Monogram Health

Founded Year

2019Stage

Series C | AliveTotal Raised

$555.15MLast Raised

$375M | 4 mos agoAbout Monogram Health

Monogram Health is a specialty provider of in-home care and benefit management services for patients living with polychronic conditions, including chronic kidney and end-stage renal disease. It develops an artificial intelligence algorithm to help predict necessary and timely care to promote the delay of kidney disease progression, and transition to dialysis and/or pre-emptive kidney transplant, as well as to help optimize patient health outcomes once on dialysis. The company was founded in 2019 and is based in Brentwood, Tennessee.

Missing: Monogram Health's Product Demo & Case Studies

Promote your product offering to tech buyers.

Reach 1000s of buyers who use CB Insights to identify vendors, demo products, and make purchasing decisions.

Missing: Monogram Health's Product & Differentiators

Don’t let your products get skipped. Buyers use our vendor rankings to shortlist companies and drive requests for proposals (RFPs).

Research containing Monogram Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Monogram Health in 9 CB Insights research briefs, most recently on Apr 26, 2023.

Apr 26, 2023 report

The State of CVC in 5 charts: Funding falls to a 5-year low in Q1’23

Expert Collections containing Monogram Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Monogram Health is included in 7 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

10,622 items

This collection includes startups selling AI SaaS, using AI algorithms to develop their core products, and those developing hardware to support AI workloads.

Digital Hospital

198 items

Startups recreating how healthcare is delivered

Digital Health

10,069 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma companies and and assistive tech developers.

Telehealth

2,856 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Health IT

3,536 items

This collection includes public and private companies, as well as startups, that market software solutions to healthcare provider organizations.

Digital Health 150

150 items

The winners of the third annual CB Insights Digital Health 150.

