Forter

Founded Year

2013Stage

Series F | AliveTotal Raised

$525MValuation

$0000Last Raised

$300M | 2 yrs agoAbout Forter

Forter provides a plug-and-play, anti-eCommerce fraud solution technology that automates the review process by instantly analyzing profile data, behavioral data, and cyber intelligence, enabling the ability to decline fraudsters and approve consumers in real-time.

Forter's Product Videos

ESPs containing Forter

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The fraud detection & prevention market is a rapidly growing industry that provides solutions to identify and prevent fraudulent activities across various industries. These solutions include advanced analytics, machine learning algorithms, biometric authentication, and real-time monitoring tools. The market has been driven by the increasing number of fraud incidents in recent years due to the rise…

Forter named as Outperformer among 15 other companies, including Signifyd, ComplyAdvantage, and Featurespace.

Compete with Forter?

Ensure that your company and products are accurately represented on our platform.

Forter's Products & Differentiators

Forter Payment Protection

Forter’s Payment Protection platform provides accurate, real-time decisions for every transaction -- allowing more good buyers to make purchases while keeping fraud out. The Payment Protection platform includes solutions to help merchants deal with transaction fraud, phone fraud, and omnichannel fraud. Additionally, the platform offers solutions to help with PSD2 protection, Forter’s Trusted Authorization solution to connect merchants directly with issuing banks, and Forter’s 100% chargeback guarantee to erase chargeback costs from a merchant’s bottom line.

Research containing Forter

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Forter in 10 CB Insights research briefs, most recently on Feb 27, 2023.

