Investments

15Portfolio Exits

2Partners & Customers

10

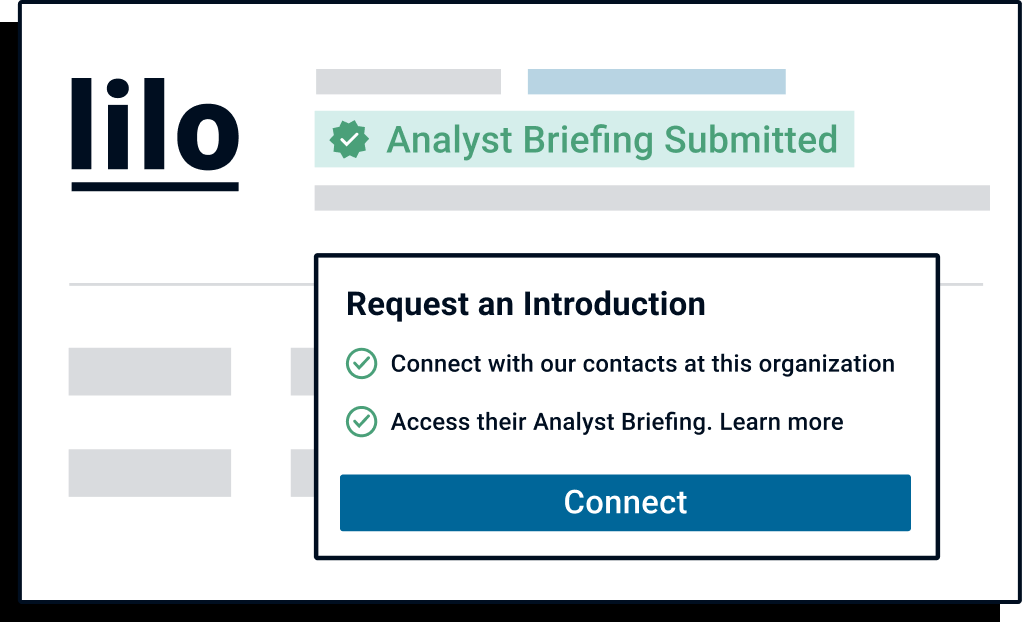

Want to inform investors similar to Mando about your company?

Submit your Analyst Briefing to get in front of investors, customers, and partners on CB Insights’ platform.

Research containing Mando

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mando in 1 CB Insights research brief, most recently on Dec 16, 2020.

Dec 16, 2020

40+ Corporations Working On Autonomous VehiclesLatest Mando News

May 4, 2023

On this Star Wars day, we look back on Disney’s imperial takeover of the most beloved sci-fi franchise of all time Baby Yoda and Mando, an iconic duo Star Wars creator George Lucas once said giving up control of his iconic space franchise was a “very, very painful” choice to make, undoubtedly made more painful that the entertainment industry’s own evil empire Disney was on the other side of the bargaining table. But 11 years on, Disney has thrown its Rancor-sized weight behind the mammoth franchise, revitalising the IP and creating yet another fearsome arm to its sprawling cluster of media franchises. It’s hard to quantify just how lucrative Disney’s US$4bn acquisition of the Star Wars IP has been over the past 11 years, considering the gargantuan sprawl of the world’s second-largest entertainment franchise (Marvel is debatably larger, though wholly irrelevant given Disney’s ownership of that IP too). Putting box office receipts aside, the Star Wars brand comprises a galaxy of streaming shows, Lego sets, theme parks, video games, books, figurines and just about anything else you can imagine, all of which generate handsome income for the Mouse House. Profit-wise, not everything has been a hit. The US$5,000-a-night Galactic Starcruiser hotel proved too many Galactic Credits for most weary smugglers. Ron Howard’s 2018 spin-off Solo: A Star Wars Story was a rare Star Wars box office bomb at the box office, while Diego Luna-starring Disney+ show Andor reportedly garnered low viewership numbers . Alden Ehrenreich as Han Solo in rare Star Wars box office bomb Solo – Credit: Disney But given the saturation of post-Disney-acquisition titles – eight films, five live-action series, a cargo-load of animated features, and around a dozen video games including AAA titles Fallen Order and Survivor – a couple of missteps are the exception to the rule. Disney’s caravan of Star Wars content shows no sign of slowing down either, with Ashoka and Skeleton Crew due on Disney+ later this year, followed by The Acolyte and new seasons of Andor in the pipeline alongside a spate of other new movie and TV show developments. It gets difficult keeping up, but one thing is clear: Disney intends to milk the Star Wars cash bantha well into the future. In terms of pure box office receipts, Disney’s Star Wars trilogy and movie spin-offs generated US$6.6bn against a total budget of US$1.7bn per Box Office Mojo data. Factoring in exhibitors’ take of the profits and everything else, Disney has made an estimated US$1.3bn at the Star Wars box office, taking a fair chunk out of Disney’s initial purchase from George Lucas in 2012. That’s without touching on streaming revenues, gaming, and the all-important merchandising income. Some estimates put merch revenues at between US$5bn to US$7bn during a movie release year, 99% undoubtedly Baby Yoda plushies, though there is no available data to make an estimation of Dinsey’s cut of the revenues. Disney, like Amazon, keeps streaming data and associated revenues close to its chest, though headline titles like The Mandalorian aren’t made on the cheap. Season one of The Mandalorian reportedly cost around US$100mln and altogether, according to internet guestimates, the three seasons streamed to date have cost at least US$360mln to make – that’s for 24, 45(ish) minute episodes. Disney+ ran up operating losses of US$1.5bn in the fourth quarter of 2022 alone due to these massive expenses Such is the drain on resources of the loss-leading Disney+ product that Disney announced major cuts to its global workforce in February, the second round of which commenced in the first week of April, in order to shore up US$5.5bn to move the steaming services financially viable . So while Disney’s landmark takeover of the Star Wars franchise will likely pay off in the long run, it has yet to be the panacea for the Mouse House’s revenue woes. Wookie numbers Critical reception to the Mouse’s brand of Star Wars entertainment has similarly been… mixed While Disney’s first foray into the galaxy far away, 2015’s The Force Awakens, was praised by critics and fans alike, subsequent titles were more contentious. 2017’s The Last Jedi inexplicably received a 91% critic rating on Rotten Tomatoes compared to just 42% from the audience. Flipping the picture, 2019’s conclusion to the sequel trilogy The Rise of Skywalker received just 52% from critics compared to 86% from the audience. The Book of Boba Fett was largely panned, while Obi-Wan Kenobi, again inexplicably garnering praise from critics, received 63% from the audience. Andor, one of the worst streaming performers, was actually well praised by fans and critics alike. Given Disney’s penchant for churning out low-effort rehashes of beloved classics, perhaps the Mouse House is plotting a remake of the most beloved Star Wars product of all time: The Star Wars Holiday Special . The nightmare fuel that was the Star Wars Holiday Special – Source: gizmodo.com