Latest Monogram Health News

Apr 27, 2023

Investors in the round: A.Capital Ventures, Andreessen Horowitz, Elad Gil, Nat Friedman, SVA Industry: Artificial Intelligence, Information Technology, Software Founders: Daniel De Freitas, Noam Shazeer Founding year: 2021 Total equity funding raised: $150.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. Floward $156.0M Round: Series C Description: Riyadh-based Floward is an online flowers and gifts eCommerce solution sourced from local and international brands with same-day delivery schedules. Founded by Abdulaziz Al Loughani in 2017, Floward has now raised a total of $186.3M in total equity funding and is backed by 500 Global, Aljazira Capital, STV, Rainwater Partners, and Faith Capital. Investors in the round: Aljazira Capital, Rainwater Partners, STV Industry: Delivery Service, E-Commerce, Flowers, Internet, Same Day Delivery Founders: Abdulaziz Al Loughani Total equity funding raised: $186.3M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 14. Isar Aerospace €155.0M Round: Series C Description: Isar Aerospace provides access to space for small and medium satellites, enabling global satellite constellations. Investors in the round: 7 Industries, Bayern Kapital, Earlybird Venture Capital, HV Capital, Lakestar, Lombard Odier, Porsche Automobil Holding, UVC Partners, Vsquared Ventures Industry: Aerospace, Information Technology, Space Travel Founders: Daniel Metzler, Josef Fleischmann, Markus Brandl Founding year: 2018 Total equity funding raised: $350.6M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 13. Asimov $175.0M Round: Series B Description: Boston-based Asimov employs artificial intelligence to develop tools for the design and manufacture of next-generation therapeutics. Founded by Alec Nielsen, Christopher Voigt, Douglas Densmore, and Raja Srinivas in 2017, Asimov has now raised a total of $205.0M in total equity funding and is backed by Andreessen Horowitz, Horizons Ventures, Fidelity Management and Research Company, AME Cloud Ventures, and Pillar VC. Investors in the round: Andreessen Horowitz, Canada Pension Plan Investment Board, Casdin Capital, Fidelity Management and Research Company, Horizons Ventures, KdT Ventures, Pillar VC Industry: Artificial Intelligence, Biotechnology, Software, Therapeutics Founders: Alec Nielsen, Christopher Voigt, Douglas Densmore, Raja Srinivas Founding year: 2017 Total equity funding raised: $205.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 12. Deepwatch $180.0M Round: Series C Description: Tampa-based Deepwatch secures the digital economy by protecting enterprise networks via its cloud security platform. Founded by Justin Morehouse in 2019, Deepwatch has now raised a total of $256.0M in total equity funding and is backed by Springcoast Capital Partners, Goldman Sachs, Vista Credit Partners, ABS Capital Partners, and Splunk Ventures. Investors in the round: Splunk Ventures, Springcoast Capital Partners, Vista Credit Partners Industry: Cloud Security, Cyber Security, Information Technology Founders: Justin Morehouse Total equity funding raised: $256.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 11. Peak Power $200.0M Round: Venture Description: Toronto-based Peak Power is a climate tech company that provides decarbonization solutions for commercial real estate and industrial customers by optimizing three core energy assets: battery energy storage systems, grid-interactive buildings, and electric vehicles. Peak Synergy enables customers to minimize operational costs, reduce emissions, and sell energy back to the grid. Founded by Benson Pei Sen Hu, Derek Lim Soo, Imran Noorani, and Matthew Sachs in 2015, Peak Power has now raised a total of $206.4M in total equity funding and is backed by Madison Energy Investments, Business Development Bank of Canada, Sustainable Development Technology Canada, FedDev, and Export Development Canada. Investors in the round: Madison Energy Investments Industry: CleanTech, Commercial Real Estate, Electric Vehicle, Energy, Energy Storage, Internet of Things, Renewable Energy, Software Founders: Benson Pei Sen Hu, Derek Lim Soo, Imran Noorani, Matthew Sachs Founding year: 2015 Total equity funding raised: $206.4M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 11. ShiftMed $200.0M Round: Venture Description: Mclean-based ShiftMed is a nursing jobs app that delivers an on-demand workforce marketplace for credentialed nursing professionals. Founded by Todd Walrath in 2019, ShiftMed has now raised a total of $245.0M in total equity funding and is backed by Blue Heron Capital, Panoramic Ventures, Motley Fool Ventures, Audacious Capital, and Q Holdings Inc. Investors in the round: Audacious Capital, Blue Heron Capital, Panoramic Ventures, Q Holdings Inc Industry: Apps, Health Care, Hospital, Marketplace, Nursing and Residential Care Founders: Todd Walrath Total equity funding raised: $245.