Stripe

Founded Year

2010Stage

Series I | AliveTotal Raised

$9.401BValuation

$0000Last Raised

$6.5B | 2 mos agoRevenue

$0000About Stripe

Stripe is a financial technology company that builds economic infrastructure for the internet. The company offers an online-based, payment processing platform that gives online merchants the ability to securely accept credit card payments through the use of custom-built forms. Stripe's software and APIs allow user's to accept payments, send payouts and manage businesses online. The company serves clients globally with a use case for SaaS, platforms, marketplaces, eCommerce, creator economy, crypto and embedded finance. It was founded in 2010 and is based in San Francisco, California.

Missing: Stripe's Product Demo & Case Studies

Promote your product offering to tech buyers.

Reach 1000s of buyers who use CB Insights to identify vendors, demo products, and make purchasing decisions.

ESPs containing Stripe

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Virtual payment terminals are online applications that allow a computer, tablet, or smartphone to process card payments without a card reader or point-of-sale hardware. Essentially, it turns a computer into a credit card terminal. They are primarily used by restaurants, delivery-based businesses, mobile businesses, or remote freelancers that receive orders by phone, fax, email, or mail — transacti…

Stripe named as Leader among 8 other companies, including Worldpay, Fundbox, and Helcim.

Missing: Stripe's Product & Differentiators

Don’t let your products get skipped. Buyers use our vendor rankings to shortlist companies and drive requests for proposals (RFPs).

Research containing Stripe

Get data-driven expert analysis from the CB Insights Intelligence Unit.

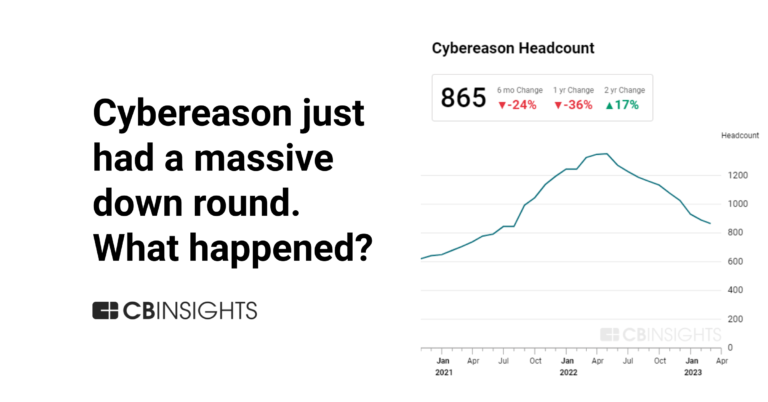

CB Insights Intelligence Analysts have mentioned Stripe in 48 CB Insights research briefs, most recently on May 4, 2023.

Expert Collections containing Stripe

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

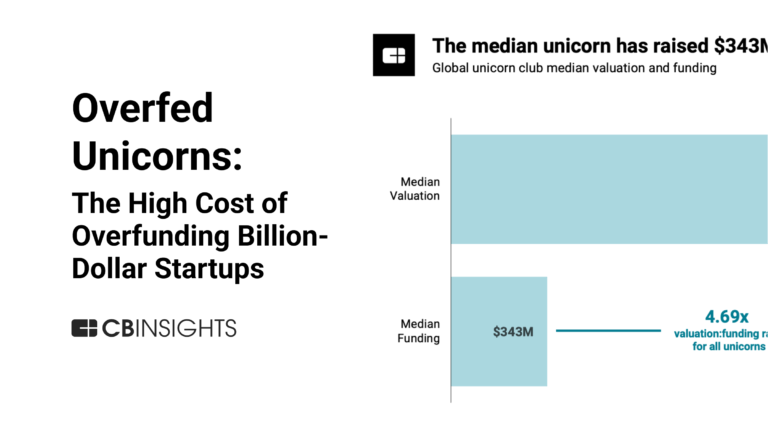

Stripe is included in 11 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,208 items

Fintech 250

1,247 items

SMB Fintech

2,001 items

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Payments

2,682 items

Companies and startups in this collection enable consumers, businesses, and governments to pay each other - online and at the physical point-of-sale.

Tech IPO Pipeline

568 items

Stripe Patents

Stripe has filed 130 patents.

