DriveWealth

Founded Year

2012Stage

Series D | AliveTotal Raised

$550.8MValuation

$0000Last Raised

$450M | 2 yrs agoRevenue

$0000About DriveWealth

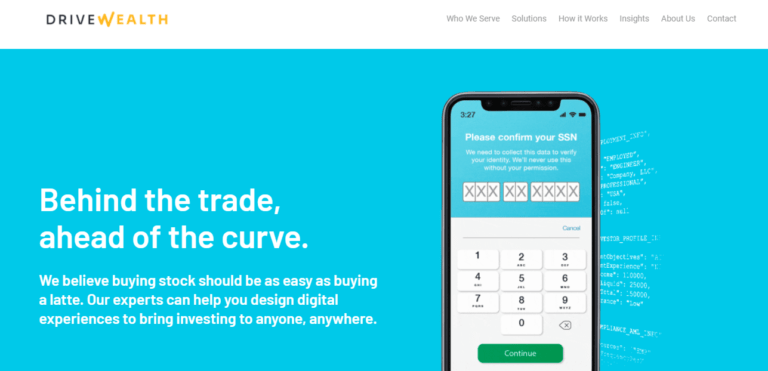

DriveWealth offers a global brokerage platform. It delivers investment capabilities and real-time fractional trading through partners. The company provides a finance application programming interface that enables global fintech, brokers, and advisors to access the United States securities market. It was founded in 2012 and is based in Chatham, New Jersey.

ESPs containing DriveWealth

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Robo advisors are digital platforms that use automation and smart algorithms to build investment portfolios, replacing a once manual process.

DriveWealth named as Leader among 7 other companies, including Saxo Bank, InvestSuite, and Ellevest.

Compete with DriveWealth?

Ensure that your company and products are accurately represented on our platform.

DriveWealth's Products & Differentiators

DriveWealth Brokerage Platform

The ONLY cloud-based, API-driven brokerage infrastructure platform providing a complete, turnkey B2B solution. The platform will power everything from customer onboarding to investing and trading, through statements, tax reporting, proxy and prospectus.

Research containing DriveWealth

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned DriveWealth in 8 CB Insights research briefs, most recently on Nov 17, 2022.

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing DriveWealth

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

DriveWealth is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,208 items

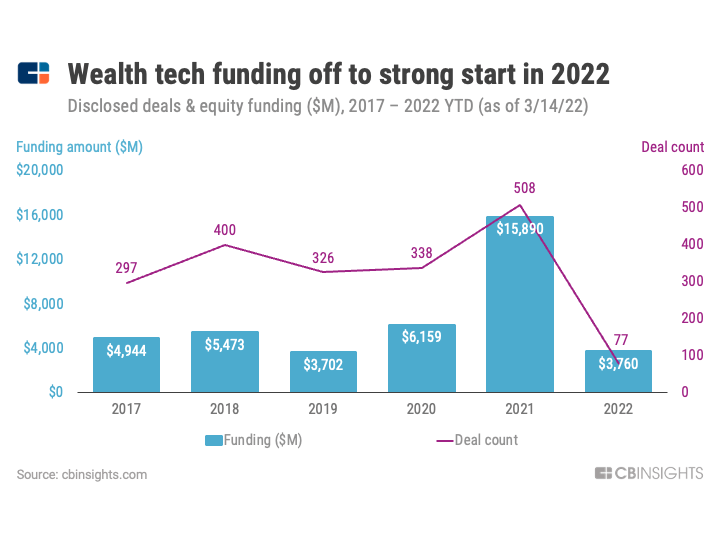

Wealth Tech

2,248 items

A category of financial technology that is digitizing & streamlining the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

7,974 items

US-based companies

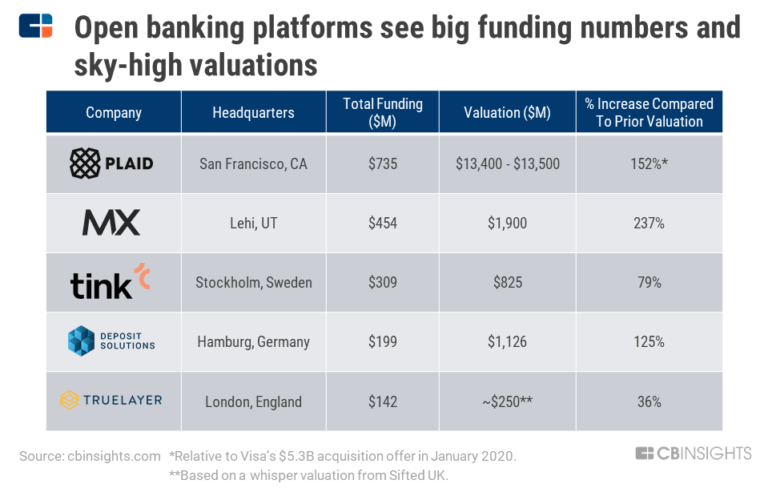

Banking

95 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 250

499 items

250 of the top fintech companies transforming financial services

DriveWealth Patents

DriveWealth has filed 2 patents.

