Sanofi-Genzyme BioVentures

Investments

25Portfolio Exits

13About Sanofi-Genzyme BioVentures

Sanofi-Genzyme Ventures is a corporate venture capital fund dedicated to helping Genzyme Corporation achieve its strategic goals. Founded in 2001, the $100 million fund has a current portfolio of direct corporate investments and has taken LP positions in funds managed by life-science focused VC firms. Through its direct investments in private early-stage companies, the fund aims to forge relationships which may lead to larger collaborations in the future. Genzyme Ventures is able to leverage the entire Genzyme organization, including its global experience and expertise in R&D, reimbursement, and commercialization, to provide portfolio companies with invaluable advice and assistance. Its Limited Partnership investments provide insight into the broader healthcare innovation landscape

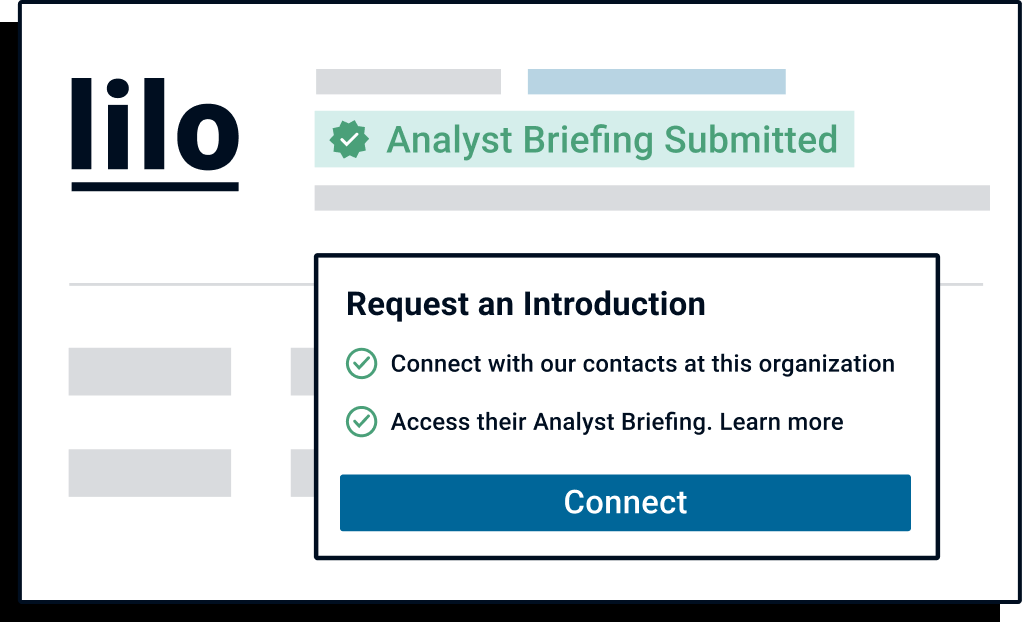

Want to inform investors similar to Sanofi-Genzyme BioVentures about your company?

Submit your Analyst Briefing to get in front of investors, customers, and partners on CB Insights’ platform.

Research containing Sanofi-Genzyme BioVentures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sanofi-Genzyme BioVentures in 1 CB Insights research brief, most recently on Apr 6, 2021.

Latest Sanofi-Genzyme BioVentures News

Jan 17, 2023

Sanofi has thrown its financial weight behind its venture capital unit, making a $750 million, multi-year commitment to enable the financier to build on a year in which it backed 10 companies globally. Sanofi Ventures is a well-established player in the biotech VC space, with its roots dating back to the formation of Sanofi-Genzyme BioVentures in 2011 and beyond that to the establishment of Genzyme Ventures a decade earlier. But Sanofi has largely stayed in the shadows, leaving its venture unit to build out a portfolio without publicly disclosing the details of how it supports the fund.

Sanofi-Genzyme BioVentures Investments

25 Investments

Sanofi-Genzyme BioVentures has made 25 investments. Their latest investment was in Omada Health as part of their Series C - II on June 6, 2017.

Sanofi-Genzyme BioVentures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/14/2017 | Series C - II | Omada Health | $50M | Yes | 2 | |

4/26/2017 | Series B - II | Evidation | $10M | Yes | 2 | |

4/25/2017 | Series C | Science 37 | $29M | No | 2 | |

10/18/2016 | Series B | |||||

2/10/2016 | Series A |

Date | 6/14/2017 | 4/26/2017 | 4/25/2017 | 10/18/2016 | 2/10/2016 |

|---|---|---|---|---|---|

Round | Series C - II | Series B - II | Series C | Series B | Series A |

Company | Omada Health | Evidation | Science 37 | ||

Amount | $50M | $10M | $29M | ||

New? | Yes | Yes | No | ||

Co-Investors | |||||

Sources | 2 | 2 | 2 |

Sanofi-Genzyme BioVentures Portfolio Exits

13 Portfolio Exits

Sanofi-Genzyme BioVentures has 13 portfolio exits. Their latest portfolio exit was Science 37 on October 07, 2021.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/7/2021 | Reverse Merger | 8 | |||

8/24/2020 | Reverse Merger | 8 | |||

3/29/2018 | IPO | Public | 3 | ||

Date | 10/7/2021 | 8/24/2020 | 3/29/2018 | ||

|---|---|---|---|---|---|

Exit | Reverse Merger | Reverse Merger | IPO | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 8 | 8 | 3 |

Sanofi-Genzyme BioVentures Acquisitions

3 Acquisitions

Sanofi-Genzyme BioVentures acquired 3 companies. Their latest acquisition was AnorMed on November 07, 2006.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

11/7/2006 | Acquired | 1 | ||||

2/8/2005 | Series D | |||||

5/31/1996 | Series B |

Date | 11/7/2006 | 2/8/2005 | 5/31/1996 |

|---|---|---|---|

Investment Stage | Series D | Series B | |

Companies | |||

Valuation | |||

Total Funding | |||

Note | Acquired | ||

Sources | 1 |

Sanofi-Genzyme BioVentures Team

5 Team Members

Sanofi-Genzyme BioVentures has 5 team members, including current Senior Vice President, James P Sherblom.

Name | Work History | Title | Status |

|---|---|---|---|

James P Sherblom | Senior Vice President | Current | |

Name | James P Sherblom | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Senior Vice President | ||||

Status | Current |

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.