The 3 most popular patent topics include:

- Payment systems

- Payment service providers

- Mobile payments

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/14/2021 | 5/2/2023 | Barcodes, Payment systems, Watch brands, Signal estimation, Dimension reduction | Grant |

Application Date | 5/14/2021 |

|---|---|

Grant Date | 5/2/2023 |

Title | |

Related Topics | Barcodes, Payment systems, Watch brands, Signal estimation, Dimension reduction |

Status | Grant |

Latest Stripe News

May 5, 2023

By One of the most significant developments in the past two decades has been the rise of e-commerce. Electronic commerce, or e-commerce, refers to any and all electronic purchasing services. The most notable form of electronic commerce in 2023 is of course, through the internet. Whether we are ordering pizza, purchasing groceries, buying new clothes, or ordering books, if we are doing so electronically, we are engaging in e-commerce. While e-commerce predates the internet, today it is largely associated with websites like Amazon, E-Bay, or GoodReads, where you can order a product and have it delivered to your doorstep. Naturally, e-commerce websites require some form of payment. For a long-time, the only available, and most popular method for transactions were credit and debit cards. However, thanks to the introduction of online payment systems, that has largely changed. What Is An Online Payment System? Online payment system, often called electronic payment system or e-commerce payment system, is a software which facilitates online payments. For example, using one of these systems, one could transfer a certain amount of cash to another account, in exchange for goods and services. These kinds of payment systems are exceedingly popular in quite a few industries, most notable the e-commerce and the iGaming industry. For those who don’t know, iGaming refers to all forms of digital wagering. Whether you are betting on sports, spinning slots, or playing poker, if you are doing so online, you are participating in the so-called iGaming industry. And when it comes to online casinos, PayPal is the most popular online payment system. What Is PayPal? In 1998, three entrepreneurs established a company called Confinity. The goal was to develop security software for handheld devices. During its first year, Confinity was largely unsuccessful, which forced them to switch over to a new business model, focusing on digital wallets. And thus, PayPal was born. Today, PayPal is the most popular and well-regarded online payment system in the world. Operating in multiple countries around the globe, PayPal produced an estimated revenue of over $20 billion in 2022. With an operating income of around $3 billion, that is quite an accomplishment. Their most recent innovation came only a year ago, when PayPal opened up to crypto-based transfers. As of 2022, PayPal’s users can send, receive, and even trade cryptocurrencies like Bitcoin, Ethereum, Tether, and Dogecoin. Unsurprising, considering cryptocurrency has had quite a boost in popular culture recently. The crypto market is one of the fastest-growing trading markets in the world, and more and more businesses are embracing crypto transactions. So, it would seem PayPal hopped on the bandwagon at just the right time. However, PayPal’s success has led to quite a few imitators. The question we have is this: is PayPal still the best digital wallet, or has a new online payment system supplanted it? In this article, we would like to explore alternative options, and see how they compare to the original. Alternatives To PayPal In 2023, we are spoiled for choice when it comes to e-wallets. PayPal may be the most popular, but it isn’t the only one. So, let us explore some alternatives, and see how they compare to the top dog. Starting with one of the top-rated digital wallets aside from PayPal, Stripe. Stripe Stripe is a financial service company headquartered in Ireland and the USA. Their main product is a payment-processing software used by quite a few e-commerce websites. According to the company, they handle transactions worth billions of dollars every year. So, what separates Stripe from PayPal? The key difference is that Stripe is a pretty straightforward solution to the problems of e-commerce. Users get a wide variety of tools, which can help them to customize their own personal payment processes. And while that sounds great at first, it also leads to Stripe’s major disadvantage. That is, you need a good degree of technical know-how to operate Stripe. With PayPal, all you need is an account, and maybe a glance at the tutorial. With Stripe, you need to know quite a bit about programming languages . For this reason, Stripe is most popular, and indeed designed, for larger firms, rather than individual transactions. Payline Headquartered in Chicago, Payline is another popular alternative to PayPal. The service offers gateway payment processing, and can integrate over 170 online shopping carts. With low monthly fees and a built-in security and fraud protection software, what more can you want from an e-wallet? So, why would someone want to avoid Payline? The main disadvantage here is the transparency when it comes to transaction costs. Namely, there is none. The company is not entirely open about the costs for transactions, which may lead to some customers spending more money than they bargained for. Some may think it is worth it. After all, Payline comes with a low monthly fee (much lower than PayPal’s), an excellent mobile app, and is probably one of the more secure digital wallets you can find. However, others are put-off by the lack of transparency. At the end of the day, you have to make your own choice and decide whether the service is worth your while. Why PayPal Remains The Most Popular? In this final section, we would like to take a look at why PayPal remains the most popular online payment system in 2023, despite some slowdown in growth. One of the main reasons is that it is already familiar. Most businesses already have a PayPal, and it is the most popular e-wallet among customers. Most people would rather stick to what they know, rather than switch over to a new service. Another reason has to do with the accessibility. PayPal is easy to set up, and even easier to use. Even in 2023, most people are not overly familiar with how computers and programming languages work. They want a simple, straightforward service, and PayPal certainly provides. Which is the main reason why it remains the most popular e-wallet in 2023.

