Shift

Founded Year

2014Stage

Series D - II | AliveTotal Raised

$319.72MAbout Shift

Shift delivers artificial intelligence (AI) based insurance solutions. It manages claims fraud detection, claims intake decisions, underwriting risk detection, improper payment detection, and more. It enables insurers to automate and optimize decisions from underwriting to claims. It was founded in 2014 and is based in Paris, France.

Shift's Product Videos

ESPs containing Shift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

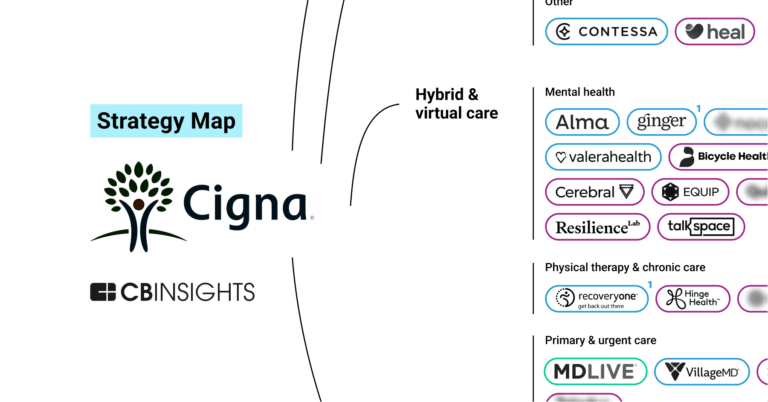

The insurance fraud detection market is a growing industry that provides solutions to detect and prevent fraudulent activities in the insurance sector. The market offers various software tools, such as predictive analytics, machine learning algorithms, and data mining techniques to identify potential fraud cases. These solutions help insurers reduce their losses by detecting fraudulent claims earl…

Shift named as Leader among 7 other companies, including Friss, Fraud.net, and ForMotiv.

Compete with Shift?

Ensure that your company and products are accurately represented on our platform.

Shift's Products & Differentiators

Shift Claims Fraud Detection

Designed to help claims professionals find hidden fraud in the claims process.

Research containing Shift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Shift in 6 CB Insights research briefs, most recently on Apr 17, 2023.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Expert Collections containing Shift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Shift is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,208 items

AI 100

99 items

Banking

380 items

Startups providing solutions to banks to automate processes and operations.

Insurtech

4,108 items

Companies and startups that use of technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

10,622 items

This collection includes startups selling AI SaaS, using AI algorithms to develop their core products, and those developing hardware to support AI workloads.

Fintech 250

499 items

250 of the top fintech companies transforming financial services

Latest Shift News

Mar 31, 2023

Share Shift Technology, a provider of artificial intelligence-based decision automation and optimization solutions for the insurance industry, and Direct Assurance, the French leader in direct insurance, which offers auto, motorcycle, home and health insurance, and is a 100% subsidiary of the AXA group, today announced their renewed collaboration. Initiated in 2018 to fight auto insurance claims fraud using Shift Claims Fraud Detection, the relationship now extends its scope to cover home insurance claims. Property and casualty insurance fraud costs the European economy €14 billion annually, and €2.5 billion in France alone. As such, insurers are looking for modern solutions which can more effectively identify and analyze suspicious claims. Working with Shift, Direct Assurance has opted for an innovative approach to this issue. Five years of successful collaboration analyzing motor claims prompted the French leader in direct insurance to extend the use of Shift’s solutions to the challenge of mitigating fraud in home insurance claims. “Fighting against fraud is one of the most effective ways to maintain the competitiveness of our rates and defend the purchasing power of the immense proportion of our bona fide customers,” explained Donatien Levesque, director of claims, Direct Assurance. Related Posts Mar 7, 2023 “In order to identify suspicious claims, we chose to combine artificial intelligence with the know-how of our experts. The enormous amount of information to be processed makes verification and comparison operations extremely difficult,” continued Nicolas Vilhelmsen, head of claims business intelligence, Direct Assurance. “That’s why we used Shift. Since 2018, this collaboration has allowed us to gain ground on fraudsters in a considerable way. We are very excited to apply this solution to our home claims, which are an increasingly important part of our business.” “From the beginning, Shift’s goal has been to put technology at the service of insurance players to help them best serve their customers,” concludes Jeremy Jawish, CEO and co-founder, Shift Technology. “We are proud to have contributed for several years to Direct Assurance’s strategic initiative to minimize the impact of fraud on its business, and to benefit its legitimate customers.”

