Investments

336Portfolio Exits

94Funds

1Partners & Customers

1About Novartis Venture Funds

Novartis Venture Funds primarily focuses on the development of novel therapeutics and platforms. NVF looks for unmet need and clinical impact, novel proprietary science and understanding of mechanism, management and board experience and capital efficiency in the program. Novartis Venture Funds invests in North America, Europe, Israel and Asia/Pacific and manage over USD 1 billion in committed capital and more than 40 portfolio companies. NVF makes equity investments in life sciences companies across Biotechnology/Biopharma, Medical Devices and Diagnostics. NVF is stage agnostic and engages in seed investments as well as later-stage investments, typically leading or co-leading an investment and playing an active role on company boards.

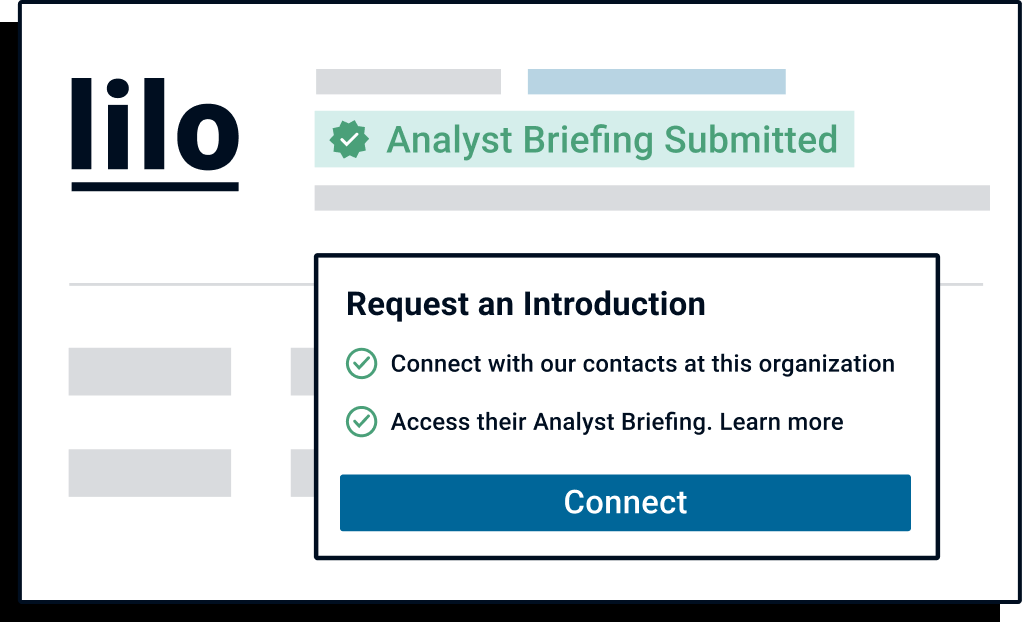

Want to inform investors similar to Novartis Venture Funds about your company?

Submit your Analyst Briefing to get in front of investors, customers, and partners on CB Insights’ platform.

Expert Collections containing Novartis Venture Funds

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Novartis Venture Funds in 1 Expert Collection, including Synthetic Biology.

Synthetic Biology

382 items

Research containing Novartis Venture Funds

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Novartis Venture Funds in 2 CB Insights research briefs, most recently on Apr 6, 2021.

Jan 19, 2021

27 Corporate Innovation Labs In HealthcareLatest Novartis Venture Funds News

Jul 7, 2022

| Novartis Venture Funds, VenBio, Aisling Capital – Designer Women -Designer Women 6h agoVenture CapitalPrivate EquitydesignerwomenViews: 16 Not a member yet? Free Membership for Qualified Investors and Industry Participants Easily Customize Content to Match Your Investment Preferences Breaking News 24/7/365 Alternative Investment Listings & LeaderBoards Industry Research, Due Diligence, Videos, Webinars, Events, Press Releases, Market Commentary, Newsletters, Fact Sheets,Presentations, Investment Mandates, Video PitchBooks & More! Company Directory AUM Accelerator Program (designed for investment managers) Over 450K+ Industry Headlines, Posts and Updates ALL ALPHAMAVEN CONTENT IS FOR INFORMATIONAL PURPOSES ONLY.CONTENT POSTED BY MEMBERS DOES NOT NECESSARILY REFLECT THE OPINION OR BELIEFS OF ALPHAMAVEN AND HAS NOT ALWAYS BEEN INDEPENDENTLY VERIFIED BY ALPHAMAVEN.PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.THIS IS NOT A SOLICITATION FOR INVESTMENT.THE MATERIAL PROVIDED HEREIN IS FOR INFORMATIONAL PURPOSES ONLY.IT DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY INTERESTS OF ANY FUND OR ANY OTHER SECURITIES.ANY SUCH OFFERINGS CAN BE MADE ONLY IN ACCORDANCE WITH THE TERMS AND CONDITIONS SET FORTH IN THE INVESTMENT'S PRIVATE PLACEMENT MEMORANDUM.PRIOR TO INVESTING, INVESTORS ARE STRONGLY URGED TO REVIEW CAREFULLY THE PRIVATE PLACEMENT MEMORANDUM (INCLUDING THE RISK FACTORS DESCRIBED THEREIN), THE LIMITED PARTNERSHIP AGREEMENT AND THE SUBSCRIPTION DOCUMENTS, TO ASK SUCH QUESTIONS OF THE INVESTMENT MANAGER AS THEY DEEM APPROPRIATE, AND TO DISCUSS ANY PROSPECTIVE INVESTMENT IN THE FUND WITH THEIR LEGAL AND TAX ADVISERS IN ORDER TO MAKE AN INDEPENDENT DETERMINATION OF THE SUITABILITY AND CONSEQUENCES OF AN INVESTMENT. ALPHAMAVEN