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 10. Skydio $230.0M Round: Series E Description: Redwood City-based Skydio uses artificial intelligence to create flying drones that are used by consumer, enterprise, and government customers. Founded by Abraham Bachrach, Adam Bry, and Matt Donahoe in 2014, Skydio has now raised a total of $570.0M in total equity funding and is backed by NVIDIA, Hercules Capital, Andreessen Horowitz, Axon, and Accel. Investors in the round: Andreessen Horowitz, Axon, DoCoMo Capital, Hercules Capital, IVP, Linse Capital, Next47, NVIDIA, UP Partners, Walton Family Foundation Industry: Artificial Intelligence, Drone Management, Drones, Machine Learning, Robotics Founders: Abraham Bachrach, Adam Bry, Matt Donahoe Founding year: 2014 Total equity funding raised: $570.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 9. Enpal €215.0M Round: Series D Description: Berlin-based Enpal is a photovoltaics leasing firm that provides solar power systems for homeowners. Founded by Jochen Ziervogel, Mario Kohle, and Viktor Wingert in 2017, Enpal has now raised a total of €465.0M in total equity funding and is backed by TPG, BlackRock, Berenberg, Heliad Equity Partners, and Picus Capital. Investors in the round: Activate Capital Partners, HV Capital, Princeville Capital, SoftBank Vision Fund, The Westly Group, TPG Industry: Energy, Environmental Consulting, Renewable Energy, Solar Founders: Jochen Ziervogel, Mario Kohle, Viktor Wingert Founding year: 2017 Total equity funding raised: €465.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 8. eToro $250.0M Round: Venture Description: eToro is a social trading and investment network that allows users to trade currencies, commodities, indices, crypto assets, and stocks. Investors in the round: ION, Ken Smythe, Social Leverage, SoftBank, Spark Capital, Velvet Sea Ventures Industry: Finance, FinTech, Social Media, Trading Platform Founders: David Ring, Ronen Assia, Yoni Assia Founding year: 2007 Total equity funding raised: $472.7M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 7. VSPN ¥1.8B Round: Series C Description: Shanghai-based VSPN is a provider of esports media with offerings such as tournaments, content and marketing. Founded by Danny Tang, Dino Ying, Ethan Teng, Gavin Zheng, and Sheng Wu in 2016, VSPN has now raised a total of $422.4M in total equity funding and is backed by Tencent, Kuaishou Technology, Susquehanna International Group (SIG), Tiantu Capital, and Nan Fung Group. Investors in the round: Savvy Gaming Group Industry: eSports, Gaming, Online Games Founders: Dino Ying, Ethan Teng, Gavin Zheng, Sheng Wu Founding year: 2016 Total equity funding raised: $422.4M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 6. Kredivo Holdings $270.0M Round: Series D Description: Kredivo Holdings provides financial services that are fast, cheap, and widely accessible, wrapped into a beautiful UX. Investors in the round: GMO Global Payment Fund, Jungle Ventures, Mizuho Bank, Naver Financial Corp., Openspace, Square Peg Capital Industry: Consumer Lending, Finance, Financial Services, FinTech Founders: Akshay Garg, Alie Tan, Umang Rustagi Founding year: 2015 Total equity funding raised: $530.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 5. United Aircraft ¥2.0B Round: Series D Description: United Aircraft specializes in the research, development, manufacturing, and service of drones and other equipment. Investors in the round: Chengdu Heavy Industry Qingyue Fund, Cornerstone Capital, Deyang Industrial Investment, Hunan Xiangtou Holdings Group Co.,Ltd, Jinniu City Investment, National Manufacturing Fund, Quantum Fund of Anhui Province, Shifang Hengxin, Sichuan Regional Synergy Fund Industry: Drone Management, Drones, Electronics, Manufacturing Founders: Gangyin Tian Total equity funding raised: ¥2.0B The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 4. Our Next Energy $300.0M Round: Series B Description: Novi-based Our Next Energy is a developer of energy storage technology to expand access to sustainable power. Founded by Mujeeb Ijaz in 2020, Our Next Energy has now raised a total of $390.0M in total equity funding and is backed by Flex, Temasek Holdings, Fifth Wall, Coatue, and Volta Energy Technologies. Investors in the round: AI Capital, Coatue, Fifth Wall, Franklin Templeton, Riverstone Holdings, Sente Ventures, Temasek Holdings, TR.PE Industry: Battery, Electronics, Energy, Energy Storage, Renewable Energy Founders: Mujeeb Ijaz Total equity funding raised: $390.