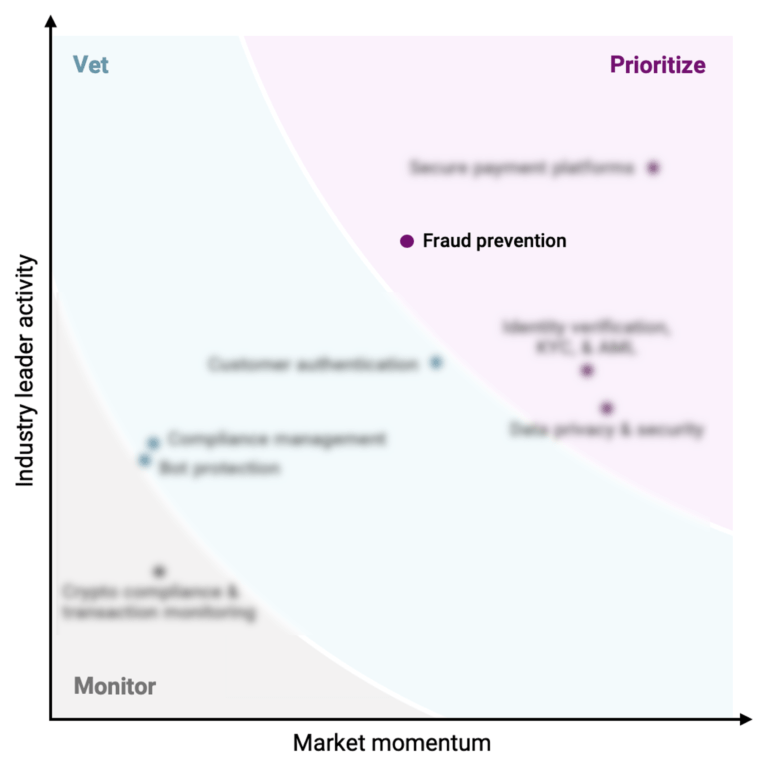

Feb 27, 2023 report

Top fraud prevention companies — and why customers chose them

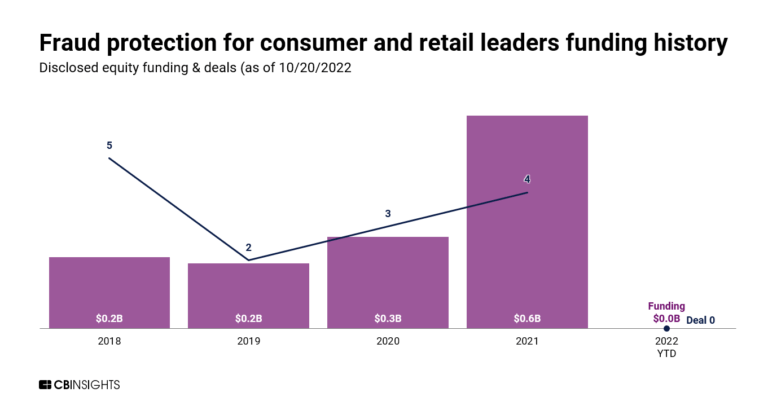

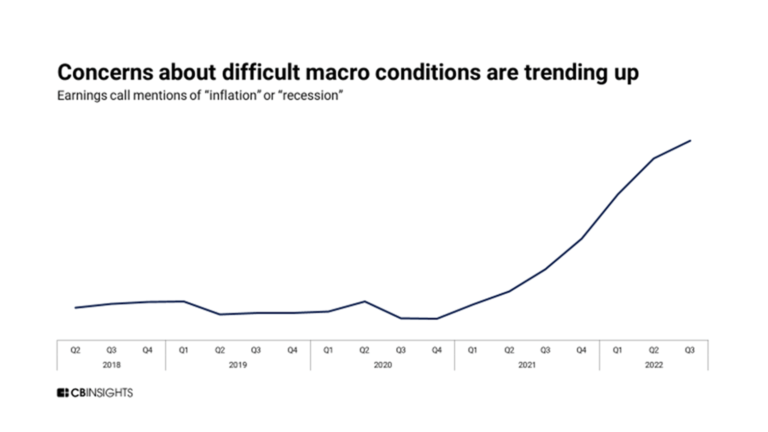

Apr 19, 2022 report

Why payments leaders are prioritizing fraud prevention

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing Forter

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

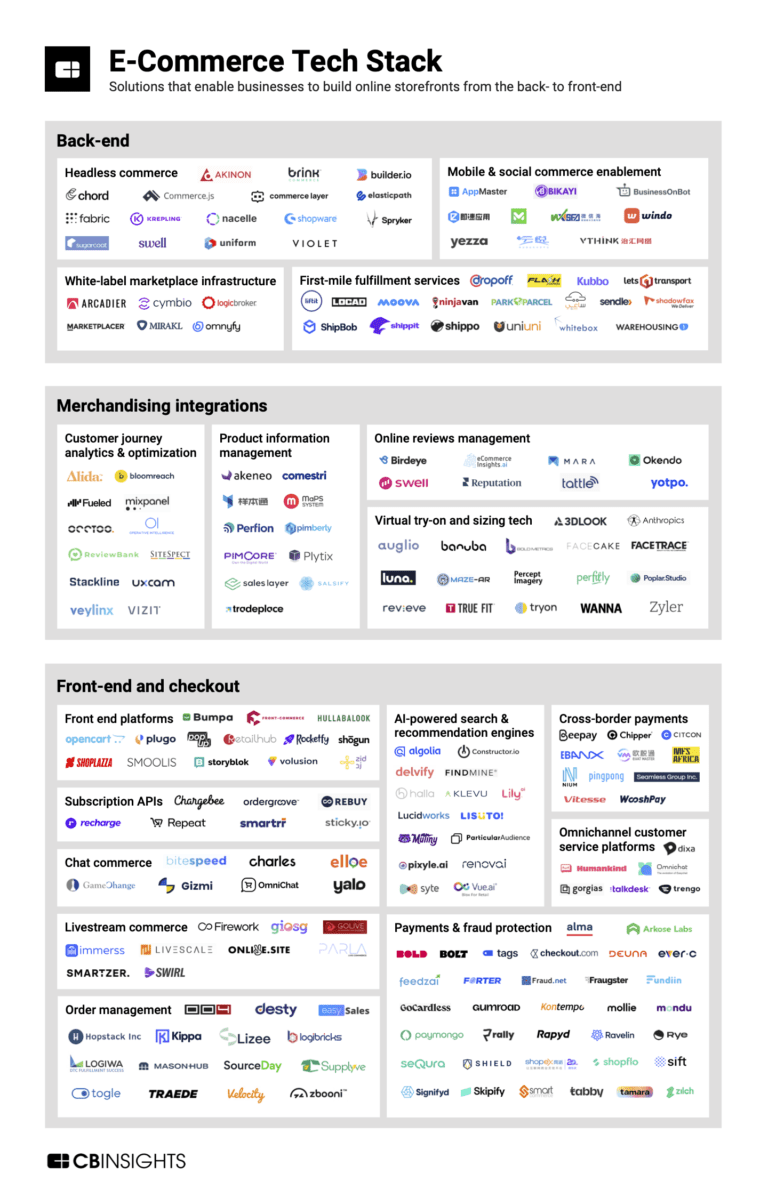

Forter is included in 10 Expert Collections, including E-Commerce.