Novartis Venture Funds Investments

336 Investments

Novartis Venture Funds has made 336 investments. Their latest investment was in Mediar Therapeutics as part of their Series A - II on March 3, 2023.

Novartis Venture Funds Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

3/15/2023 | Series A - II | Mediar Therapeutics | $85M | No | 6 | |

12/22/2022 | Series C - II | Ribon Therapeutics | $25M | No | Atlas Venture, Novartis Venture Funds, Peregrine Ventures, Pfizer, The Column Group, U.S. Venture Partners, and Undisclosed Investors | 2 |

12/2/2022 | Series A | Mediar Therapeutics | $31.76M | Yes | 2 | |

11/22/2022 | Series C | |||||

9/14/2022 | Series A |

Date | 3/15/2023 | 12/22/2022 | 12/2/2022 | 11/22/2022 | 9/14/2022 |

|---|---|---|---|---|---|

Round | Series A - II | Series C - II | Series A | Series C | Series A |

Company | Mediar Therapeutics | Ribon Therapeutics | Mediar Therapeutics | ||

Amount | $85M | $25M | $31.76M | ||

New? | No | No | Yes | ||

Co-Investors | Atlas Venture, Novartis Venture Funds, Peregrine Ventures, Pfizer, The Column Group, U.S. Venture Partners, and Undisclosed Investors | ||||

Sources | 6 | 2 | 2 |

Novartis Venture Funds Portfolio Exits

94 Portfolio Exits

Novartis Venture Funds has 94 portfolio exits. Their latest portfolio exit was Oculis on March 03, 2023.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/3/2023 | Reverse Merger | 3 | |||

11/11/2021 | Acquired | 10 | |||

10/22/2021 | Acquired | 25 | |||

Date | 3/3/2023 | 11/11/2021 | 10/22/2021 | ||

|---|---|---|---|---|---|

Exit | Reverse Merger | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 3 | 10 | 25 |

Novartis Venture Funds Fund History

1 Fund History

Novartis Venture Funds has 1 fund, including Novartis Med-Tech Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

Novartis Med-Tech Fund | $115M | 1 |

Closing Date | |

|---|---|

Fund | Novartis Med-Tech Fund |

Fund Type | |

Status | |

Amount | $115M |

Sources | 1 |

Novartis Venture Funds Partners & Customers

1 Partners and customers

Novartis Venture Funds has 1 strategic partners and customers. Novartis Venture Funds recently partnered with Heptares Therapeutics on .

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

Licensor | United Kingdom | Heptares Therapeutics Limited Ltd , the drug discovery company focused on G-protein-coupled receptor targets , announced today that it has entered into an option agreement with the Novartis under which Heptares Therapeutics Limited will apply its proprietary StaR ™ technology to generate novel drug leads against a nominated , unspecified GPCR target of interest to Novartis . | 1 |

Date | |

|---|---|

Type | Licensor |

Business Partner | |

Country | United Kingdom |

News Snippet | Heptares Therapeutics Limited Ltd , the drug discovery company focused on G-protein-coupled receptor targets , announced today that it has entered into an option agreement with the Novartis under which Heptares Therapeutics Limited will apply its proprietary StaR ™ technology to generate novel drug leads against a nominated , unspecified GPCR target of interest to Novartis . |

Sources | 1 |

Novartis Venture Funds Team

8 Team Members

Novartis Venture Funds has 8 team members, including current Managing Director, Laura Brass.

Name | Work History | Title | Status |

|---|---|---|---|

Laura Brass | MPM Capital, TriNetX, Wyss Institute, Harvard University, and Elixir Pharmaceuticals | Managing Director | Current |

Name | Laura Brass | ||||

|---|---|---|---|---|---|

Work History | MPM Capital, TriNetX, Wyss Institute, Harvard University, and Elixir Pharmaceuticals | ||||

Title | Managing Director | ||||

Status | Current |

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.