MFS Africa

Founded Year

2009Stage

Debt - II | AliveTotal Raised

$217.7MLast Raised

$100M | 1 yr agoAbout MFS Africa

MFS Africa develops value-added services for mobile wallets. MFS Africa provides accessible, affordable, inclusive alternatives for remittance/money transfers, micro-lending, micro-insurance, micro-savings, and payments. It serves companies operating in the financial sector as well as individuals. It was founded in 2009 and is based in Sandton, South Africa.

Missing: MFS Africa's Product Demo & Case Studies

Promote your product offering to tech buyers.

Reach 1000s of buyers who use CB Insights to identify vendors, demo products, and make purchasing decisions.

ESPs containing MFS Africa

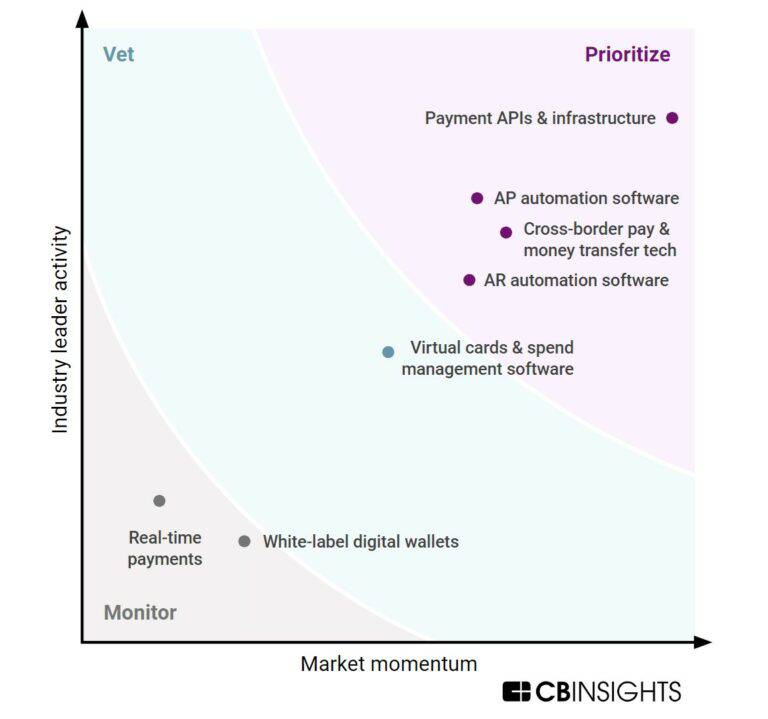

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Cross-border payments & money transfer tech companies help businesses send funds to other businesses, often internationally.These companies make money transfer cheaper and faster by building various tech solutions: cross-border payments infrastructure that doesn’t run on traditional bank networks; platforms that allow clients to access legacy bank rails more easily; and crypto-based payment soluti…

MFS Africa named as Challenger among 15 other companies, including Ripple, Western Union, and ZEPZ.

Missing: MFS Africa's Product & Differentiators

Don’t let your products get skipped. Buyers use our vendor rankings to shortlist companies and drive requests for proposals (RFPs).

Research containing MFS Africa

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned MFS Africa in 4 CB Insights research briefs, most recently on Jan 23, 2023.

Jan 23, 2023 report

Top cross-border payments companies — and why customers chose them

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing MFS Africa

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

MFS Africa is included in 6 Expert Collections, including Digital Lending.

Digital Lending

1,883 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

2,682 items

Companies and startups in this collection enable consumers, businesses, and governments to pay each other - online and at the physical point-of-sale.

Fintech

3,855 items

Insurtech

3,891 items

Companies and startups that use of technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech 250

249 items

CB Insights' annual list of the 250 most promising private fintech companies in the world. FTX was removed after declaring bankruptcy on 11/11/2022.