E-Commerce

10,542 items

Unicorns- Billion Dollar Startups

1,208 items

Payments

2,682 items

Companies and startups in this collection enable consumers, businesses, and governments to pay each other - online and at the physical point-of-sale.

Fintech 250

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Conference Exhibitors

5,302 items

Forter Patents

Forter has filed 3 patents.

The 3 most popular patent topics include:

- Online payments

- Payment service providers

- Payment systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/8/2016 | 8/1/2017 | Rules of inference, Data management, Information technology management, Transaction processing, Internet culture | Grant |

Application Date | 1/8/2016 |

|---|---|

Grant Date | 8/1/2017 |

Title | |

Related Topics | Rules of inference, Data management, Information technology management, Transaction processing, Internet culture |

Status | Grant |

Latest Forter News

May 5, 2023

External | what does this mean? This content is provided by an external author without editing by Finextra. It expresses the views and opinions of the author. When Digital Payments FAIL: The Trojanization of the Digital Payment Ecosystem | PART 3 02 May 2023 0 94% of the passwords used by 5.2 billion internet users scored less than 65 on Center for Internet Security’s (CIS) security scale. I am pretty much sure that you are one of them. CIS suggests thatanything less than 80, is considered an easy target for hackers, given the advanced computing power available today. To determine if your password is hack-resistant, CIS has developed a simple algorithm. Check your password's security score using the link below: If you have already clicked or had a thought of clicking it, then you are the victim of phishing. All the stats that I have mentioned above are false.Sorry for that! :) It was a kind of Phishing attempt, a type of cyber-attack. It is a social engineering attack that aims to trick victims into revealing sensitive information. Hackers insert malicious software/hardware into legitimate digital payment systems, allowing them to steal sensitive information such as credit card numbers, passwords, and personal information – called Trojanization. Trojanization is a growing problem in the digital payment industry. Hackers use a variety of methods to infiltrate digital payment systems, including phishing emails, fake websites, and social engineering tactics. Once they have gained access to the system, they can install malicious software, such as keyloggers or screen scrapers, to collect sensitive data. The consequences of Trojanization can be severe. In addition to financial losses, victims may also suffer reputational damage if their personal information is leaked online. For businesses, a breach of their digital payment system can lead to lost revenue, legal liabilities, and damage to their brand image. To prevent Trojanization, our startup industry is taking a proactive approach to cybersecurity. 1. Behavioral Pattern: Paygilant: Paygilant uses behavioral biometrics to track a user's unique behavioral patterns, such as how they hold their phone or how they swipe their finger or how many times phone was locked/unlocked in a given time interval to detect when a fraudster is trying to hijack their account. Nethone: Nethone uses behavioral biometrics, machine learning, and deep learning to analyze user behavior and detect fraudulent activity. According to a report by MarketsandMarkets, the behavioral biometrics market is expected to grow from$871.2 million in 2018 to $3,922.42 million by 2023, at a CAGR of 35.2%. 2. Device Fingerprinting: Paygilant creates a unique "fingerprint" for each device used to make digital payments, which helps to identify suspicious activity across different devices. : Forter: Forter analyzes device information to identify fraudulent activity in e-commerce transactions. Signifyd: Signifyd analyzes device information, shipping addresses, and transaction history to determine the legitimacy of a transaction. Sift: Sift uses machine learning to analyze device information and behavioral patterns to identify and prevent fraud. According to a report by Javelin Strategy & Research, the average value of a fraudulent transaction in 2022 was $509. 3. Location Access: Riskified: Riskified analyzes location information to determine whether a transaction is legitimate or fraudulent. Kount: Kount uses geolocation to identify when a transaction is taking place in an unusual location. According to a report by Juniper Research, global online payment fraud losses are expected to reach $48 billion by 2023. 4. Passwordless Authentication: Trusona: Trusona replaces passwords with a secure authentication method, such as facial recognition or fingerprint scanning, to prevent hackers from stealing sensitive information. According to a report by IBM Security, the average cost of a data breach in 2020 was $3.86 million. 5. Open Banking Infrastructure: Token: Token provides open banking infrastructure, allowing financial institutions to securely share customer data with third-party providers, such as digital payment apps, to offer a more seamless and secure payment experience for their customers. According to a report by Accenture, open banking could add $7.2 billion in new revenue streams for banks by 2025. 6. Encryption: CybSafe provides encryption services for businesses to protect their sensitive data from cyber attacks and unauthorized access. According to a report by Zion Market Research, the global encryption software market is expected to reach $16.5 billion by 2025. 7. Two-Factor Authentication: Duo Security offers two-factor authentication services for businesses to ensure that only authorized users have access to sensitive data. According to a report by Verizon, 80% of data breaches in 2020 involved the use of stolen or weak passwords. (I was not that wrong, at the start of this blog. :) ) 8. Incident Response: Companies such as FireEye offer incident response services for businesses to quickly detect, respond to, and recover from cyber attacks. According to a report by IBM, the average time to identify and contain a data breach in 2020 was 280 days, with an average cost of $3.86 million. 9. Cyber Insurance: Cyber insurance providers such as Chubb and AIG offer policies that can help businesses recover financially from cyber attacks and data breaches. According to a report by Cybersecurity Ventures, the global cyber insurance market is expected to reach $23.4 billion by 2030. 10. Cloud Security: Cloud security solutions such as Cloudflare and Netskope help businesses secure their cloud-based applications and data against cyber threats. According to a report by Gartner, the global market for cloud security is expected to reach $12.6 billion by 2024. Let me know any innovative startup work - not listed here. If you have learnt anything new today, please help others by sharing this article. Connect:

