Investments

1134Portfolio Exits

154Funds

18Partners & Customers

1Service Providers

1About Khosla Ventures

Khosla Ventures provides venture assistance and strategic advice to entrepreneurs working on breakthrough technologies. It focuses on a broad range of areas including consumer, enterprise, education, advertising, financial services, semiconductors, health, big data, agriculture/food, sustainable energy, and robotics. The firm was founded in 2004 and is based in Menlo Park, California.

Want to inform investors similar to Khosla Ventures about your company?

Submit your Analyst Briefing to get in front of investors, customers, and partners on CB Insights’ platform.

Expert Collections containing Khosla Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Khosla Ventures in 23 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

HR Tech

65 items

Store tech (In-store retail tech)

55 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Agriculture Technology (Agtech)

24 items

Companies that are using technology to make farms more efficient

Banking

44 items

Based on CB Insights Research Brief: https://www.cbinsights.com/blog/industry-market-map-landscape/#retail banking

Unicorns- Billion Dollar Startups

115 items

Research containing Khosla Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Khosla Ventures in 11 CB Insights research briefs, most recently on Dec 9, 2021.

Aug 5, 2021

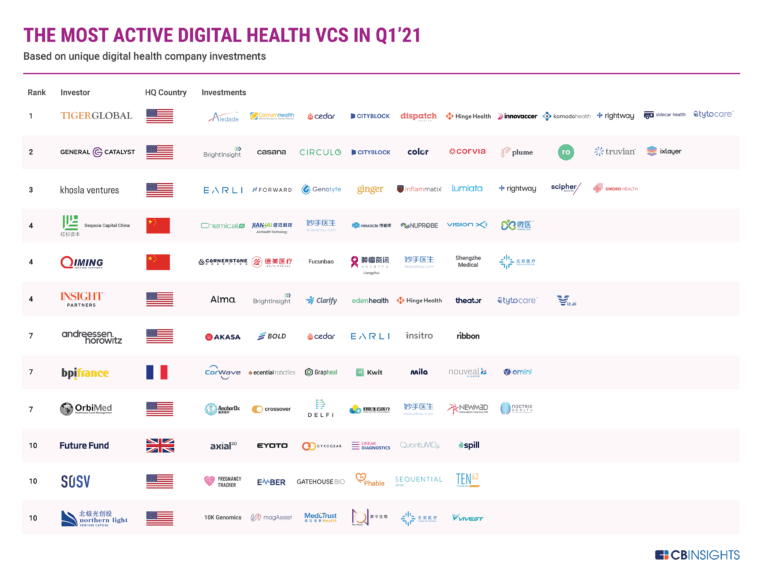

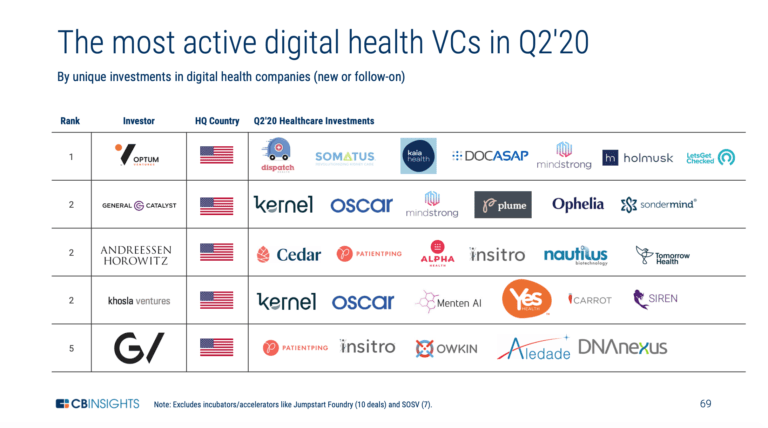

Here Are The Most Active Healthcare Investors

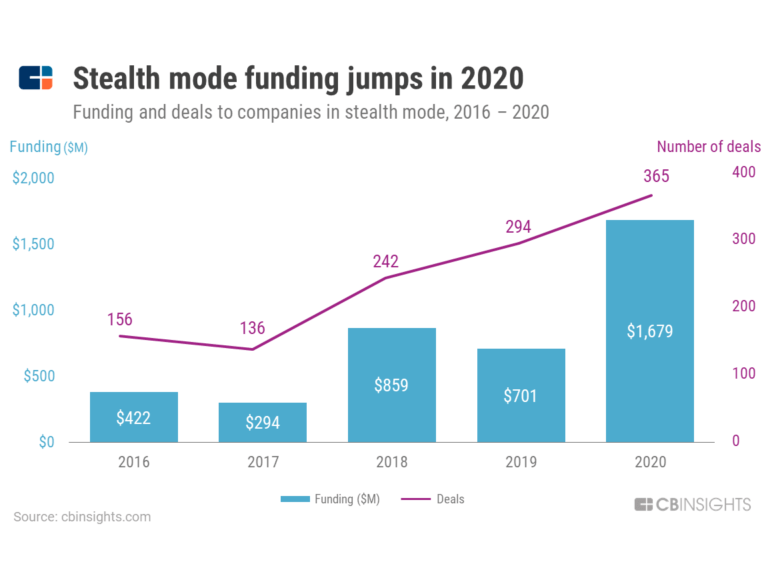

Feb 2, 2021

Stealth Startup Funding Surged In 2020

Aug 4, 2020

Here Are Q2’s Most Active Healthcare InvestorsLatest Khosla Ventures News

May 7, 2023

Nomba, a payment service provider for African businesses, has raised $30 million in a pre-series B funding round led by Base10 Partners, a San Francisco-based venture capital fund that has invested in Nubank, Plaid, and Brex. The equity funding round was oversubscribed, with participation from Helios Digital Ventures, Shopify, Partech, and Khosla Ventures. Despite the growth of digital payments across Africa, most businesses still only have access to generic point-of-sale machines to support the collection of payments. These machines also typically work in isolation from the rest of the business operations, leading to inefficiencies in their business processes. With this new funding, Nomba aims to deliver payment solutions that are designed for the specific services that businesses provide, enabling them to operate more efficiently and deliver excellent customer experiences. For example, restaurants will be able to access menus, manage inventory, receive payments, and perform other business