Shift Frequently Asked Questions (FAQ)

When was Shift founded?

Shift was founded in 2014.

Where is Shift's headquarters?

Shift's headquarters is located at 14, Rue Gerty Archimède, Paris.

What is Shift's latest funding round?

Shift's latest funding round is Series D - II.

How much did Shift raise?

Shift raised a total of $319.72M.

Who are the investors of Shift?

Investors of Shift include Guidewire Software, Iris Capital, Accel, General Catalyst, Bessemer Venture Partners and 9 more.

Who are Shift's competitors?

Competitors of Shift include Quantexa, Click-Ins, AiDA, omni:us, QantEv and 15 more.

What products does Shift offer?

Shift's products include Shift Claims Fraud Detection and 4 more.

Who are Shift's customers?

Customers of Shift include Markerstudy Insurance Services Limited , Amica, Economical and First Central.

Compare Shift to Competitors

Friss uses proprietary analytics software to provide solutions in the fields of fraud, risk, and compliance for the insurance industry. It offers products such as underwriting insights, risk assessment at underwriting, fraud detection at claims, compliance screening, and investigations at SIU. The company was founded in 2006 and is based in Utrecht, Netherlands.

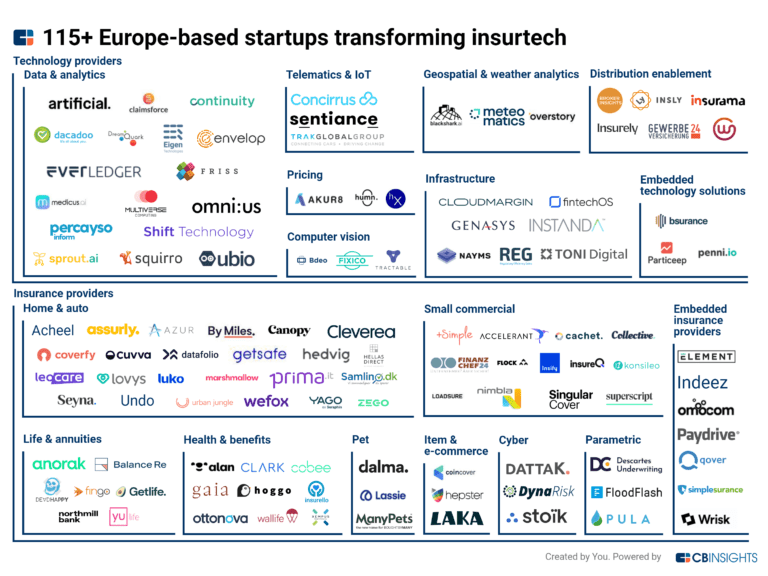

omni:us provides intelligent insurance claim automation services. It offers solutions to process digital insurance documents by classifying them and extracting valuable data points. The company was formerly known as SearchInk. It was founded in 2015 and is based in Berlin, Germany.

Click-Ins detect and predict fraud for insurance and car companies. The platform helps to predict fraud at the point of sale as well as point of claim using an approach that uses intelligence techniques including link analysis, open-source intelligence, text analytics, and signal and image processing. The company was formerly known as Get Me Ins. It was founded in 2014 and is based in Netanya, Israel.

SAS provides software and solutions for business analytics, data management, and AI, used to gather, manage, and analyze corporate information. It offers business analytics SaaS for a range of industries that include agriculture, banking, education, healthcare, insurance, life sciences, manufacturing, retail and consumer goods, public sector, sports, telecommunications and utility industries. The company was founded in 1976 and is based in Cary, North Carolina.

Featurespace offers financial crime and fraud prevention technology solutions. It uses adaptive behavioral analytics for fraud detection and risk management in the gaming, banking, and insurance sectors. The company was founded in 2008 and is based in Cambridge, United Kingdom.

Paperbox develops a document processing platform. The company offers a software-as-a-service (SaaS) for intelligent document processing in insurance. It was founded in 2021 and is based in Gent, Belgium.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.