Stash

Founded Year

2015Stage

Debt | AliveTotal Raised

$491.85MValuation

$0000Last Raised

$52.6M | 7 mos agoAbout Stash

Stash offers a mobile investment application. It helps people start investing with small sums, gain investing confidence gradually, and build smart financial habits for the long term. The company was formerly known as Collective Returns. It was founded in 2015 and is based in New York, New York.

Compete with Stash?

Ensure that your company and products are accurately represented on our platform.

Stash's Products & Differentiators

Invest, Retire + Custodial

With just 1¢1, customers can buy fractional shares of stocks and funds, build their own diversified portfolios, and learn how to invest confidently; access to a curated selection of +3,000 ETFs and stocks; option to open personal brokerage, Roth or traditional IRAs and/or custodial (UGMA and UTMA) accounts.

Research containing Stash

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stash in 10 CB Insights research briefs, most recently on Nov 3, 2022.

Nov 3, 2022

3 banking trends to watch

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021

Jul 8, 2021 report

How Robinhood Makes MoneyExpert Collections containing Stash

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

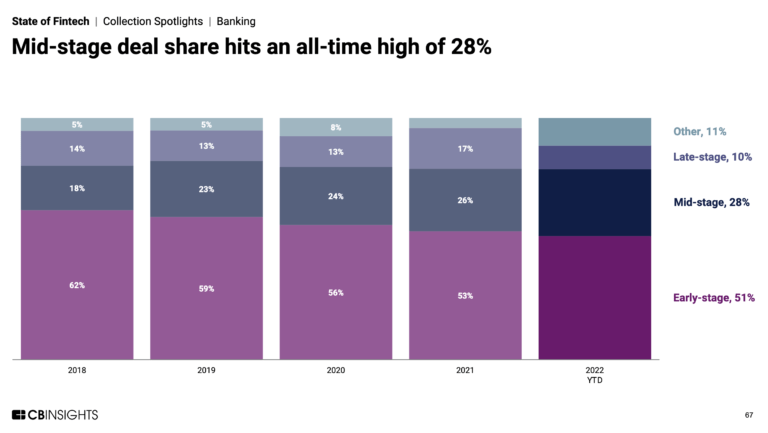

Stash is included in 6 Expert Collections, including Banking.

Banking

881 items

Unicorns- Billion Dollar Startups

1,208 items

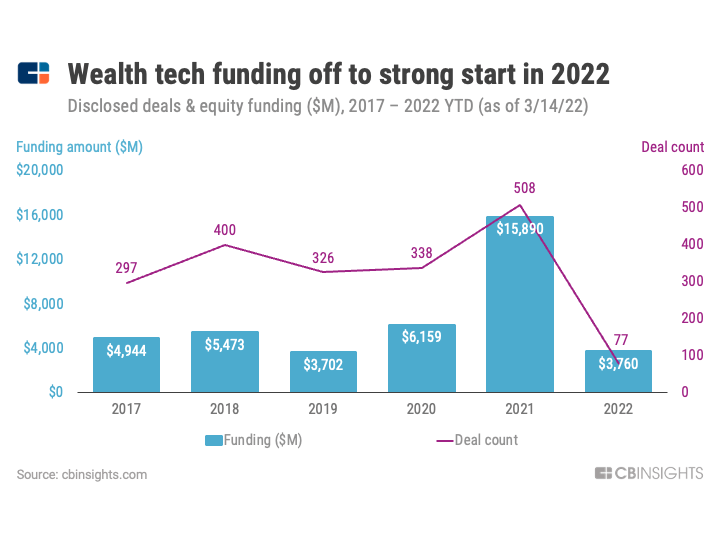

Wealth Tech

2,015 items

A category of financial technology that is digitizing & streamlining the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

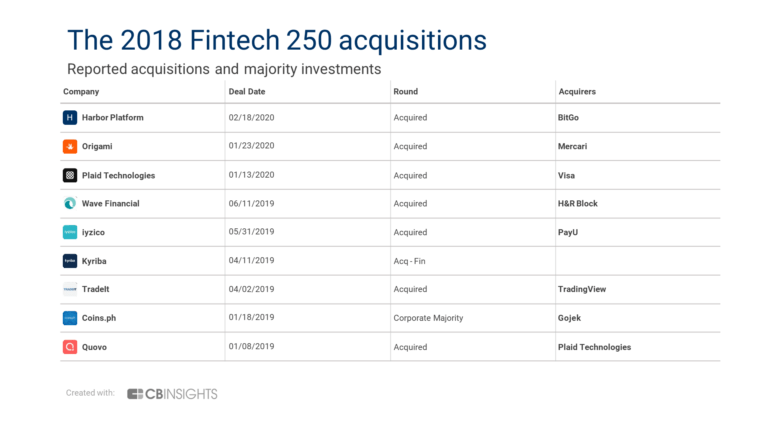

Fintech 250

997 items

Fintech

7,974 items

US-based companies

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Stash Patents

Stash has filed 6 patents.

