Next Insurance

Founded Year

2016Stage

Corporate Minority | AliveTotal Raised

$881MAbout Next Insurance

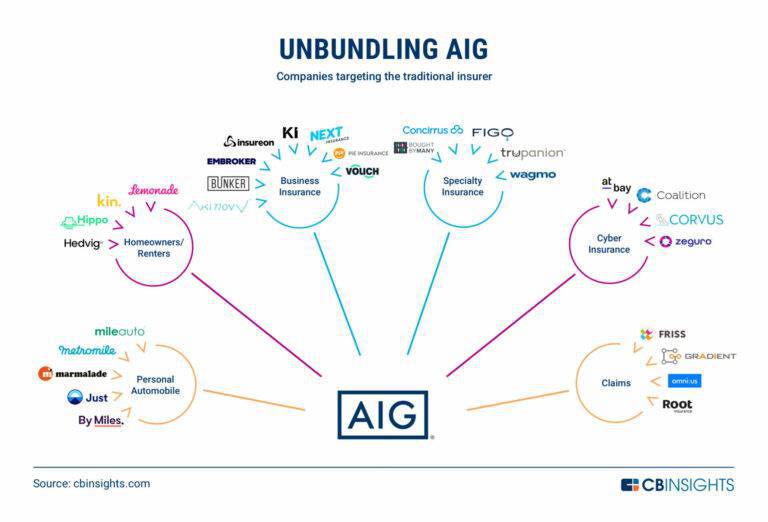

Next Insurance operates as a small business insurance company. It provides insurance on general liability, workers' compensation, commercial auto, equipment and tools, commercial property, and more. It serves beauty, cleaning, real estate, entertainment, financial services, and other sectors. The company was founded in 2016 and is based in Palo Alto, California.

Compete with Next Insurance?

Ensure that your company and products are accurately represented on our platform.

Next Insurance's Products & Differentiators

General Liability

General liability insurance, also known as commercial general liability (CGL), covers the risks that affect almost every business, no matter what your industry. It is the most common insurance for small businesses and self-employed professionals, and it’s typically the first policy purchased by new businesses.

Research containing Next Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

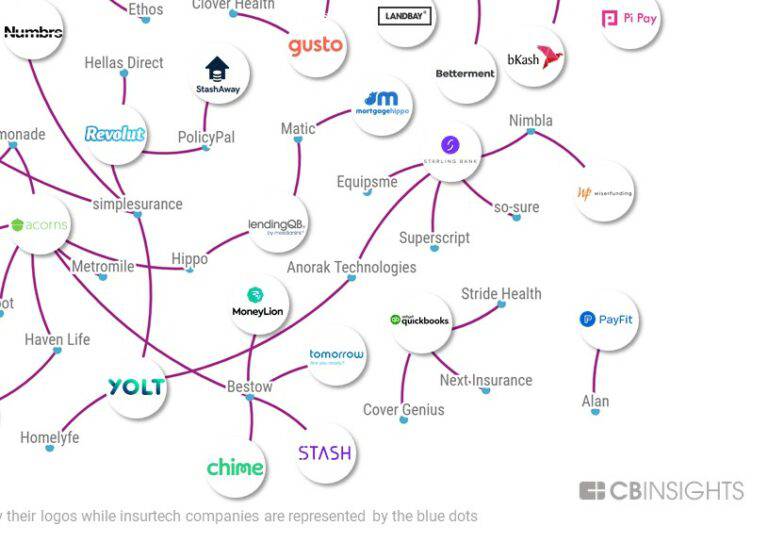

CB Insights Intelligence Analysts have mentioned Next Insurance in 14 CB Insights research briefs, most recently on Oct 4, 2022.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Expert Collections containing Next Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Next Insurance is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,208 items

Fintech 250

1,247 items

SMB Fintech

1,584 items

Insurtech

4,048 items

Companies and startups that use of technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Fintech