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 4. Wiz $300.0M Round: Series D Description: Tel Aviv-based Wiz is a cybersecurity company that allows companies to find security issues in public cloud infrastructure. Founded by Ami Luttwak, Assaf Rappaport, Roy Reznik, and Yinon Costica in 2020, Wiz has now raised a total of $900.0M in total equity funding and is backed by Howard Schultz, Sequoia Capital, Salesforce, Lightspeed Venture Partners, and Insight Partners. Investors in the round: Bernard Arnault, Blackstone Group, Cyberstarts, Greenoaks, Howard Schultz, Index Ventures, Insight Partners, Lightspeed Venture Partners, Sequoia Capital Industry: Cloud Security, Cyber Security, Enterprise Software, Security Founders: Ami Luttwak, Assaf Rappaport, Roy Reznik, Yinon Costica Founding year: 2020 Total equity funding raised: $900.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 4. JD Industry $300.0M Description: JD Industry specializes in industrial maintenance, repair, and operations (MRO). Investors in the round: Baring Private Equity Asia, G42 Expansion Fund, M&G Investments, Mubadala, Sequoia Capital China Industry: B2B, Consumer Goods, Industrial Founders: Richard Liu Total equity funding raised: $530.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 3. Adept AI $350.0M Description: Adept AI is a machine learning research and product lab building general intelligence. Investors in the round: A.Capital Ventures, Addition, Atlassian Ventures, Caterina Fake, Frontiers Capital, General Catalyst, Greylock, Microsoft, NVIDIA, PSP Growth, Spark Capital, SVA, Workday Ventures Industry: Artificial Intelligence, Machine Learning, Software Founders: Ashish Vaswani, David Luan, Niki Parmar Founding year: 2022 Total equity funding raised: $415.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 2. Monogram Health $375.0M Round: Series C Description: Brentwood-based Monogram Health is a specialty provider of evidence-based in-home care and benefit management services for polychronic patients. Founded by Christopher A. Booker and Mike Uchrin in 2019, Monogram Health has now raised a total of $547.0M in total equity funding and is backed by Humana, TPG, Norwest Venture Partners, CVS Health, and Heritage Group. Investors in the round: Cigna Ventures, CVS Health, Frist Cressey Ventures, Heritage Group, Humana, Memorial Hermann Hospital, Norwest Venture Partners, Pura Vida Investments, Scan, TPG Industry: Health Care, Hospital, Wellness Founders: Christopher A. Booker, Mike Uchrin Founding year: 2019 Total equity funding raised: $547.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 1. SandboxAQ $500.0M Round: Venture Description: Palo Alto-based SandboxAQ is an enterprise SaaS company that provides AI and quantum computing solutions. Founded by Jack D. Hidary in 2016, SandboxAQ has now raised a total of $500.0M in total equity funding and is backed by Breyer Capital, Section 32, T. Rowe Price, Avant Global, and Time Ventures. Investors in the round: Breyer Capital, Eric Schmidt, T. Rowe Price, Time Ventures Industry: Artificial Intelligence, Cyber Security, Information Technology, Quantum Computing, SaaS Founders: Total equity funding raised: $500.0M The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 1. Lenskart $500.0M Round: Series I Description: Lenskart is an online optical platform that sells prescription eyewear, branded contact lenses, sunglasses, and accessories. Investors in the round: Abu Dhabi Investment Authority Industry: Delivery, E-Commerce, Eyewear, Fashion, Shopping Founders: Amit Chaudhary, Peyush Bansal, Ramneek Khurana, Sumeet Kapahi Founding year: 2008 Total equity funding raised: $1.4B The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100 1. Rippling $500.0M Round: Series E Description: Rippling is a human resource management company that offers an all-in-one platform to help manage HR and IT operations. Investors in the round: Greenoaks Industry: Employment, Human Resources, Information Technology, IT Management, Productivity Tools Founders: Parker Conrad, Prasanna Sankar Founding year: 2016 Total equity funding raised: $1.2B The days of DIY APIs are done and gone – get on the GraphQL edge. Join Hasura at The Clancy in San Francisco on Thursday, May 4 to learn about the remarkable development and data access advantages of GraphQL. Our curated lineup of speakers and partners from AWS, Snowflake, and Yugabyte will share how data plus APIs power the modern enterprise. Use code AW100 to claim your complimentary ticket ($99 value) today. REGISTER NOW FOR FREE WITH CODE AW100