The 3 most popular patent topics include:

- Credit cards

- Debit cards

- Payment systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/19/2021 | 12/6/2022 | Grant |

Application Date | 2/19/2021 |

|---|---|

Grant Date | 12/6/2022 |

Title | |

Related Topics | |

Status | Grant |

Latest Stash News

Mar 5, 2023

William 13 mins ago 157 Lex Markets is an online trading platform specializing in fractional real estate investments. The platform offers investors access to a range of investment properties and the ability to invest in them with smaller amounts of capital. Although Lex Markets is a great platform for those interested in real estate investing, it may not be suitable for all investors. In this article, Benzinga explores six of the best alternatives to Lex Markets and highlights their pros and cons. Disclosure: *Conditions apply. Fund raising Fundrise is a real estate investment platform that offers investors the opportunity to invest in private market real estate with smaller amounts of capital. The platform offers a range of investment products, including eREITs and eFunds, and provides investors with access to a diverse portfolio of properties. Smaller investment minimums Higher fees compared to some other platforms Stash 1 Stash banking services provided by Stride Bank, NA, Member FDIC. Stash Stock-Back® Debit Mastercard® is issued by Stride Bank pursuant to license from Mastercard International. Mastercard and the circle design are registered trademarks of Mastercard International Incorporated. All stock rewards earned will be stored in your Stash Invest account. Investment products and services provided by Stash Investments LLC and are not FDIC insured, not bank guaranteed and may lose value Stash is an investment platform that offers a range of investment options, including fractional investments in real estate. The platform allows investors to build a diversified portfolio of investments and offers a user-friendly interface. Split real estate investments

Stash Frequently Asked Questions (FAQ)

When was Stash founded?

Stash was founded in 2015.

Where is Stash's headquarters?

Stash's headquarters is located at 500 7th Avenue, New York.

What is Stash's latest funding round?

Stash's latest funding round is Debt.

How much did Stash raise?

Stash raised a total of $491.85M.

Who are the investors of Stash?

Investors of Stash include Goodwater Capital, Entree Capital, T. Rowe Price, Owl Ventures, Eldridge and 11 more.

Who are Stash's competitors?

Competitors of Stash include Bundil, Bits of Stock, Moneybox, Acorns, UNest and 11 more.

What products does Stash offer?

Stash's products include Invest, Retire + Custodial and 4 more.

Compare Stash to Competitors

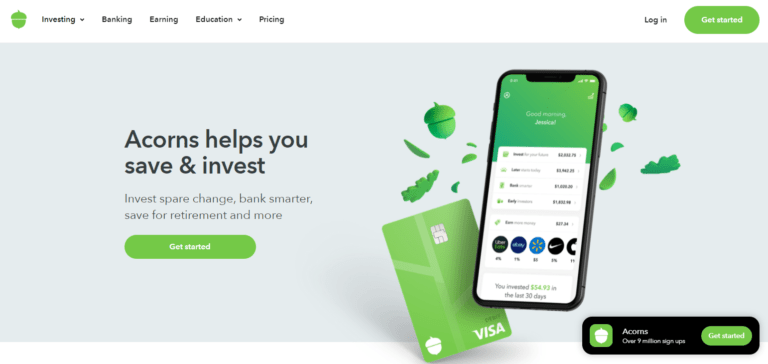

Acorns operates as a financial service provider. It offers micro-investing by enabling the investment of aggregated sub-dollar amounts in fractional shares and leverages a proprietary brokerage and advisory engine, rounds up credit, and debit card purchases to the nearest dollar, then automatically collects and invests that spare change into a portfolio of index funds offered by money managers. It was founded in 2012 and is based in Irvine, California.

ChangEd is a mobile application that links student loan accounts with credit and debit cards. Card transactions are rounded up to the nearest dollar, and the change is applied to student loans via an FDIC-insured ChangEd personal account.

Bundil operates as a crypto investment mobile platform. It allows users to automatically invest spare change from everyday credit or debit card purchases into Bitcoin and other cryptocurrencies. It was founded in 2017 and is based in Dallas, Texas.

Moneybox is a mobile savings and investment application. It provides an application to enable users to round up the digital spare change from everyday card transactions and invest that change into three tracker funds within stocks and shares. It was founded in 2015 and the company is based in London, United Kingdom.

Cred provides a personalized investment portfolio tool that matches a client's existing worldview and long-term investing need.

M1 Finance develops a personal finance platform. It unites individual perspectives and empowers financial well-being with tools to invest, borrow, and spend. It was founded in 2015 and is based in Chicago, Illinois.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.