The 3 most popular patent topics include:

- Derivatives (finance)

- Financial markets

- Investment

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/8/2018 | 8/30/2022 | Financial markets, Derivatives (finance), Share trading, Investment, Stock market | Grant |

Application Date | 2/8/2018 |

|---|---|

Grant Date | 8/30/2022 |

Title | |

Related Topics | Financial markets, Derivatives (finance), Share trading, Investment, Stock market |

Status | Grant |

Latest DriveWealth News

Apr 29, 2023

DriveWealth targets the Top 100 U.S-listed ETFs with CETF April 29, 2023 DriveWealth has launched the DriveWealth ICE 100 Index ETF (CETF), a new exchange traded fund listed on the New York Stock Exchange that targets the top 100 U.S.-listed ETFs. CETF seeks to provide investment results that, before fees and expenses, track the performance of the ICE DriveWealth 100 Index, a rules-based, equal-weighted index consisting of the 100 top ETFs based on a methodology that ranks eligible funds according to size, liquidity, and risk-adjusted return. The index will rebalance quarterly. “ETFs represent an important investment opportunity for all types of investors – from Baby Boomers to Gen Z,” said DriveWealth’s founder and CEO Bob Cortright in a news release. “Our partners are now able to offer their investors a way to seek access to the top 100 ETFs in the US through a single investment product.” DriveWealth is working with State Street Corp. as the administrator and service provider for the ETF. Foreside Fund Services is the distributor. To be included in the index, funds must be listed on a U.S. exchange, have at least $100 million in assets, and volume must exceed $3 million on a daily average. The index will not include levered products, inverse funds, exchange-traded notes, or ETFs-of-ETFs. Varun Pawar, head of ICE Data Indices added: “By creating an index of the top-performing ETFs, rather than individual stocks, the ICE DriveWealth 100 Index offers a unique benchmark for the market as a whole. This kind of insight is valuable for all industry participants and is a demonstration of the flexibility and innovation ICE can bring to the ETF industry.”

DriveWealth Frequently Asked Questions (FAQ)

When was DriveWealth founded?

DriveWealth was founded in 2012.

Where is DriveWealth's headquarters?

DriveWealth's headquarters is located at 15 Exchange Place, Chatham.

What is DriveWealth's latest funding round?

DriveWealth's latest funding round is Series D.

How much did DriveWealth raise?

DriveWealth raised a total of $550.8M.

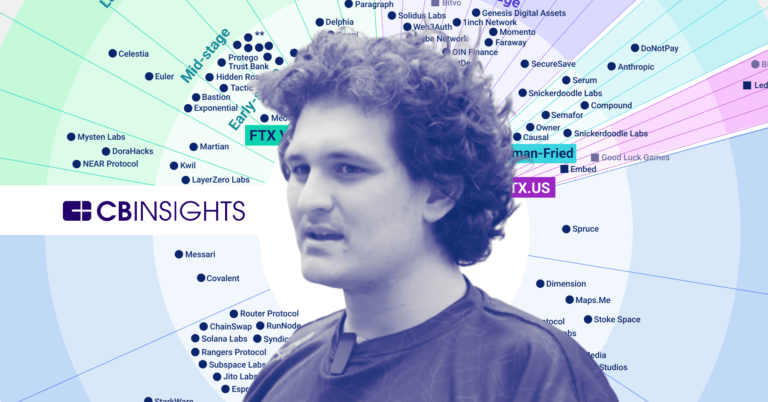

Who are the investors of DriveWealth?

Investors of DriveWealth include Point72 Ventures, Fidelity International Strategic Ventures, Flight Deck, FTX, Greyhound Capital and 10 more.

Who are DriveWealth's competitors?

Competitors of DriveWealth include Tradier and 8 more.

What products does DriveWealth offer?

DriveWealth's products include DriveWealth Brokerage Platform and 2 more.

Compare DriveWealth to Competitors

Alpaca is an application programming interface (API) stock brokerage company for developers and bots. It monitors stocks and enter buy and sell orders manually by introducing a commission-free trading platform where individuals can easily use algorithms, trading bots, and artificial intelligence. It was founded in 2015 and is based in San Mateo, California.

Upvest enables businesses to build great investment experiences, tailored to their customers’ needs. The company's single investment API and digital infrastructure – along with its modular design – make it easy and cost-effective to offer customized investment products. Upvest was founded in 2017 and is based in Berlin, Germany.

Bumped is an app that links to an user's credit or debit card and gives users fractional shares of stock at stores they shop at.

Velexa provides an investing technology platform that empowers financial institutions and disruptive players to capitalize on the demand for modern and embedded investing experiences. The company's solutions make it easy for any business to launch investing services and products that can be seamlessly integrated. The company was founded in 2021 and is based in London, England.

lemon.markets offer a platform that provides frictionless trading, reliable market data, and a developer community. It was founded in 2020 and is based in Berlin, Germany.

Scripbox offers an online wealth management platform. It helps users to choose a suitable investment time frame through a robo-advisor and recommends mutual funds. The company was founded in 2012 and is based in Bengaluru, India.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.