Uala

Founded Year

2017Stage

Series D | AliveTotal Raised

$608MValuation

$0000Last Raised

$350M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+10 points in the past 30 days

About Uala

Uala provides a neo-bank and personal financial management mobile application. Its services include transferring money, paying bills, loading credit on prepaid cell phones and transport cards, and more. The company was founded in 2017 and is based in Buenos Aires, Argentina.

Compete with Uala?

Ensure that your company and products are accurately represented on our platform.

Uala's Products & Differentiators

Payments

We offer a core transactional product base which includes: bill payments, prepaid services, purchases, money transfers.

Research containing Uala

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uala in 14 CB Insights research briefs, most recently on Nov 17, 2022.

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing Uala

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uala is included in 5 Expert Collections, including Banking.

Banking

1,071 items

Unicorns- Billion Dollar Startups

1,208 items

Fintech

4,924 items

Fintech 250

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Future Unicorns 2019

50 items

Latest Uala News

Mar 31, 2023

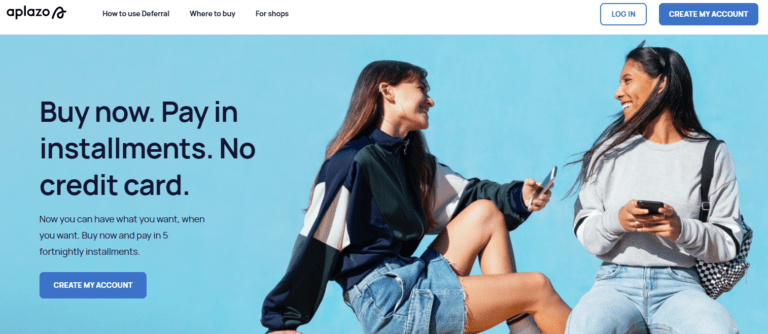

DUBLIN--(BUSINESS WIRE)--The "Argentina Buy Now Pay Later Business and Investment Opportunities Databook - 75+ KPIs on BNPL Market Size, End-Use Sectors, Market Share, Product Analysis, Business Model, Demographics - Q1 2023 Update" report has been added to ResearchAndMarkets.com's offering. BNPL payments in Argentina are expected to grow by 54.6% on an annual basis to reach US$2,070.9 million in 2023. Medium to long term growth story of BNPL industry in Argentina remains strong. BNPL payment a

Uala Frequently Asked Questions (FAQ)

When was Uala founded?

Uala was founded in 2017.

Where is Uala's headquarters?

Uala's headquarters is located at Nicaragua 4677, Buenos Aires.

What is Uala's latest funding round?

Uala's latest funding round is Series D.

How much did Uala raise?

Uala raised a total of $608M.

Who are the investors of Uala?

Investors of Uala include Soros Fund Management, Monashees+, Tencent Holdings, Ribbit Capital, Greyhound Capital and 18 more.

Who are Uala's competitors?

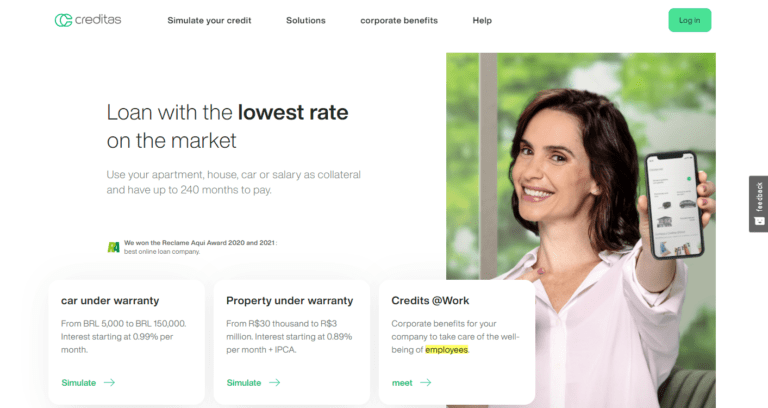

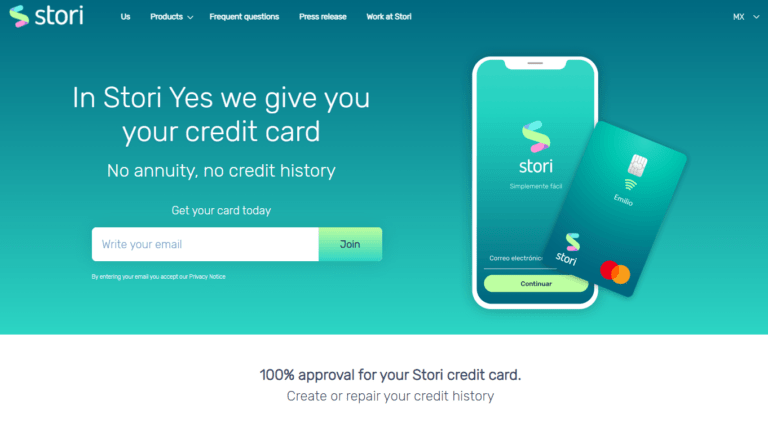

Competitors of Uala include Stori, Creditas, Klar, BNEXT, Prex, Albo, TPaga, Neon, Fondeadora, Nubank and 14 more.

What products does Uala offer?

Uala's products include Payments and 3 more.

Compare Uala to Competitors

Nubank provides technology-driven financial services. It offers digital accounts, credit cards, loans, corporate cards, and more. It was founded in 2013 and is based in Sao Paulo, Brazil.

Klar operates as a financial technology company. It offers a mobile application and a debit card that gives users full control of their money and the benefits of a credit card. The company was founded in 2019 and is based in Mexico City, Mexico.

Neon is a fintech payment institution operating in the modalities of issuing electronic money and issuing postpaid instruments. It offers services such as loans, investments, digital wallets, and digital account services. The company was founded in 2014 and is based in Sao Paulo, Brazil.

BNEXT is a digital financial products marketplace where users can find alternatives to their financing, investment, and savings needs. The company was founded in 2016 and is based in Madrid, Spain.

Agibank is a technology company that offers financial products and services. Its aim is to improve the daily lives of people through financial inclusion of the emerging social classes in Brazil, today precariously served or at the margin of the traditional banking system. Agibank has a differentiated value proposal focused on a business model structured through a highly scalable digital infrastructure.

Digio is a digital payment platform and online credit card created via a partnership between Bradesco and Banco do Brasil in 2016.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.