7,974 items

US-based companies

Latest Next Insurance News

May 5, 2023

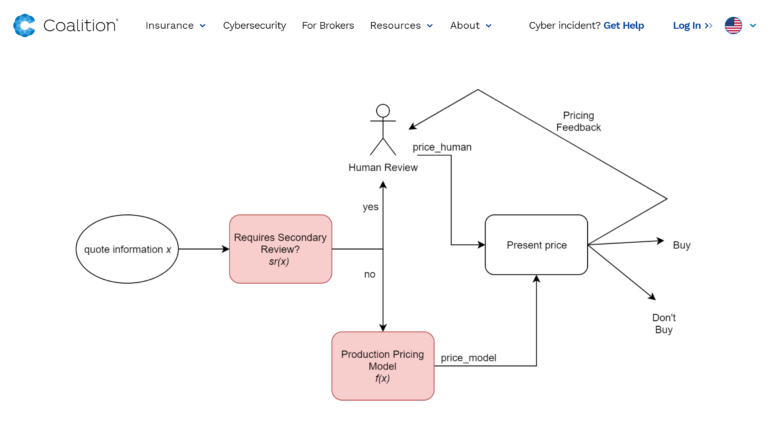

Share Akur8, the next generation insurance pricing solution powered by transparent machine learning, announced that NEXT Insurance, a leading digital insurtech company transforming small business insurance, has selected its Risk and Rate modeling solution to build a data-driven, high-performing and scalable predictive modeling framework for their insurance pricing process. Through this agreement, Akur8 continues its growth within the commercial insurance marketplace in the U.S. “Our partnership with such an innovative and true disruptor of the small business insurance market – a historically complicated industry – demonstrates that Akur8 is a powerful pricing solution for all types of insurance companies across all lines of business.” Developed explicitly for insurers, Akur8’s solution enhances pricing processes by using proprietary machine-learning technology. The core benefits for the commercial insurance marketplace include accelerated model building, transparent GLM outputs, and data-driven underwriting. Building on NEXT’s leading AI and machine learning capabilities, the company will leverage Akur8’s technology as the foundation for a scalable, transparent, and efficient pricing platform. “We are thrilled to support NEXT, a modern leader revolutionizing small business insurance, and enhance its pricing process with our state-of-the-art risk and rate modeling platform. This partnership also demonstrates the relevance and attractiveness of Akur8’s solution for insurance providers targeting the small business market,” stated Samuel Falmagne , CEO at Akur8. Brune de Linares, Chief Client Officer at Akur8 agreed, “Our partnership with such an innovative and true disruptor of the small business insurance market – a historically complicated industry – demonstrates that Akur8 is a powerful pricing solution for all types of insurance companies across all lines of business.” Related Posts NEXT, founded in 2016, is committed to helping small businesses thrive by providing a one-stop-shop to customized and affordable insurance policies the company is trusted by over 450 thousand business owners and serves over 1,300 classes of business, including restaurant owners, general contractors, accountants, fitness professionals and many more. NEXT’s seamless policy purchasing process and affordable pricing is one of the many reasons the company experienced rapid growth over the years. “While every small business is unique, they all share a need for accurate policy pricing. We’ve long been committed to investing in machine learning and predictive analytics for superior underwriting and pricing, and this unique approach has solidified us as a technology leader in the space,” said Phil Natoli, Chief Actuary at NEXT. “Together with Akur8, we’re able to further innovate upon our current capabilities to deliver even more accuracy, speed and efficiency at scale for NEXT’s growing customer bases.” “With Akur8’s platform, our actuarial, data science, and product teams can collaborate seamlessly throughout the insurance pricing process. It ensures higher efficiency and delivers visual insights that are explainable across a variety of stakeholders,” noted Peter Yin, Senior Actuarial Manager at NEXT.

Next Insurance Frequently Asked Questions (FAQ)

When was Next Insurance founded?

Next Insurance was founded in 2016.

Where is Next Insurance's headquarters?

Next Insurance's headquarters is located at 975 California Avenue, Palo Alto.

What is Next Insurance's latest funding round?

Next Insurance's latest funding round is Corporate Minority.

How much did Next Insurance raise?

Next Insurance raised a total of $881M.

Who are the investors of Next Insurance?