Stripe Frequently Asked Questions (FAQ)

When was Stripe founded?

Stripe was founded in 2010.

Where is Stripe's headquarters?

Stripe's headquarters is located at 510 Townsend Street, San Francisco.

What is Stripe's latest funding round?

Stripe's latest funding round is Series I.

How much did Stripe raise?

Stripe raised a total of $9.401B.

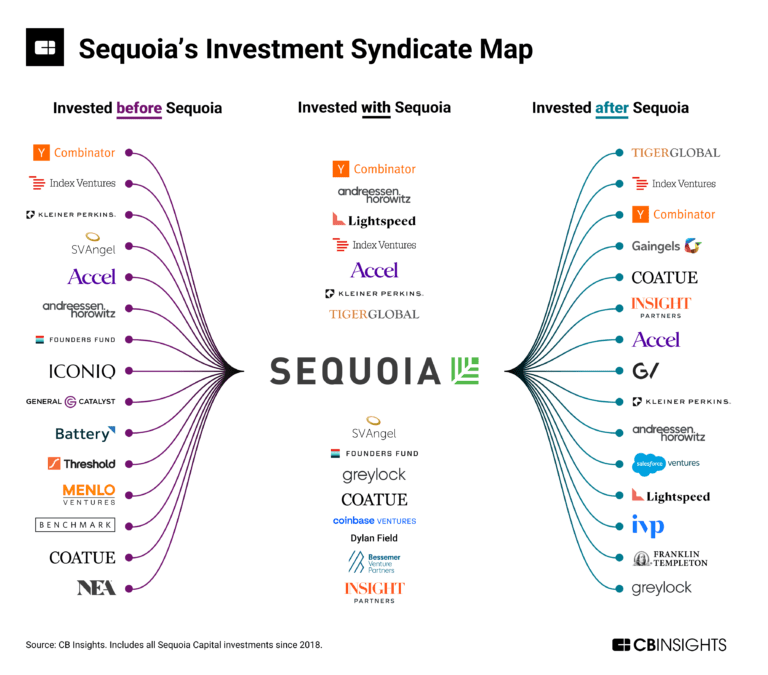

Who are the investors of Stripe?

Investors of Stripe include General Catalyst, Andreessen Horowitz, Thrive Capital, Founders Fund, Goldman Sachs and 39 more.

Who are Stripe's competitors?

Competitors of Stripe include Optty, Hypur, Diesta, Till Payments, Trolley, Worldpay, Opn, Imburse Payments, Yoco, Dintero and 123 more.

Compare Stripe to Competitors

GoCardless is an online direct debit provider. It is an international payments network for businesses to take and settle recurring payments from anywhere, to anywhere, in any currency. It was founded in 2011 and is based in London, United Kingdom.

YapStone is a global provider of web and mobile payment technology solutions, offering a platform that powers electronic payments for international online and mobile marketplaces, including HomeAway and VRBO, as well as for targeted, large vertical markets, including apartment and vacation rentals, HOA communities, self-storage and non-profits. YapStone develops tailored payment solutions to address partner needs.

Lemon Way is a pan-European payment institution dedicated to marketplaces, crowdfunding platforms, e-commerce websites, and other companies looking for payment processing, wallet management and third-party payment in a KYC/AML - regulated framework.

TouchBistro is an iPad-based restaurant management platform. It offers an integrated payments solution designed to meet the needs and fast pace of the food service industry. The firm was founded in 2011 and is based in Toronto, Canada.

Pine Labs offers cloud-based point-of-sale (PoS) payments solutions, allowing merchants to accept credit or debit card payments, as well as methods such as e-wallets, QR code payment solutions, and unified payments interface (UPI)-based solutions.

Klarna offers a range of payment solutions to e-stores. It offers services such as direct payments, pay-after-delivery options, and installment plans. It also provides security solutions for credit and fraud risks for e-stores. The company was founded in 2005 and is based in Stockholm, Sweden.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.