Monogram Health Frequently Asked Questions (FAQ)

When was Monogram Health founded?

Monogram Health was founded in 2019.

Where is Monogram Health's headquarters?

Monogram Health's headquarters is located at 5410 Maryland Way, Brentwood.

What is Monogram Health's latest funding round?

Monogram Health's latest funding round is Series C.

How much did Monogram Health raise?

Monogram Health raised a total of $555.15M.

Who are the investors of Monogram Health?

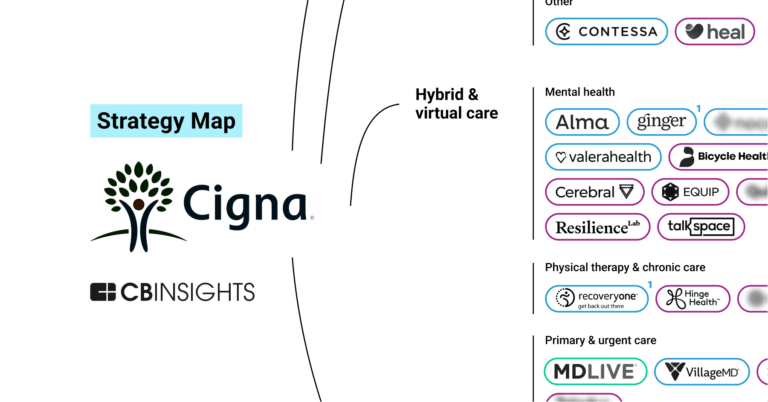

Investors of Monogram Health include Frist Cressey Ventures, Norwest Venture Partners, TPG Capital, SCAN Health Plan, Cigna Ventures and 8 more.

Who are Monogram Health's competitors?

Competitors of Monogram Health include Somatus and 2 more.

Compare Monogram Health to Competitors

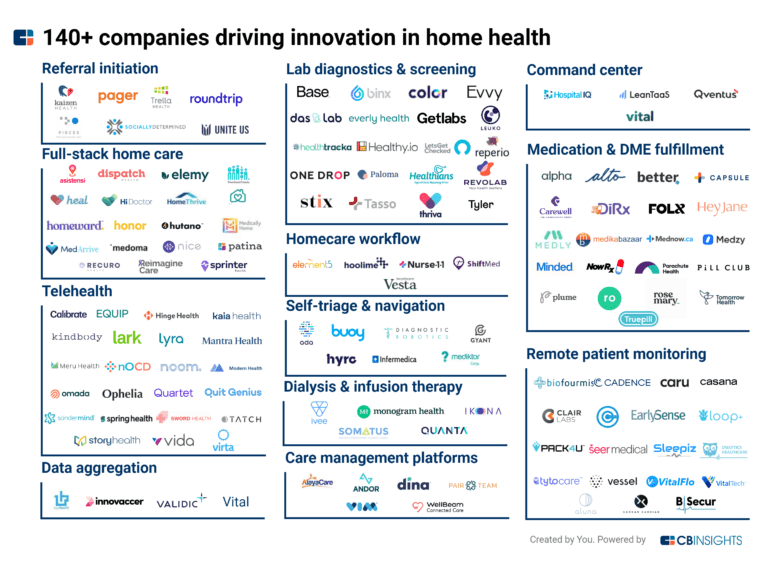

Strive Health delivers a kidney care service line for health systems and payors, powered by specialized analytics and Nephrology caregivers. The company was founded in 2018 and is based in Denver, Colorado.

Somatus aims to delay or prevent the progression of chronic kidney disease (CKD) to ESRD, help eligible patients access home-based dialysis modalities which improve their outcomes, and maximize the number of patients who qualify for and receive kidney transplantation. Users can receive concierge kidney care in the comfort of your home. As a patient, they will have direct access to 24/7 medical attention. Somatus' team will be comprised of nurses, physicians, and other health professionals who can anticipate as well as address medical needs.

Carenostics provides an artificial intelligence and machine learning platform to address the underdiagnosis, undertreatment, and health inequities of chronic disease. It builds clinical decision support models to identify opportunities for earlier clinical intervention by applying machine learning to routine patient care data. It was founded in 2020 and is based in Berwyn, Pennsylvania.

ClosedLoop operates as a healthcare data science platform. It enables providers, payers, and value-based care organizations to make accurate, explainable, and actionable predictions of individual-level health risks, improve outcomes, and reduce costs. The company was founded in 2017 and is based in Austin, Texas.

RenalTracker is a web/mobile behaviour-changing platform for Chronic Kidney Disease (CKD) empowering patients through personalised, coach-guided wellness in-between doctor's visits.

Cricket Health provides comprehensive kidney care with a personalized, evidence-based approach to managing chronic kidney disease (CKD) and end-stage renal disease (ESRD). Through a combination of software and services, the company provides home dialysis to patients. The company was founded in 2015 and is based in San Francisco, California. In March 2022, Cricket Health merged with Fresenius Health Partners and InterWell Health to create Transforming Kidney Care.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.