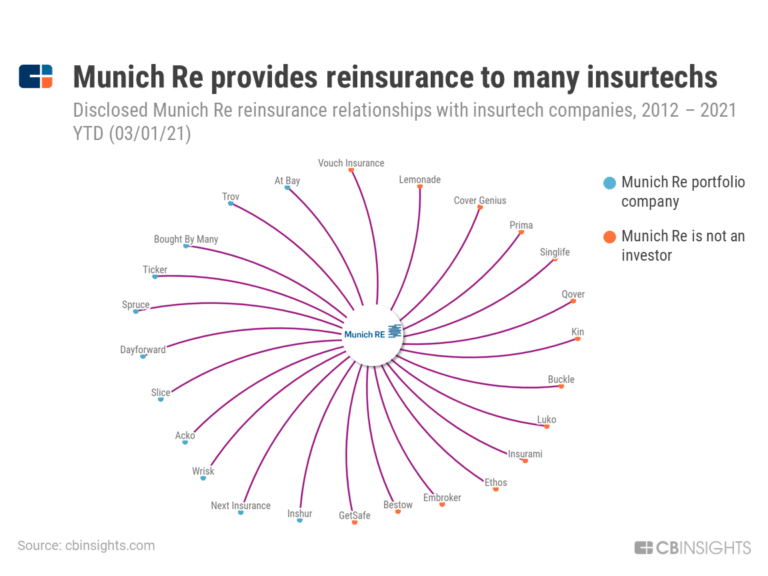

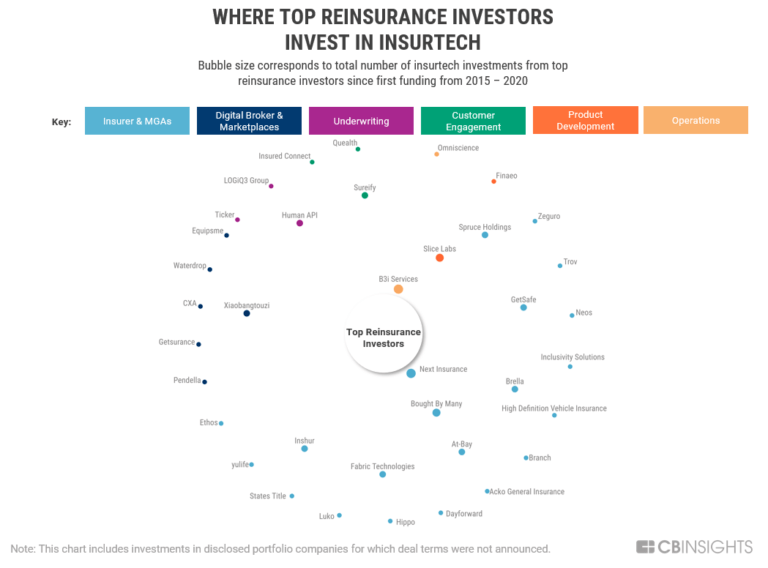

Investors of Next Insurance include Mitsui Sumitomo Insurance, Group 11, Zeev Ventures, FinTLV, CapitalG and 14 more.

Who are Next Insurance's competitors?

Competitors of Next Insurance include Thimble, Assureful, Superscript, Hourly, Pie Insurance and 16 more.

What products does Next Insurance offer?

Next Insurance's products include General Liability and 4 more.

Compare Next Insurance to Competitors

Embroker operates as a digital insurance company. It offers custom-built insurance policies that are underwritten instantly with real-time claims tracking for small and mid-sized enterprises. The company was founded in 2015 and is based in San Francisco, California.

Pie Insurance operates a platform for workers' compensation insurance. Its platform matches price with risk across a broad spectrum of small business types, which allows Pie to offer affordable insurance to small business owners. The firm was founded in 2017 and is based in Washington, District of Columbia.

Hiscox is a specialist insurance company. It offers errors and omissions, cyber and data security, media liability, entertainment production risk, general liability, professional liability, crime, ransom, terror, and property insurance through brokers and directly online to small businesses.

Coverdash is a fully-digital commercial insurance agency that aims to make insurance accessible to small businesses of all shapes and sizes through its embedded technology. It provides insurance services for freelancers, e-commerce, and small businesses. The company was founded in 2022 and is based in New York, New York.

Caribou is a technology company enabling users to shop and compare insurance quotes from trusted carriers. It partners with lenders, such as credit unions and community banks, to bring customers cheap rates and monthly payments helping them in their auto refinances. It was founded in 2016 and is based in Washington, DC.

Liberty Mutual Insurance focuses primarily on property and casualty insurance. It provides insurance products and services for personal automobiles, homeowners, commercial vehicles, general liability, surety, commercial property, and more. Additionally, the company offers reinsurance services. It serves both individuals and businesses. The company was formerly known as Massachusetts Employees Insurance Association (MEIA). It was founded in 1912 and is based in Boston, Massachusetts.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.