functions all from the same hardware. For transport and logistics companies, Nomba’s solutions will enable them to directly connect their transactions to payments, creating a more seamless experience that increases sales and profitability. Starting in Nigeria, Nomba will also deliver a range of business tools, including invoicing and order management solutions, to improve efficiency and reduce the cost of operations for businesses across the continent. It is a fully licensed payment service provider that serves more than 300 000 businesses – from solo-preneurs to large organisations – with payment solutions to help them grow and thrive. Since launching in 2016 as “Kudi.ai,” a chatbot integration that responds to financial requests on social apps, Nomba has evolved over the years into a profitable, omnichannel payment service provider. The company processes $1 billion in monthly transactions, which represents a market-leading gross transaction value (GTV) for a payment service provider in Africa. Before this funding round, Nomba had only previously raised $5 million in funding, leveraging those funds to successfully grow the business and deliver solutions that have positively impacted hundreds of thousands of businesses across Nigeria. This new capital will enable the company to deliver more solutions for businesses in Nigeria, across Africa, and in other markets, as opportunities may emerge. According to Yinka Adewale, CEO and co-founder of Nomba, “We see payment as a business model, not just a product, and we want to make it easier for businesses to take advantage of all that is possible in their payment processes to support their continued growth and success. “We have a long list of products we have been working on, and the funds we have raised as well as the investors that have backed us give us a lot of confidence about what can be achieved with more effective payment solutions in the hands of business owners.” Luci Fonseca, partner at Base10 , said, “Nomba’s track record of innovation and capital efficiency makes it one of the most exciting start-ups in Africa. We are thrilled to be supporting them to deliver their game-changing solutions to power growth and continued success for businesses in Nigeria and beyond.” The funding round will enable Nomba to further innovate and develop its products and services, empowering African businesses to grow and thrive through customised payment solutions. The demand for more effective payment solutions is high, and the company is well-positioned to lead the way in the African market.

Khosla Ventures Investments

1,134 Investments

Khosla Ventures has made 1,134 investments. Their latest investment was in Nomba as part of their Series A - II on May 5, 2023.