E-Commerce

217 items

MFS Africa Patents

MFS Africa has filed 5 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/27/2016 | 1/1/2019 | Windows Server System, Wireless networking, Elevators, Database management systems, Identity documents | Grant |

Application Date | 12/27/2016 |

|---|---|

Grant Date | 1/1/2019 |

Title | |

Related Topics | Windows Server System, Wireless networking, Elevators, Database management systems, Identity documents |

Status | Grant |

Latest MFS Africa News

Apr 14, 2023

By Leandra Monteiro Share MFS Africa, the largest digital payments network in Africa, operating in over 35 African countries, has partnered with Access Bank, Nigeria’s largest bank, to expand AccessAfrica remittance corridors. The partnership will provide simplified transfers for AccessAfrica customers, enabling real-time, cost-effective cross-border payments for individuals and businesses who want to send financial support to their families abroad or facilitate trade transactions. AccessAfrica customers will also be able to receive payments from all over the world through MFS Africa partners. Commenting on the partnership with MFS Africa, Senior Banking Advisor, Retail, Access Bank, Robert Giles said, “This partnership builds on the existing cross-border payment infrastructure by Access Bank and would facilitate payments to more African corridors, increasing the number of countries we can send instant payments through Access Africa to. Our partnership with MFS Africa and access to hundreds of millions of people in the new markets will help our customers pay and be paid, facilitating greater economic inclusion through trade as well as helping families across borders. Critically this propels us closer towards being ‘Africa’s gateway to the world’ and democratizing access to payments through affordable, safe and reliable platforms.” “The partnership reaffirms MFS Africa’s commitment to making borders matter less for individuals and organisations across the continent, ultimately fostering financial inclusion. Through this partnership we’ll be expanding Access instant outbound remittance reach to potentially 400 million mobile wallets and more than 130 banks across over 35 African countries, enabling thousands of people and businesses throughout the continent to receive payments in real-time from Nigeria, and improving convenience for and facilitating trade with the neighbouring countries and beyond. Uplifting the African continent through sustainable and accessible financial services has always been at the center of what we do at MFS Africa. Partnering with Access Bank, who shares this ethos, made complete sense,” shared Dare Okoudjou, CEO at MFS Africa. AccessAfrica is Access Bank’s service that allows customers to conveniently transfer and receive money across the world from loved ones and business partners. Previous Article Digital monthly issue Global coverage

MFS Africa Frequently Asked Questions (FAQ)

When was MFS Africa founded?

MFS Africa was founded in 2009.

Where is MFS Africa's headquarters?

MFS Africa's headquarters is located at 3rd Floor, The Place, Sandton.

What is MFS Africa's latest funding round?

MFS Africa's latest funding round is Debt - II.

How much did MFS Africa raise?

MFS Africa raised a total of $217.7M.

Who are the investors of MFS Africa?

Investors of MFS Africa include CommerzVentures, AfricInvest, Admaius Capital Partners, AXA Investment Managers, Vitruvian Partners and 13 more.

Who are MFS Africa's competitors?

Competitors of MFS Africa include JUMO Marketplace and 1 more.

Compare MFS Africa to Competitors

Cgtz is a business-to-customer (B2C) debt investment portal, providing various investments products for the individual and small and medium enterprises (SMEs).

Fincra provides payment solutions that enable users to accept payments securely, get settled and move money across borders. The company offers products such as collections, payouts, virtual bank accounts, and APIs for businesses, fintechs, and developers. It was founded in 2019 and is based in Toronto, Ontario.

Flutterwave provides payment technology and financial tools for businesses. It enables businesses to send and collect payments, process payments, and build financial products. The company was founded in 2016 and is based in San Francisco, California.

Optasia offers mobile value-added services and airtime credits for mobile operators and financial institutions to capitalize on unexplored markets. The company provides a wide range of financial solutions using its analytics tools, such as micro-cash loans, handset loans, credit services for pre-paid utilities, dynamic feed trends, big data analytics, and other related services. In early 2022, it changed its name from Channel VAS to Optasia. Optasia was founded in 2012 and is based in Dubai, United Arab Emirates.

Migo delivers a cloud-based platform enabling companies to offer credit to customers, augmenting traditional bank and payment card infrastructure. The platform provides a digital account and credit line and uses this credit line to make purchases from a merchant or withdraw cash without the need for point-of-sale hardware or plastic cards. It was formerly known as Mines.io. The company was founded in 2014 and is based in San Francisco, California.

Pngme is a unified financial data API for financial institutions and developers in Sub-Saharan Africa. Pngme provides digital data pipelines, scalable API architecture, and a suite of developer tools that enable financial institutions and developers to access a single source of truth on new and existing users and develop financial products that reach more individuals and businesses.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.