Mando Investments

15 Investments

Mando has made 15 investments. Their latest investment was in Deep Insight as part of their Series A on July 7, 2022.

Mando Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/7/2022 | Series A | Deep Insight | $2.7M | No | 2 | |

1/18/2022 | Seed VC - II | Deep Insight | Yes | FuturePlay, and Mando | 1 | |

1/18/2022 | Seed VC - II | ETA Electronics | Yes | FuturePlay, and Mando | 1 | |

1/18/2022 | Seed VC | |||||

1/7/2022 | Series A |

Date | 7/7/2022 | 1/18/2022 | 1/18/2022 | 1/18/2022 | 1/7/2022 |

|---|---|---|---|---|---|

Round | Series A | Seed VC - II | Seed VC - II | Seed VC | Series A |

Company | Deep Insight | Deep Insight | ETA Electronics | ||

Amount | $2.7M | ||||

New? | No | Yes | Yes | ||

Co-Investors | FuturePlay, and Mando | FuturePlay, and Mando | |||

Sources | 2 | 1 | 1 |

Mando Portfolio Exits

2 Portfolio Exits

Mando has 2 portfolio exits. Their latest portfolio exit was Cobot on August 01, 2022.

Mando Partners & Customers

10 Partners and customers

Mando has 10 strategic partners and customers. Mando recently partnered with ANAND Group on February 2, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

2/9/2023 | Partner | India | Anand Group exploring possibility of PE infusion in its EV arm Anevolve Anand Group is open to more collaborations under Anevolve , says Singh . | 1 | |

9/21/2022 | Partner | Israel | HL Mando to Collaborate with Argus in Automotive Cybersecurity HL Mando plans to build its own cyber hacking monitoring system in collaboration with Argus . | 1 | |

7/27/2021 | Partner | India | Anand Group and Mando set up JV to tap electric 2-, 3W parts market The multi-company Anand Group and Mando Corporation are to set up a new joint venture called Anand Mando eMobility , aimed at tapping the growing market for two - and three-wheeler powertrain electrification . | 1 | |

5/13/2021 | Partner | ||||

3/22/2021 | Client |

Date | 2/9/2023 | 9/21/2022 | 7/27/2021 | 5/13/2021 | 3/22/2021 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Client |

Business Partner | |||||

Country | India | Israel | India | ||

News Snippet | Anand Group exploring possibility of PE infusion in its EV arm Anevolve Anand Group is open to more collaborations under Anevolve , says Singh . | HL Mando to Collaborate with Argus in Automotive Cybersecurity HL Mando plans to build its own cyber hacking monitoring system in collaboration with Argus . | Anand Group and Mando set up JV to tap electric 2-, 3W parts market The multi-company Anand Group and Mando Corporation are to set up a new joint venture called Anand Mando eMobility , aimed at tapping the growing market for two - and three-wheeler powertrain electrification . | ||

Sources | 1 | 1 | 1 |

Mando Team

1 Team Member

Mando has 1 team member, including current Chief Executive Officer, Sang-Su Oh.

Name | Work History | Title | Status |

|---|---|---|---|

Sang-Su Oh | Chief Executive Officer | Current |

Name | Sang-Su Oh |

|---|---|

Work History | |

Title | Chief Executive Officer |

Status | Current |

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.