management, Spark Capital, DRW Venture Capital and 24 more.

Who are Fireblocks's competitors?

Competitors of Fireblocks include Safeheron, Ledger, Taurus, Liminal, GK8, BitGo, Copper, TMIA, Cybavo, GMEX Group and 20 more.

What products does Fireblocks offer?

Fireblocks's products include MPC-CMP wallet infrastructure and 4 more.

Who are Fireblocks's customers?

Customers of Fireblocks include Customer Name: Revolut , Crypto.com and GMO Trust.

Compare Fireblocks to Competitors

Copper operates a cryptocurrency custody and prime broking platform for digital assets. It enables institutions to acquire, store, and trade digital assets through its multi-signature safeguarding applications. The company was founded in 2018 and is based in London, United Kingdom.

BitGo provides regulated custody, financial services, and core infrastructure for investors. The company delivers a bitcoin security platform to mitigate risk and optimizes capital efficiency. It offers a multi-signature wallet, portfolio management, corporate treasury, and enterprise enablement to secure Bitcoin from theft and loss. The company was formerly known as WhenSoon and Twist and Shout. It was founded in 2013 and is based in Palo Alto, California.

Hex Trust is a fully licensed and insured provider of bank-grade custody for digital assets. Through its proprietary platform Hex Safe, we deliver custody, DeFi, brokerage, and financing solutions for financial institutions, digital asset organizations, corporate and private clients. Hex Trust has offices in Hong Kong, Singapore, and Vietnam and is expanding across Europe and the Middle East.

Ledger is a global platform for digital assets and Web3. It offers various products such as the Nano S Plus, Nano X, and the Ledger live app to offer consumers to securely buy, store, swap, grow, and manage crypto. The company was founded in 2014 and is based in Paris, France.

Anchorage Digital offers a crypto platform providing institutions with integrated digital asset financial services and infrastructure solutions. It offers a digital bank as a crypto-native bank and also offers crypto strategies for leading institutions. The company provides security and the benefits of asset accessibility, including capturing yield from staking and inflation, voting, auditing proof of existence, and fast transactions. The company was founded in 2017 and is based in San Francisco, California.

Cobo is Asia Pacific’s largest digital asset custodian and blockchain technology provider, based in Singapore. Trusted by over 500 institutions and HNWIs to grow and protect their crypto assets, the company focuses on building scalable infrastructure and powering the Web 3.0 revolution around the world. As a strong blockchain and DeFi infrastructure builder, Cobo provides SaaS (Software-as-a-Service) products such as WaaS (Wallet-as-a-Service), DaaS (DeFi-as-a-service), NaaS (NFT-as-a-Service), and Argus (The Smart Contract Based Custody).

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.