Khosla Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

5/2/2023 | Series A - II | Nomba | $30M | No | 7 | |

4/25/2023 | Series B - II | Replit | $97.4M | Yes | Andreessen Horowitz, Ark Invest, Bloomberg Beta, Coatue Corp., Hamilton Helmer, Khosla Ventures, Naval Ravikant, SV Angel, Undisclosed Investors, and Y Combinator | 4 |

4/19/2023 | Series A | Gather Health | $15M | Yes | Commonwealth Care Alliance, Khosla Ventures, Maverick Ventures, and Undisclosed Investors | 2 |

4/19/2023 | Series B | |||||

4/5/2023 | Series D |

Date | 5/2/2023 | 4/25/2023 | 4/19/2023 | 4/19/2023 | 4/5/2023 |

|---|---|---|---|---|---|

Round | Series A - II | Series B - II | Series A | Series B | Series D |

Company | Nomba | Replit | Gather Health | ||

Amount | $30M | $97.4M | $15M | ||

New? | No | Yes | Yes | ||

Co-Investors | Andreessen Horowitz, Ark Invest, Bloomberg Beta, Coatue Corp., Hamilton Helmer, Khosla Ventures, Naval Ravikant, SV Angel, Undisclosed Investors, and Y Combinator | Commonwealth Care Alliance, Khosla Ventures, Maverick Ventures, and Undisclosed Investors | |||

Sources | 7 | 4 | 2 |

Khosla Ventures Portfolio Exits

154 Portfolio Exits

Khosla Ventures has 154 portfolio exits. Their latest portfolio exit was WaveOne on March 27, 2023.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/27/2023 | Acquired | 8 | |||

2/9/2023 | Acquired | 17 | |||

2/9/2023 | Reverse Merger | 4 | |||

Date | 3/27/2023 | 2/9/2023 | 2/9/2023 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Reverse Merger | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 8 | 17 | 4 |

Khosla Ventures Fund History

18 Fund Histories

Khosla Ventures has 18 funds, including Khosla Ventures Opportunity Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/6/2022 | Khosla Ventures Opportunity Fund I | $550M | 2 | ||

11/1/2021 | Khosla Ventures VII | $1,400M | 2 | ||

6/20/2019 | Khosla Ventures VI (AIV) | $50M | 1 | ||

6/20/2019 | Khosla Ventures VI (AIV) Holding | ||||

12/31/2014 | Khosla Ventures Seed C |

Closing Date | 1/6/2022 | 11/1/2021 | 6/20/2019 | 6/20/2019 | 12/31/2014 |

|---|---|---|---|---|---|

Fund | Khosla Ventures Opportunity Fund I | Khosla Ventures VII | Khosla Ventures VI (AIV) | Khosla Ventures VI (AIV) Holding | Khosla Ventures Seed C |

Fund Type | |||||

Status | |||||

Amount | $550M | $1,400M | $50M | ||

Sources | 2 | 2 | 1 |

Khosla Ventures Partners & Customers

1 Partners and customers

Khosla Ventures has 1 strategic partners and customers. Khosla Ventures recently partnered with BIOeCON on November 11, 2007.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

11/1/2007 | Partner | Netherlands | Khosla Ventures and BIOeCON Form KiOR Inc / PRNewswire / -- Khosla Ventures and BIOeCON announce today the formation of their joint venture KiOR Inc. . | 1 |

Date | 11/1/2007 |

|---|---|

Type | Partner |

Business Partner | |

Country | Netherlands |

News Snippet | Khosla Ventures and BIOeCON Form KiOR Inc / PRNewswire / -- Khosla Ventures and BIOeCON announce today the formation of their joint venture KiOR Inc. . |

Sources | 1 |

Khosla Ventures Service Providers

1 Service Provider

Khosla Ventures has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type |

Partnership data by VentureSource

Khosla Ventures Team

12 Team Members

Khosla Ventures has 12 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Vinod Khosla | Founder | Current | |

Name | Vinod Khosla | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder | ||||

Status | Current |

Compare Khosla Ventures to Competitors

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Index Ventures is a global venture capital firm that invests in the commercial services, media, retail, and information technology sectors. It was founded in 1996 and is based in London, U.K.

Kleiner Perkins Caufield & Byers (KPCB) is a venture capital firm based in Menlo Park, CA that primarily focuses its global investments in practice areas including technology and life sciences.

Insight Partners is a global venture capital and private equity firm. It seeks to invest in mobile, cybersecurity, big data, the internet of things, artificial intelligence, and construction technology sectors. Insight Partners was formerly known as Insight Venture Partners. The company was founded in 1995 and is based in New York, New York.

SyndicateRoom is an online equity crowdfunding platform that allows its members to co-invest in exciting companies with seasoned investors.

Vista Equity Partners is a private equity financing firm that is focused on investing in software and technology-enabled businesses. The company was founded in 2000 and is based in San Francisco, California.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.