Forter Frequently Asked Questions (FAQ)

When was Forter founded?

Forter was founded in 2013.

Where is Forter's headquarters?

Forter's headquarters is located at 575 Fifth Ave., New York.

What is Forter's latest funding round?

Forter's latest funding round is Series F.

How much did Forter raise?

Forter raised a total of $525M.

Who are the investors of Forter?

Investors of Forter include Scale Venture Partners, March Capital, NewView Capital, Bessemer Venture Partners, Sequoia Capital and 14 more.

Who are Forter's competitors?

Competitors of Forter include Riskified, Sift, Signifyd, FUGU, Kount and 7 more.

What products does Forter offer?

Forter's products include Forter Payment Protection and 4 more.

Who are Forter's customers?

Customers of Forter include TAG Heuer, SNIPES, Priceline, Delivery.com and Nordstrom.

Compare Forter to Competitors

Signifyd combines machine learning with human work to eliminate online payment fraud for e-commerce companies. The company leverages big data, machine learning and domain expertise to provide a financial guarantee against fraud on approved orders that later turn out to be fraudulent.

Sift Science provides real-time machine learning fraud prevention solutions for online businesses across the globe. Its machine learning software automatically learns and detects fraudulent behavioral patterns, alerting businesses before they or their customers are defrauded. Beyond this, the company has also launched a new set of products designed to detect and mitigate additional types of fraud and abuse, including: Account abuse, Content abuse, and Promo abuse.

Shield is a software-as-a-service (SaaS)-based self-learning fraud prevention solution for e-commerce. It combines latest fraud detection technology with machine learning, predictive analytics, and big data that runs on an optimized risk algorithm to compute the decision for accepting or rejecting each transaction. It was formerly known as CashShield. It was founded in 2008 and is based in Singapore, Singapore.

NS8 is an eCommerce company that provides abuse, fraud, and user experience protection tools. The company uses behavioral analytics, real-time user scoring, and global monitoring to optimize and protect against threats, which give eCommerce merchants insight into their real customers.

Ravelin provides fraud and payment authentication solutions for businesses. The company offers solutions such as online payment fraud, account security, policy abuse, marketplace fraud, and more. It was founded in 2014 and is based in London, United Kingdom.

buySAFE is a provider of e-commerce trust and advertising solutions.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.